Dollar remains generally weak today as recovery attempts faltered quickly. Though, selling remains centered against European majors and Yen. FOMC monetary policy decision is a focus today but it’s unlikely to give the greenback any sustainable support. Overall, major pairs and crosses are bounded inside yesterday’s range, though. Gold and silver are also consolidating below yesterday’s spike highs.

Technically, Dollar’s declines are losing downside momentum as seen in 4 hour MACD of EUR/USD, USD/CHF, USD/CHF and USD/CAD. But we’d maintain that some minor levels need to be violated before the first signs of short term bottoming in the greenback. The levels include 1.1681 minor support in EUR/USD, 1.2838 minor support in GBP/USD, 0.7063 support in AUD/USD, 0.9230 minor resistance in USD/CHF, 105.68 minor resistance in USD/JPY and 1.3445 minor resistance in USD/CAD.

In Asia, Nikkei closed down by 1.15%. Hong Kong HSI is up 0.41%. China Shanghai SSE is up 2.04%. Singapore Strait Times is down -0.19%. Japan 10-year JGB yield is down -0.0038 at 0.022. Overnight, DOW dropped -0.77%. S&P 500 dropped -0.65%. NASDAQ dropped -1.27%. 10-year yield dropped -0.028 to 0.581, below 0.6 handle.

Fitch downgrade Japan’s rating outlook to negative, expects no rate cut by BoJ

Fitch affirmed Japan’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at “A”, but downgraded the outlook to negative from stable. The rating agency said: “The coronavirus pandemic has caused a sharp economic contraction in Japan, despite the country’s early success in containing the virus… The Negative Outlook reflects that the higher debt ratio and downside risks to the macroeconomic outlook will nevertheless exacerbate the challenge of placing the debt ratio on a downward path over the medium term.”

Fitch also projects the economy to contract by -5% in 2020, before rebounding to 3.2% growth in 2021 “due partly to the low base effect”. GDP would not recover to pre-pandemic level until 4Q21. The gross general government debt ratio will rise by 26% in 2020 to around 259% of GDP and stabilize just above 260% in 2021-22. General government deficit would surge to 14.3% of GDP in 2020, up from 3.1% in 2019, then drop back to 10.9% in 2021 and 5.3% in 2022.

The rating agency also expects BoJ to maintain current interest-rate setting through “at least the end of 2022” under the YCC framework. It expects BoJ to “refrain from” cutting interest rate further because of the impact on “bank profitability”. Rather, “an extension of temporary quantitative easing programmes beyond their expiry in March 2021 or refinements to its forward guidance remain more likely.” Fitch also projects headline CPI of -0.6% at the end of 2020 and turns marginally positive in 2021.

Australia CPI dropped -1.9% qoq in Q2, biggest fall in 72 year of history

Australia CPI plunged -1.9% qoq in Q2, slightly above expectation of -2.0% qoq. That’s still the largest quarterly fall in the 72 year history of the data. Annually, CPI turned negative to -0.3% yoy, down from Q1’s 2.2% yoy. It’s only the third time annual inflation turned negative since 1949. The previous times were in 1962 and 1997-98.”

Nevertheless, the quarterly decline was mainly the result of free child care (-95%), a significant fall in fuel price (-19.3%) and a fall in pre-school and primary education (-16.2%). Excluding these three components, the CPI would have risen 0.1% qoq in Q2.

UK BRC shop price dropped -1.3% yoy in Jun, deflation continues across on-food channels

UK BRC shop price index dropped -1.3% yoy in June, improved from May’s -1.6% yoy.

Helen Dickinson OBE, Chief Executive, British Retail Consortium: “Falling prices at tills is good news for shoppers, and will hopefully tempt more people onto our high streets and retail destinations.”

Mike Watkins, Head of Retailer and Business Insight, Nielsen: “There was no further upwards pressure on shop prices in food during July and deflation continues across the non-food channels.”

Fed to hold its cards until September

FOMC rate decision is a major focus today but there is little expectation on anything dramatic there. Fed funds rate will be held at 0.00-0.25%. The unlimited asset purchase program will continue at a pace of USD 80B for treasuries and USD 40B for MBS. There might be change to forward guidance though, to tie future rate hike to employment and inflation. But the big changes will be held until September.

By September meeting, Fed should have completed the policy framework review. Congress should have passed any additional fiscal stimulus. More information will be obtained regarding the economy, in particular with second wave of coronavirus infections in effect. Updated economic projections will also be completed.

Some suggested readings on FOMC:

- FOMC Preview – Preparing for Changes in Monetary Policy

- Fed Meeting: A More Cautious Message

- July Flashlight for the FOMC Blackout Period

On the data front

Swiss will release Credit Suisse economic expectations. UK will release M4 money supply and mortgage approvals. US will release wholesale inventories, goods trade balance and pending home sales.

USD/JPY Daily Outlook

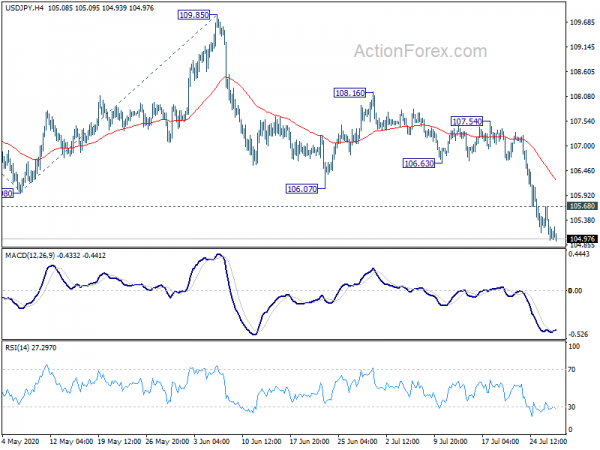

Daily Pivots: (S1) 104.80; (P) 105.25; (R1) 105.53; More...

Intraday bias in USD/JPY remains on the downside for the moment. Current fall is part of the decline from 111.71 and should target 100% projection of 111.71 to 105.98 from 109.85 at 104.12 next. On the upside, above 105.68 minor resistance will turn intraday bias neutral again and bring consolidation. But recovery should be limited below 106.63 support turned resitsance to bring another decline.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Jun | -1.30% | -1.60% | ||

| 01:30 | AUD | CPI Q/Q Q2 | -1.90% | -2.00% | 0.30% | |

| 01:30 | AUD | CPI Y/Y Q2 | -0.30% | -0.40% | 2.20% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | -0.10% | 0.10% | 0.50% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 1.20% | 1.40% | 1.80% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Jul | 39.4 | 48.7 | ||

| 08:30 | GBP | Mortgage Approvals Jun | 35K | 9K | ||

| 08:30 | GBP | M4 Money Supply M/M Jun | 2.20% | 2.00% | ||

| 12:30 | USD | Wholesale Inventories Jun P | -0.40% | -1.20% | ||

| 12:30 | USD | Goods Trade Balance (USD) Jun | -75.5B | -74.3B | ||

| 14:00 | USD | Pending Home Sales M/M Jun | 15.60% | 44.30% | ||

| 14:30 | USD | Crude Oil Inventories | 1.0M | 4.9M | ||

| 18:00 | USD | FOMC Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |