Commodity currencies are general under pressure today, following global stock markets lower. Record Q2 GDP contraction in Germany and US are weighing on sentiments. Rebound in jobless claims add to concern of double dip recession. US futures also tumble after President Donald Trump floats the idea of delaying 2020 presidential election. Oil appears to be starting the long-overdue correction. Canadian Dollar is the worst performing one for now, followed by Aussie and Kiwi. Sterling is the strongest, followed by Swiss Franc and then Dollar.

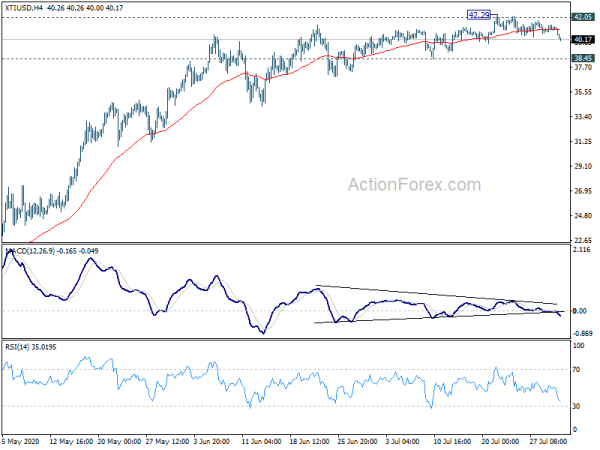

Technically, while 40 handle looks vulnerable in WTI crude oil, the larger rise is not in threat yet as long as 38.45 support holds. Current fall might just be part of a sideway consolidation pattern, after failing 42.05 key resistance on first attempt. However, break of 38.45 would signal that deeper correction is underway.

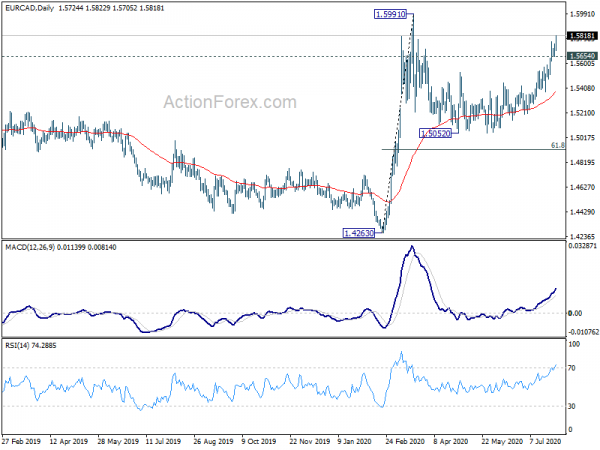

Accompanying the falling oil prices, EUR/CAD is extending near term rebound today. As long as 1.5654 support holds, further rise should be seen to 1.5991 short term top and possibly above.

In other markets, DOW open down -300 pts in initial trading. FTSE is currently down -2.43%. DAX is down -3.38%. CAC is down 2.15%. Germany 10-year yield is down -0.045 at -0.542, moving further away from -0.5 handle. Earlier in Asia, Nikkei dropped -0.26%. Hong Kong HSI dropped -0.69%. China Shanghai SSE dropped -0.23%. Singapore Strait Times dropped -1.70%. Japan 10-year yield dropped -0.0016 to 0.020.

US GDP dropped -32.9% annualized in Q2, largest on record since 1947

US GDP contracted -32.9% annualized in Q2, slightly less than expectation of -35.0%. That’s nevertheless the sharpest annualized decline in quarterly records dating back to 1947.

“The decline in second quarter GDP reflected the response to Covid-19, as `stay-at-home’ orders issued in March and April were partially lifted in some areas of the country in May and June, and government pandemic assistance payments were distributed to households and businesses,” BEA said in the release.

US initial jobless claims rose to 1.43m, continuing claims rose back to 17m

US initial jobless claims rose 12k to 1434k in the week ending July 25, slightly below expectation of 1450k. But that’s still the second straight week of increase in the figure. Four-week moving average of initial claims rose 6.5k to 1369k.

Continuing claims rose 867k to 17018k in the week ending July 18. Four-week moving average of continuing claims rose 436k to 17058k.

