Sterling is trading as the second strongest currency for the week so far, next to Euro, as markets await BoE Super Thursday. While monetary is widely expected to be unchanged, the vote split and inflation report will catch all attention from the markets. Meanwhile, commodity currencies are generally lower even though risk appetite remains firm in the stock markets. DOW extended its record run and closed up 0.24% at 2201.24, above 22k handle. US treasury yields were mixed with 10 year yield closed up 0.011 at 2.262. In other markets, Gold dipped notably and is trading below 1270. WTI crude oil recovered after a steep dip earlier this week to below 48.50. WTI is currently trading at 49.4 and struggles to regain 50 handle.

BoE vote split and projections watched

BoE is widely expected to keep monetary policy unchanged today. The Bank rate should be held at 0.25% with the asset purchase target kept at GBP 435B. The vote split and updated economic forecast from the quarterly inflation report will be the main focuses. Normally, there are nine voting members in the MPC but i was lowered to eight earlier this year after Charlotte Hogg resigned. Kristin Forbes was the most hawkish one and started voting for a hike since March. After two meetings, Michael Saunders and Ian McCafferty joined last month to make the the vote 5-3 to kept interest rate unchanged. That was at a time when inflation in UK was still accelerating. Chief economist Andy Haldane then expressed his hawkish comments on interest rate and BoE Governor Mark Carney then said that there will be rate hike debates soon.

However, the situation have changed since then. CPI slowed back sharply from 2.9% yoy to 2.6% yoy in June. Q2 growth was sluggish at 0.3% qoq. And speculations on a rate hike cooled. It’s unlikely that Haldane with vote for a hike this time. The most hawkish one, Forbes, has left the MPC already in June. Her replacement Silvana Tenreyro is seen as generally on the dovish side. That makes a 6-2 vote split the base case for this meeting. And the outcome will be rather dovish should either Saunders or McCafferty change their mind.

IMF recently downgraded UK growth forecast after a weak Q1. IMF now expects UK economy to growth 1.7% this year, notably lower than 2.0% projection back in April. BoE’s own projections might follow with a downgrade in the quarterly inflation report today. On the other hand, if inflation forecast could be kept unchanged, it will indicate that policymakers still believe that the spike in CPI earlier this year was temporary. And that will reduce the chance of a rush to rate hike in near term.

Fed officials support balance sheet reduction this fall

San Francisco Fed President John Williams said that the September FOMC meeting seems "an appropriate time" to start shrinking the USD 4.5T balance sheet. He noted that the economy has "fully recovered" from the financial crisis and inflation will reach 2% target "in the next year or two". Boston Fed President Eric Rosengren also said that "there’s no reason to have that extraordinary accommodation coming from the balance sheet any longer." Cleveland Fed President Loretta Mester said that Fed should continue to gradual approach of stimulus removal even with fluctuation in economic data. She emphasized the "benefits to this consistency" and it "removes some ambiguity" and underscores that policy focuses on "medium-run outlook". On the other hand, St. Louis Fed President James Bullard said that inflation outlook "has deteriorated in 2017" and "I would not support further moves in the near term." And for now, Bullard believed that "we should remain on pause."

US-China relations turns sour

On the geopolitical front, US President Donald Trump has become less patient over China’s actions, of lack of actions, towards North Korea, a hermit kingdom that has been growing provocative with it missile tests. Trump and China’s President Xi Jinping agreed back in May that the latter would increase diplomatic and economic pressure over North Korea, in an attempt to denuclearize the country. However, little effect has been seen so far and North Korea even had two successful tests of ICBM missile over the past month. A CNN report revealed that revised military options for North Korea have been prepared by the US though diplomatic engagement is still preferred.

US-China trade relations have soured since July and it was reported that the US has been preparing broad trade case against China. We believe the triggering point is China’s reluctance to confront North Korea over nuclear weapons. Indeed, Trump, since his inauguration in January, has linked US-China trade relations to the North Korean problem. Staying in Asia, China claims India pulled out most troops from Doklam in India and Donglang in China, the tri-junction border shared by China, India, and Bhutan. The standoff has entered its seventh week and neither side appears ready for a war or a compromise.

On the data front

Australia trade surplus narrowed to 0.86b in June. New Zealand ANZ commodity price dropped -0.8% in July. China Caixin PMI services dropped 0.1 to 51.5 in July. Looking ahead, BoE rate decision will be the main focus in European session. In addition, UK will release PMI services. ECB will also release monthly bulletin while Eurozone will release PMI services final. In US session, ISM services will be the main focus will jobless claims and factory orders will also be featured.

