Sterling weakens broadly yesterday and is trading as the second weakest major currency for the week at the moment. The House of Lords in US passed an amended bill on Brexit yesterday after having the highest turnout since 1831. The vote was passed by 366 to 268 to add addition condition to the so called "European Union (Notification of Withdrawal) Bill". That demands a guarantee of "meaningful vote" by the Parliament on the outcome of Brexit talks. And it’s seen by analysts as securing veto power on any final agreements. The bill will now return to the House of Commons for deciding whether to accept the Lord’s amendments. The debate could probably held on next Monday.

The UK Brexit Secretary David Davis described the result of the vote as "disappointing". And he criticized that "it is clear that some in the Lords would seek to frustrate that process, and it is the government’s intention to ensure that does not happen." Davis pledged to "overturn these amendments in the House of Commons." Brexit minister for the Lords George Bridges also said in his final plea before the vote that "this amendment simply makes the negotiations much harder from day one for the prime minister as it increases the incentive for the European Union to offer nothing but a bad deal."

UK Chancellor Exchequer to deliver budget statement

Sterling traders are also getting cautious ahead of Chancellor of Exchequer Paul Hammond’s first full budget statement today. The statement comes at the time just weeks before prime minister May’s trigger of Article 50 for Brexit negotiation. And there are a lot of uncertainties surrounding the situation. The focus will be on what he would do to shield the UK economy from the impact of Brexit. Hammond has already revealed that he plans to build up GBP 60b reserve to deal with Brexit related uncertainties.

Japan Q4 GDP revised up, but missed expectation

The Japanese yen strengthens today, in particular against European majors, as Nikkei continues its slump. Q4 GDP growth was finalized at 0.3% qoq, revised up from 0.2% qoq but missed expectation of 0.4% qoq. GDP deflator was finalized at -0.1% qoq, unrevised. Current account surplus narrowed to JPY 1.26T in January, below expectation of JPY 1.46T. Bank lending grew 2.8% yoy in February. Also from Asian session, New Zealand manufacturing activity rose 0.8% in Q4.

Looking ahead…

German industrial production and Swiss CPI will be featured in European session. Main focus could be on US ADP employment report. US will also release non-farm productivity revision. Canada will release housing starts, labor productivity and building permits.

EUR/GBP Daily Outlook

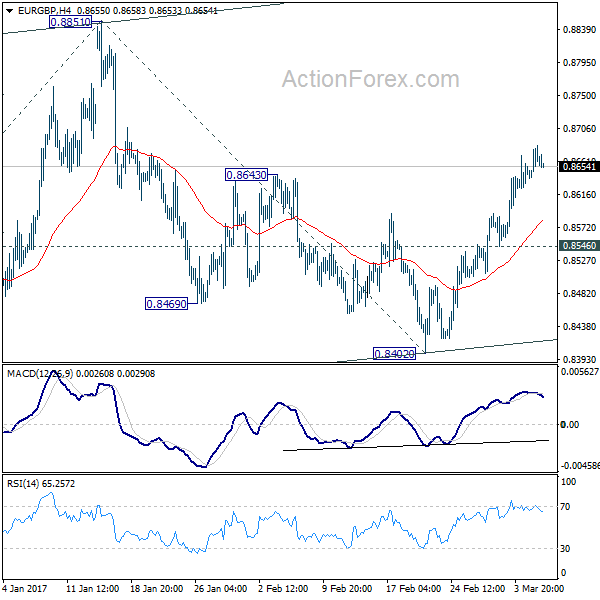

Daily Pivots: (S1) 0.8636; (P) 0.8660; (R1) 0.8681; More…

EUR/GBP lost some upside momentum after hitting 0.8682. But further rise is still expected as long as 0.8546 support stays intact. As noted before, rise from 0.8402 is viewed as the third leg of the corrective price actions from 0.8303.Such rally would target 0.8851 resistance and above. However, whole price actions from 0.8303 are viewed as the second leg of the correction from 0.9304. Hence, we’d expect strong resistance from 100% projection of 0.8303 to 0.8851 from 0.8402 at 0.8950 to limit upside. On the downside, below 0.8546 minor support will turn bias back to the downside for 0.8402 support. instead

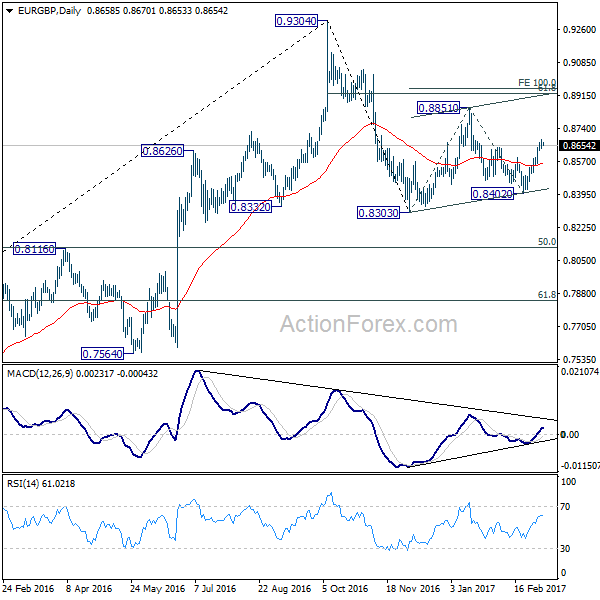

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. Deeper fall cannot be ruled out yet. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside. Overall, the corrective pattern would take some time to complete before long term up trend resumes at a later stage. Break of 0.9304 will pave the way to 0.9799 (2008 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| CNY | Trade Balance (USD) Feb | 27.8B | 51.4B | |||

| CNY | Trade Balance (CNY) Feb | 173B | 355B | |||

| 21:45 | NZD | Manufacturing Activity Q4 | 0.80% | 0.40% | 1.10% | |

| 23:50 | JPY | Current Account (JPY) Jan | 1.26T | 1.46T | 1.67T | 1.66T |

| 23:50 | JPY | GDP Q/Q Q4 F | 0.30% | 0.40% | 0.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 F | -0.10% | -0.10% | -0.10% | |

| 23:50 | JPY | Bank Lending incl Trusts Y/Y Feb | 2.80% | 2.50% | ||

| 5:00 | JPY | Eco Watchers Survey Current Feb | 49.9 | 49.8 | ||

| 5:00 | JPY | Leading Index Jan P | 105.4 | 104.8 | ||

| 7:00 | EUR | German Industrial Production M/M Jan | 2.60% | -3.00% | ||

| 8:15 | CHF | CPI M/M Feb | 0.20% | 0.00% | ||

| 8:15 | CHF | CPI Y/Y Feb | 0.30% | |||

| 12:30 | GBP | Annual Budget Release | ||||

| 13:15 | USD | ADP Employment Change Feb | 184K | 246K | ||

| 13:15 | CAD | Housing Starts Feb | 205K | 207K | ||

| 13:30 | USD | Non-Farm Productivity Q4 F | 1.50% | 1.30% | ||

| 13:30 | USD | Unit Labor Costs Q4 F | 1.60% | 1.70% | ||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | 1.20% | |||

| 13:30 | CAD | Building Permits M/M Jan | -6.60% | |||

| 15:30 | USD | Crude Oil Inventories | 1.5M |