ECB: Uncertainty remains extremely elevated, very difficult to predict the extent and duration of recovery

In its Monthly Bulletin, ECB said, “looking beyond the disruption stemming from the coronavirus pandemic, euro area growth is resuming with the gradual lifting of containment measures, supported by favourable financing conditions, the euro area fiscal stance and a resumption in global activity.” However, “uncertainty remains extremely elevated, making it very difficult to predict the likely extent and duration of the recovery.”

On inflation, “over the review period (4 June to 15 July 2020), market-based indicators of longer-term inflation expectations have continued to increase slowly towards the levels prevailing as of late February, while survey-based indicators of inflation expectations declined slightly. ”

ECB reiterated that it “continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.”

Eurozone economic sentiment jumped sharply to 82.3

Eurozone Economic Sentiment Indicator registered a sharp increase of 6.5 in July to 82.3, up from June’s 75.8. Improvements are seen in industry (from -21.6 to -16.2), services (from -35.5 to -26.1), retail trade (from -19.4 to -15.3). Consumer confidence (-14.5 to -15.0) and construction (-11.6 to -12.6) dropped slightly. Employment Expectations Indicator rose for the third month a a row (by 4.0 to 87.0). Eurozone Business Climate rose from -2.25 to -1.80.

Eurozone unemployment rate rose to 7.8% in June, up from 7.7%, above expectation of 7.7%. EU unemployment rate rose to 7.1%, up from 7.0%. Eurostat estimates that 15.023 million people are unemployment the EU, with 12.685m in Eurozone.

German GDP contracted record -10.1% qoq in Q2

Germany GDP contracted -10.1% qoq in Q2, worse than expectation of -9.0% qoq. That’s also the largest decline since the beginning of quarterly GDP calculations for Germany in 1970. The contraction was also more than double of that during the financial market and economic crisis back in Q1 2009 (-4.7% qoq).

Also released, Germany unemployment dropped -18k in July, versus expectation of 45k rise. Unemployment was unchanged at 6.4% versus expectation of 6.5%. Italy unemployment jumped to 8.8% in June, up from revised 8.3%, above expectation of 8.5%.

Swiss KOF rose to 85.7, strong rebound but still below long-term average

Swiss KOF Economic Barometer rose strongly, for the second month, to 85.7 in July, up from 60.6. That’s also well above expectation of 72.5. Nevertheless, “despite this positive development, the value remains clearly below its long-term average.”

KOF also said, ‘n the manufacturing sector, “the outlook is brightening in all segments”, particularly pronounced in the metal industry, the electrical industry, the wood, glass, stone and earths industry, mechanical engineering and the chemical, pharmaceutical and plastics industry.

New Zealand ANZ business confidence: Bounces are fun but nearly run its course

New Zealand ANZ Business Confidence rose to -31.8 in July, up from June’s -34.4, but down from prelim reading of -29.8. Confidence was worst in agriculture at -54.5 and beat in retail at -22.6 while all sector stayed negative. Own activity outlook rose to -8.9, up notably from June’s -25.9, but also revised down to -6.8. Activity was worst in agriculture again at -15.2 but best in services at -5.0.

ANZ said “bounces are fun, but this one has probably nearly run its course.” It warned that “unfortunately, that blow is coming; it’s inevitable.” Border will remain closed for the rest of the year, which is “one of the few certainties in our economic forecasts at the moment”. That means “big hole in economic activity, centred on tourism and the foreign education sector.” Also, the blow “won’t be felt evenly” with the country “split into two economies – the tourism-dependent regions and the rest”.

From Australia, import price index dropped -1.9% qoq in Q2 versus expectation of -2.5% qoq. Building permits dropped -4.9% mom in June versus expectation of 0.0% mom.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2932; (P) 1.2973; (R1) 1.3033; More….