GBP/USD Daily Outlook

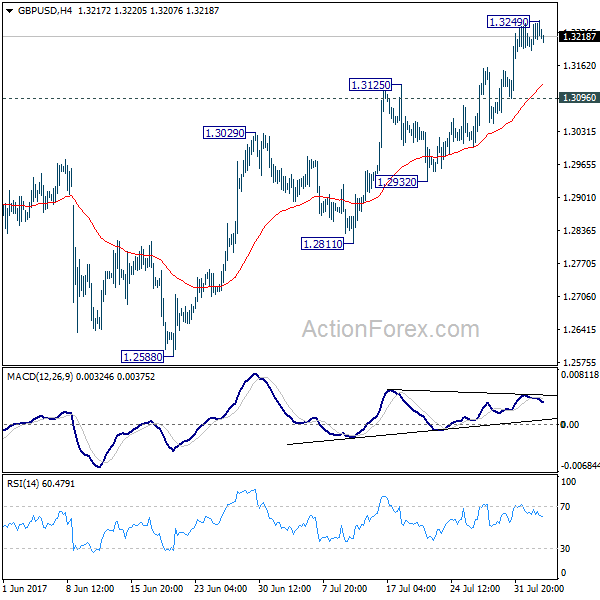

Daily Pivots: (S1) 1.3191; (P) 1.3221; (R1) 1.3252; More…

GBP/USD lost some momentum after hitting 1.3249. Intraday bias is turned neutral for some consolidations first. Further rally is expected as long as 1.3096 minor support holds. Above 1.3249 will target 1.3444 key resistance. But still, price actions from 1.1946 are viewed as a corrective pattern. Hence, we’ll look for topping signal again around 1.3444. Meanwhile, break of 1.3096 will be the first sign of reversal. Intraday bias will be turned back to 1.2932 support first in that case.

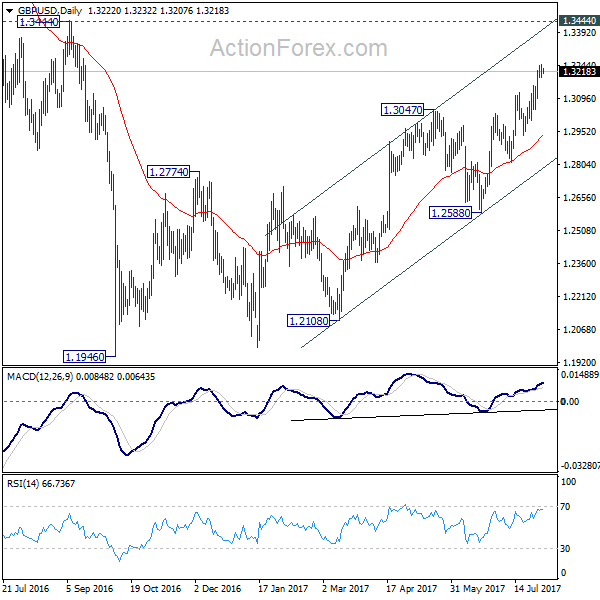

In the bigger picture, overall, price actions from 1.1946 medium term low are seen as a corrective pattern that is still in progress. While further upside is expected, larger outlook remains bearish as long as 1.3444 key resistance holds. Down trend from 1.7190 (2014 high) is expected to resume later after the correction completes. And break of 1.2588 will indicate that such down trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | NZD | ANZ Commodity Price Jul | -0.80% | 2.10% | ||

| 1:30 | AUD | Trade Balance (AUD) Jun | 0.86B | 1.77B | 2.47B | 2.02B |

| 1:45 | CNY | Caixin China PMI Services Jul | 51.5 | 51.9 | 51.6 | |

| 7:45 | EUR | Italy Services PMI Jul | 54.1 | 53.6 | ||

| 7:50 | EUR | France Services PMI Jul F | 55.9 | 55.9 | ||

| 7:55 | EUR | Germany Services PMI Jul F | 53.5 | 53.5 | ||

| 8:00 | EUR | ECB Economic Bulletin | ||||

| 8:00 | EUR | Eurozone Services PMI Jul F | 55.4 | 55.4 | ||

| 8:30 | GBP | Services PMI Jul | 53.6 | 53.4 | ||

| 9:00 | EUR | Eurozone Retail Sales M/M Jun | 0.00% | 0.40% | ||

| 9:00 | EUR | Eurozone Retail Sales Y/Y Jun | 2.50% | 2.60% | ||

| 11:00 | GBP | BoE Rate Decision | 0.25% | 0.25% | ||

| 11:00 | GBP | BoE Asset Purchase Target | 435B | 435B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 2–0–6 | 3–0–5 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–8 | 0–0–8 | ||

| 11:00 | GBP | BoE Inflation Report | ||||

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | -19.30% | |||

| 12:30 | USD | Initial Jobless Claims (JUL 29) | 242K | 244K | ||

| 14:00 | USD | ISM Non-Manufacturing Composite Jul | 56.9 | 57.4 | ||

| 14:00 | USD | Factory Orders Jun | 2.80% | -0.80% | ||

| 14:30 | USD | Natural Gas Storage | 17B |