The powerful rallies in Euro and Gold remain the dominate theme for today as traders seems to be focusing on the worsening US-China relations as well as second wave of coronavirus infections in the US and Asia. Swiss franc tumbles sharply, as mainly pressured by the selloff against Euro while Yen is firm and resilient. The developments suggest that the moves are not driven by broad based risk aversion, which is also reflected in sluggishness in the stock markets. Dollar remains pressured, following Swiss Franc as the second weakest.

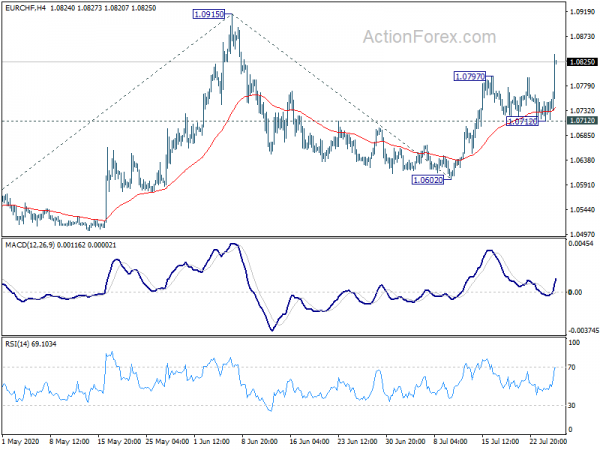

Technically, EUR/CHF’s break of 1.0797 is a positive sign for the common currency. Further rise should be seen to 1.0915 near term resistance next. The focus will turn to Euro/commodity currency crosses. In particular, EUR/AUD is now at around midpoint of 1.6033/6772 range, and it’s picking up momentum towards the upper side. EUR?CAD is also accelerating higher towards 1.5991 near term resistance. Break of these levels would further solidify EUR/USD’s medium term up trend towards 1.2555 resistance.

In Europe, currently, FTSE is down -0.22%. DAX is down -0.05%. CAC is down -0.35%. Germany 10-year yield is down -0.367 at -0.483. Earlier in Asia, Nikkei dropped -0.16%. Hong Kong HSI dropped -0.41%. China Shanghai SSE rose 0.26%. Singapore Strait Times dropped -0.14%. Japan 10-year JGB yield rose 0.037 to 0.020.

US durable goods orders rose 7.3% in Jun, ex-transport orders up 3.3%

US durable goods orders rose 7.3% mom to USD 206.9B in June, above expectation of 6.5% mom. Ex-transport orders rose 3.3% mom, slightly below expectation of 3.5% mom. Ex-defend orders rose 9.2% mom. Transportation equipment rose 20.0% mom.

German Ifo business climate rose to 90.5, services turned positive

German Ifo Business climate rose to 90.5 in July, up from 86.3, above expectation of 89.3. That’s also the third rise in a row as the economy is “recovery step by step”. Current situation index rose to 84.5, up from 81.3, missed expectation of 85.0. Expectations index rose to 97.0, up from 91.6, beat expectation of 93.4.

Looking at some details, manufacturing index rose from -22.7 to -12.0. Service index rose from -6.0 to 2.0, turned positive for the first time since February. Trade rose from -14.2 to -5.2. Construction rose form -7.7 to -2.4.

ECB Panetta: PEPP to be used in full unless there are significant upside surprises

ECB Executive Board member Fabio Panetta warned in an interview that it’s “too soon to declare victory” on coronavirus pandemic. Recent economic data “certainly indicate that we’re making progress”, he said.

“But we need to view these improvements with caution, because they are an effect of the rebound that was to be expected after the earlier disastrous fall in economic activity and reflect the large-scale intervention of economic policies.” “Moreover, they don’t diverge from our forecasts. So they don’t give us sufficient grounds for satisfaction.”

He added that “economic activity is still well below pre-crisis levels”. Based on ECB’s projections “we won’t see a return to those levels before the end of 2022”. Outlook is also uncertain for the economy and jobs while growth is uneven.

Regarding monetary policy, Panetta expects to use the resources available under the PEPP “in full” unless there are “significant upside surprises”. “The programme is working well, and I don’t see any economic reasons to change our decisions or actions.”

BoJ: Economy unlikely to reach pre-pandemic level even in fiscal 2022

Summary of Opinions of BoJ’s July 14-15 meeting reiterated that the economy is “likely to improve gradually” from H2, but the pace is expected to be “only moderate” as coronavirus impact remains. The economy is “unlikely” to return to pre-pandemic level “even in fiscal 2022”, since it will take time for a “structural change” to overcome the pandemic impacts.

