Euro and Swiss Franc rise broadly today but upside is so far limited. Traders are still cautiously awaiting EU leaders’s decision on the EUR 750B recovery fund. On the other hand, Sterling suffers notable selling for today, thanks to selling in cross against Euro. Canadian Dollar is following as the second weakest and then Dollar. US futures are pointing to a mildly higher open, which is disadvantageous to the greenback. Though, we’ll whether stocks could maintain gains at close.

Technically, EUR/GBP’s rally resumes after brief consolidation and should target a test on 0.9175 short term top. EUR/JPY is also in progress to extend the rebound from 119.31 towards 124.43 high. The developments keep GBP/JPY in range above 133.94 minor support. However, break of 133.94 could prompt deeper selloff towards 131.68 support. That could spill over to other Sterling pairs.

In Europe, currently, FTSE is up 0.48%. DAX is up 0.27%. CAC is down -0.32%. Germany 10-year yield is down -0.0090 at -0.472. Earlier in Asia, Nikkei dropped -0.32%. Hong Kong HSI rose 0.47%. China Shanghai SSE rose 0.13%. Singapore Strait Times dropped -0.20%. Japan 10-year JGB yield rose 0.0008 to 0.017.

BoE Bailey: We’re beginning to see this recovery

BoE Governor Andrew Bailey said the policymakers are seeing “activity return” and “we are beginning to see this recovery”. In particular, housing markets and new car sales are returning “quite strongly” but not in hospitality and entertainment. The return to normal is still a “very big question”. Also, he doesn’t yet know the “full story” of the long term economic damage of the coronavirus pandemic.

“Financial markets indicate interest rates will stay very low,” he added. “People can see that we are committed to keeping markets stable via quantitative easing… There is a legitimate question about what we do with QE when things get back to normal.”

ECB: Professional forecasters see deeper GDP contraction in 2020, stronger rebound afterwards

According to the last ECB Survey of Professional Forecasters, the economy is projected to have a deeper contraction of -8.3% in 2020 (vs prior -5.5%). Nevertheless, stronger GDP growth is expected in 2021 (5.7% vs prior 4.3%) and 2022 (2.4% vs prior 1.7%).

HICP forecast was kept unchanged at 0.4% for 2020. But it was revised lower to 1.0% in 2021 (prior 1.2%) and 1.3% in 2022 (prior 1.4%).

Unemployment rate forecast for 2020 was revised down to 9.1% (prior 9.4%). But it was revised up to 9.3% in 2021 (prior 8.9%) and 8.5% in 2022 (prior 8.4%).

Eurozone CPI finalized at 0.3% yoy, EU CPI at 0.8%

Eurozone CPI was finalized at 0.3% yoy in June, up from May’s 0.1% yoy. Highest contribution came from food, alcohol & tobacco (+0.60%), followed by services (+0.55%), non-energy industrial goods (+0.05%) and energy (-0.93%).

EU CPI was finalized at 0.8% yoy in June, up from May’s 0.6% yoy. Among the member states, the lowest annual rates were registered in Cyprus (-2.2%), Greece (-1.9%) and Estonia (-1.6%). The highest annual rates were recorded in Poland (3.8%), Czechia (3.4%) and Hungary (2.9%). Compared with May, annual inflation fell in seven Member States and rose in twenty.

New Zealand BusinessNZ PMI rose to 56.3, highest since Apr 2018

New Zealand BusinessNZ Performance of Manufacturing Index rose sharply to 56.3 in June, up from 39.8. That’s also the highest level since April 2018. Looking at some details, production rose from 38.1 to 58.6. New orders rose from 39.2 to 58.6. Employment rose fro 39.2 to 48.5, but stayed below 50.

BusinessNZ’s executive director for manufacturing Catherine Beard said: “We should remain cautious that one expansionary result does not represent a trend given ongoing offshore uncertainty around COVID-19. A consistent trail of new orders over the coming months would go a long way towards ensuring the second half of 2020 is better than the first. ”

EUR/USD Mid-Day Outlook

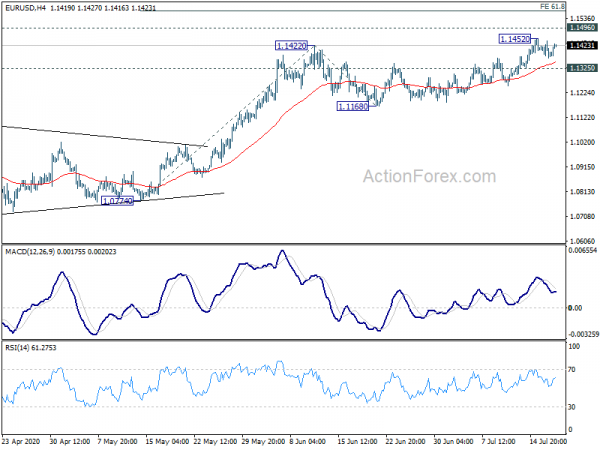

Daily Pivots: (S1) 1.1355; (P) 1.1399; (R1) 1.1426; More….

EUR/USD is staying in consolidation below 1.1452 temporary top. Intraday bias remains neutral first. Further rise could still be seen and break of 1.1452 will target 1.1496 key resistance. Firm break there will carry larger bullish implications and target 61.8% projection of 1.0774 to 1.1422 from 1.1168 at 1.1568 next. On the downside, break of 1.1325 minor support will turn bias back to the downside for 1.1168 support. Decisive break there will indicate near term bearish reversal.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ PMI Jun | 56.3 | 39.7 | 39.8 | |

| 09:00 | EUR | Eurozone CPI M/M Jun F | 0.30% | 0.30% | -0.10% | |

| 09:00 | EUR | Eurozone CPI Y/Y Jun F | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone CPI Core M/M Jun F | 0.30% | 0.30% | 0.30% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun F | 0.80% | 0.80% | 0.80% | |

| 12:30 | USD | Housing Starts Jun | 1.19M | 1.17M | 0.97M | 1.01M |

| 12:30 | USD | Building Permits un | 1.24M | 1.30M | 1.22M | |

| 12:30 | CAD | Wholesale Sales M/M May | 5.70% | -12.60% | -21.60% | -21.40% |