Global stock markets are lifted by the agreement on the EUR 750B Next Generation EU recovery package. Commodity currencies surge broadly with Australian Dollar leading the way. RBA Governor indicated that the current exchange rate is inline with Australia’s fundamentals. On the other hand, Dollar, Yen and Swiss Franc are under broad based pressure due to strong risk-on markets. Euro is also weak after traders take profits after the news of the stimulus deal.

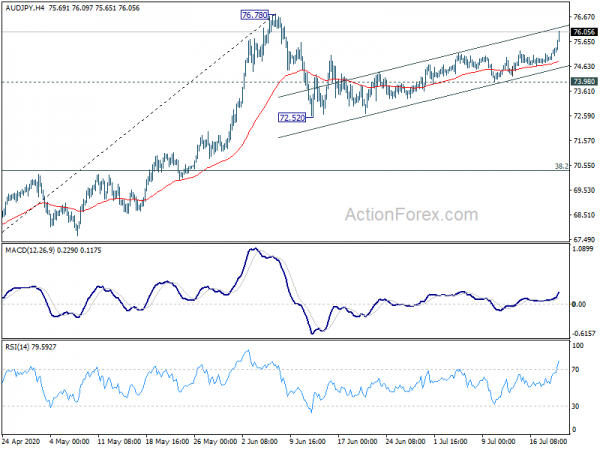

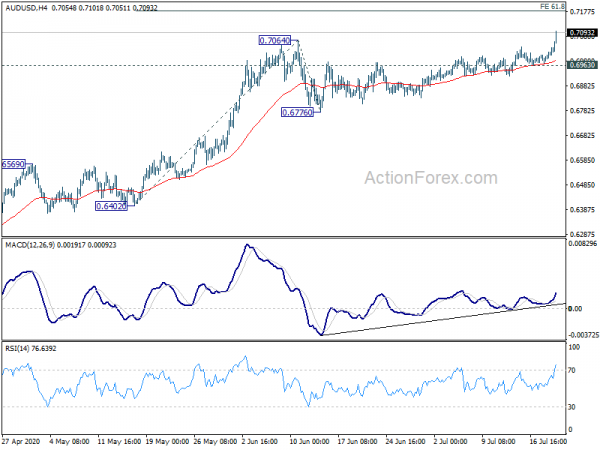

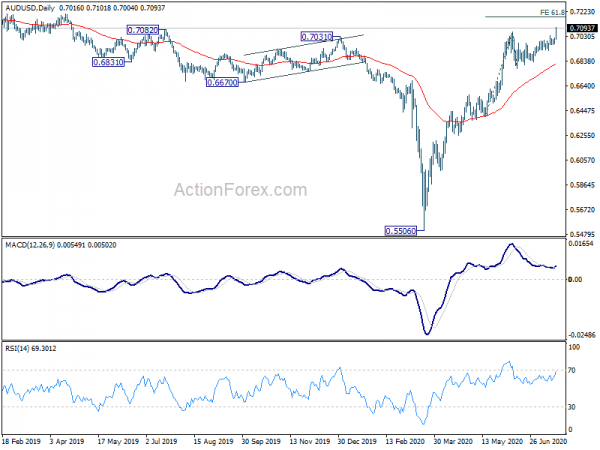

Technically, AUD/USD’s break of 0.7064 suggests resumption of whole rebound from 0.5506. Next major target will be 55 month EMA at 0.7316. EUR/AUD is also heading back to 1.6033 support with today’s steep decline. Firm break there will resume whole fall from 1.9799. AUD/JPY is also accelerating sharply higher today and is set to take on 76.78 high very soon.

In Europe, currently, FTSE is up 0.42%. DAX is up 1.59%. CAC is up 1.02%. Germany 10-year yield is up 0.0016 at -0.459. Earlier in Asia, Nikkei rose 0.73%. Hong Kong HSI rose 2.31%. China Shanghai SSE rose 0.20%. Singapore Strait Times rose 0.50%. Japan 10-year JGB yield dropped -0.0102 to 0.016.