Also, the economic shock of COVID-19 seems to be “largely attributable to a negative demand shock”. There are signs that a decline in short-term inflation expectations is affecting medium- to long-term ones. “Downward pressure will likely be exerted on prices for the time being”.

One opinion noted that it’s appropriate to ” revise the forward guidance to make it a more powerful one that does not allow deflation to take hold and leads to additional easing measures under the concrete conditions related to prices.” One said BoJ should examine the ” transmission channels and effects of policy measures while paying attention to risks that prices and growth expectations will decline further and that such situation will last for a protracted period”.

RBA Kent: Pandemic policy responses represent bread and butter of central banking

RBA Assistant Governor Chris Kent said in a speech that Australian authorities have provided “unprecedented support, including via fiscal, monetary and prudential policies” in response to the severe impact of the coronavirus pandemic. RBA has been focused on “keeping the cost of borrowing low and helping to maintain the supply of credit”.

He described that RBA’s measures can be ” thought of as representing the ‘bread and butter’ of central banking – providing liquidity to meet demand at a time of considerable need, thereby acting to stabilise crucial markets.”

The operations have “worked well” and “contributed to a noticeable improvement in market sentiment and accommodative financial conditions.” Also, in response to a question, Kent said negative rates were not an option for now and new monetary policy measures are not under consideration for the moment.

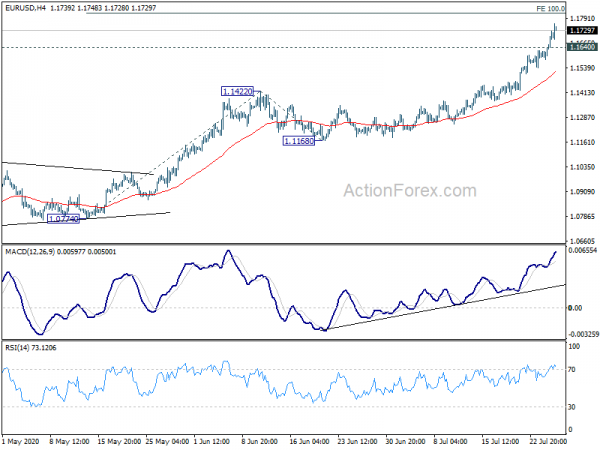

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1605; (P) 1.1631; (R1) 1.1682; More…..

EUR/USD’s rally continues to accelerate today and hits as high as 1.1764 so far. Intraday bias remains on the upside for 100% projection of 1.0774 to 1.1422 from 1.1168 at 1.1816 first. Break will target 161.8% projection at 1.2216 next. On the downside, below 1.1640 minor support will turn intraday bias neutral and bring consolidations first. But downside of retreat should be contained by 1.1422 resistance turned support and bring another rally.

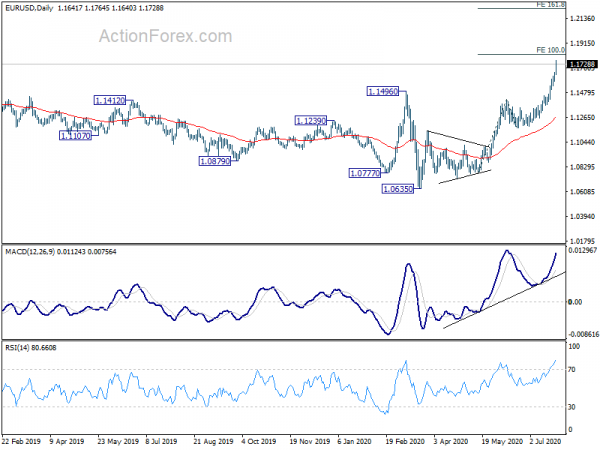

In the bigger picture, the strong break of 1.1496 resistance now suggests that whole down trend from 1.2555 (2018 high) has completed at 1.0635 already. Rise form 1.0635 should be the third leg of the pattern from 1.0339 (2017 low). Further rise should be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516 ). This will remain the favored case as long as 1.1168 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 04:30 | JPY | All Industry Activity Index M/M May | -3.50% | -3.50% | -6.40% | |

| 08:00 | EUR | Germany IFO Business Climate Jul | 90.5 | 89.3 | 86.2 | 86.3 |

| 08:00 | EUR | Germany IFO Expectations Jul | 97 | 93.4 | 91.4 | 91.6 |

| 08:00 | EUR | Germany IFO Current Assessment Jul | 84.5 | 85 | 81.3 | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jun | 9.20% | 9.30% | 8.90% | |

| 12:30 | USD | Durable Goods Orders Jun | 7.30% | 6.50% | 15.70% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Jun | 3.30% | 3.50% | 3.70% |