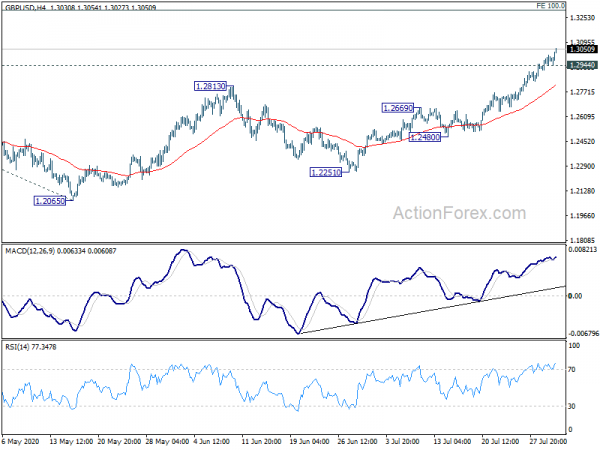

GBP/USD’s rally continues today and hits as high as 1.3054 so far. Intraday bias remains on the upside for 100% projection of 1.1409 to 1.2647 from 1.2065 at 1.3303 next. On the downside, below 1.2944 minor support will turn intraday bias neutral first. But retreat should be contained well above 1.2669 resistance turned support to bring another rally.

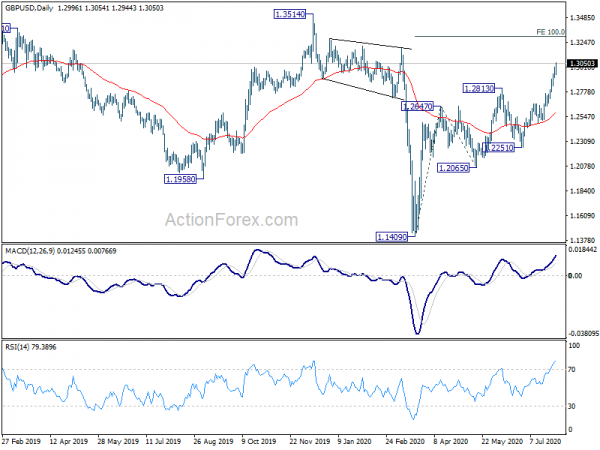

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jun | 0.50% | 35.60% | 41.70% | |

| 23:50 | JPY | Retail Trade Y/Y Jun | -1.20% | -6.50% | -12.50% | |

| 01:00 | NZD | ANZ Business Confidence Jul | -31.8 | -29.8 | ||

| 01:30 | AUD | Import Price Index Q/Q Q2 | -1.90% | -2.50% | -1.00% | |

| 01:30 | AUD | Building Permits M/M Jun | -4.90% | 0.00% | -16.40% | -15.80% |

| 07:00 | CHF | KOF Economic Barometer Jul | 85.7 | 72.5 | 59.4 | 60.6 |

| 07:55 | EUR | Germany Unemployment Rate Jul | 6.40% | 6.50% | 6.40% | |

| 07:55 | EUR | Germany Unemployment Change Jul | -18K | 45K | 69K | 68K |

| 08:00 | EUR | Germany GDP Q/Q Q2 P | -10.10% | -9.00% | -2.20% | -2.00% |

| 08:00 | EUR | Italy Unemployment Rate Jun | 8.80% | 8.50% | 7.80% | 8.30% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 7.80% | 7.70% | 7.40% | 7.70% |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jul | 82.3 | 75.7 | 75.8 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jul | -16.2 | -17.2 | -21.7 | -21.6 |

| 09:00 | EUR | Eurozone Consumer Confidence Jul | -15 | -15 | -15 | -14.7 |

| 09:00 | EUR | Eurozone Services Confidence Jul | -26.1 | -22.9 | -35.6 | -35.5 |

| 09:00 | EUR | Eurozone Business Climate Jul | -1.8 | -2.26 | -2.25 | |

| 12:00 | EUR | Germany CPI M/M Jul P | -0.50% | -0.20% | 0.60% | |

| 12:00 | EUR | Germany CPI Y/Y Jul P | -0.10% | 0.20% | 0.90% | |

| 12:30 | USD | Initial Jobless Claims (Jul 24) | 1434K | 1450K | 1416K | 1422K |

| 12:30 | USD | GDP Annualized Q2 A | -32.90% | -35.00% | -5.00% | |

| 12:30 | USD | GDP Price Index Q2 A | -1.80% | 1.20% | 1.60% | 1.40% |

| 14:30 | USD | Natural Gas Storage | 25B | 37B |