Canada retail sales rose 18.7% in May, expected to rise further 24.5% in June

Canada retail sales rose 18.7% mom to CAD 41.8B in May, below expectation of 21.0% mom rise. It’s also insufficient to recover April’s -26.4% mom decline. Additionally, sales were also -20% below February’s pre-pandemic level. Sales were up in 10 out of 11 sub sectors, Motor vehicle and parts dealers, general merchandise stores, as well as clothing and clothing accessories stores were the main contributors to the rebound.

Statistics Canada also said that in advance estimate of June, retail sales would increase 24.5% mom. But owing to its preliminary nature, the figure should be expected to be revised.

Also from Canada, new housing price index rose 0.1% mom in June, below expectation of 0.2% mom.

Released in European session, Swiss trade surplus widened to CHF 3.2B in June. UK public sector net borrowing dropped to GBP 34.8B in June.

RBA Lowe: Negative rates and FX intervention are not directions to head in

RBA Governor Philip Lowe reiterated in a speech that “there has been no change to the Board’s view that negative interest rates in Australia are extraordinarily unlikely”. Negative interest rates would come with costs and causes “stresses in the financial system”. They would also “encourage people to save more rather than spend more”. It’s “not a direction we need to head in”.

Meanwhile, there is evidence that Australian Dollar’s exchange rate is “broadly in line with its economic fundamentals”. Foreign exchange market intervention would have “limited effectiveness” and involve “substantial financial risks to the public balance sheet and complicate international relationships. Hence, “this too is not a direction we need to head in”.

On the economy, he said “fortunately, we have now turned the corner” in the labor market. Many firms heavily affected by the coronavirus shutdowns are now “rehiring and lifting hours” as restrictions are eased in most of Australia. However, in some sectors like construction and professional services, the pipeline of work is “drying up” as new orders have declined. Hours worked in these businesses will decline further ahead.

Lowe expected unemployment is likely to “increase further, even with the recovery underway”. Many people who lost they job will “start looking for jobs” and thus be classified as rejoining the labor force. That will push up the measured unemployment rate, like what happened with June’s figures. One of the keys to returning to a strong labor market is “restoring confidence”.

Japan CPI core rose to 0% in Jun, out of negative region

Japan all item CPI rose 0.1% mom in June, CPI core (less fresh food) rose 0.1% mom, CPI core core (less fresh food and energy) rose 0.1% mom too. Annually, CPI was unchanged at 0.1% yoy. CPI core climbed back to 0.0% yoy, up from -0.2% yoy, above expectation of -0.1% yoy. CPI core-core was unchanged at 0.4% yoy.

The pickup in CPI core out of negative territory suggests that impact of free fall in energy prices earlier this year started to fade. There could also be some stabilization effect as the nationwide state of emergency was lifted in late May. Yet, there is little chance of a strong rebound in inflation, nor the economy, as external and domestic demand remain weak with coronavirus pandemic dragging on.

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6988; (P) 0.7002; (R1) 0.7032; More…

AUD/USD accelerates to as high as 0.7101 so far today. Break of 0.7064 resistance confirms resumption of whole rise form 0.5506. Intraday bias is now on the upside for near term target of 61.8% projection of 0.6402 to 0.7064 from 0.6776 at 0.7185. On the downside, break of 0.6963 support is needed to confirm short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, rebound from 0.5506 medium term bottom could be correcting whole long term down trend from 1.1079 (2011 high). Further rally would be seen to 55 month EMA (now at 0.7311). This will remain the preferred case as long as it stays above 55 week EMA (now at 0.6750). Sustained trading below 55 week EMA will turn focus back to 0.5506 low instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Jun | 0.00% | -0.10% | -0.20% | |

| 01:30 | AUD | RBA Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Jun | 3.22B | 2.80B | 2.71B | |

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Jun | 34.8B | 39.9B | 54.5B | 44.7B |

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.10% | 0.20% | 0.10% | |

| 12:30 | CAD | Retail Sales M/M May | 18.70% | 21.00% | -26.40% | |

| 12:30 | CAD | Retail Sales ex Autos M/M May | 10.60% | 11.90% | -22.00% |