Sentiments seemed to have a turn as surge of coronavirus cases in the US pushed California back into lockdown. Asian markets are under some selling pressure. But the more indicative development was the sharp -2.13% decline in NASDAQ overnight. It remains to be seen if tech index is finally giving up its resilience as investors take profits. In the currency markets, Swiss Franc, Dollar and Yen are back in control, rising broadly today. Commodity currencies are generally weak, with Sterling additionally pressured by much weaker than expected GDP rebound in May.

Technically, immediate focus will be on 1.2508 minor support in GBP/USD, 133.94 minor support in GBP/JPY, and 0.9067 minor resistance in EUR/GBP. Firm break of these levels will indicate Sterling’s recent rebound has completed and would bring deeper selloff in general. 0.6922 minor support in AUD/USD will also be watched and break should finally indicate completion of the corrective rebound from 0.6776.

In Asia, Nikkei closed down -0.87%. Hong Kong HSI is down -1.62%. China Shanghai SSE is down -0.83%. Singapore Strait Times is down -0.55%. Japan 10-year JGB yield is down -0.0073 at 0.024. Overnight, DOW rose 0.04%. S&P 500 dropped -0.94%. NASDAQ dropped -2.13%. 10-year yield rose 0.007 to 0.640.

UK GDP grew just 1.8% mom in May, economy still a quarter below Feb level

UK GDP grew notably by 1.8% mom in May but the rebound was somewhat disappointing and missed expectation of 5.0% mom. Production jumped sharply by 6.0% mom, with manufacturing up 8.4%. Services rose 0.9% mom while construction rose 8.2% mom. But all were insufficient to recover the contraction in April (production -20.2% mom, manufacturing -24.4% mom, services -18.9% mom, construction -40.2% mom. Agriculture continued contraction by -6.2% mom.

For the three months to May, GDP dropped by -19.1% 3mo3m. Production dropped -15.5% 3mo3m. Manufacturing dropped -18.0% 3mo3m. Service dropped -18.9% 3mo3m. Construction dropped -29.8% 3mo3m. Agriculture dropped -6.3% 3mo3m.

Jonathan Athow, Deputy National Statistician for Economic Statistics, said: “Manufacturing and house building showed signs of recovery as some businesses saw staff return to work. Despite this, the economy was still a quarter smaller in May than in February, before the full effects of the pandemic struck. In the important services sector, we saw some pickup in retail, which saw record online sales. However, with lockdown restrictions remaining in place, many other services remained in the doldrums, with a number of areas seeing further declines.”

Also from UK, trade deficit narrowed to GBP -2.8B in May, better than expectation of GBP -8.2B. BRC retail sales monitor rose 10.9% yoy in June.

Australia NAB business confidence turned positive, turnaround faster than expected

Australia NAB Business Confidence rose to 1 in June, up from May’s -20, turned positive after rebounding sharply from the record lows over the past three months. Business Conditions also improved notably to -7, up from -24. Looking at some details, trading conditions rose to -7, up from -19. Profitability conditions rose from -8, up from -19. Employment conditions also rose to -11, up from -31.

Alan Oster, NAB Group Chief Economist, said: “Overall, there has been a very large and fast rebound in the business survey over the past two months, but keeping perspective over just how large the hit to both activity and confidence is very important. While the turnaround has possibly occurred faster than expected, things have certainly not fully recovered. Conditions and capacity utilisation remain very weak and will take some time to recover”.

China trade surplus narrowed to USD 46.4B in June as imports jumped more than exports

In June, in USD term, China’s total trade rose 1.5% yoy to USD 380.7B. Exports rose 0.5% yoy to USD 213.6B. Imports rose 2.7% yoy to USD 167.2B. Trade surplus narrowed to USD 46.4B, down from May’s USD 62.9B.

From January to June, total trade dropped -6.6% ytd yoy to USD 2029.7B. Exports dropped -6.2% ytd yoy to USD 1098.8B. Imports dropped -7.1% ytd yoy to USD 931.0B. Trade surplus came in at USD 167.8B year-to-June.

From January to June, with EU, total trade dropped -4.9% ytd yoy to USD 284.2B. Exports dropped -1.5% ytd yoy to USD 172.3B. Imports dropped -9.6% ytd yoy to USD 111.9B.

From January to June, with US, total trade dropped -9.7% ytd yoy to USD 234.0B. Exports dropped -11.1% ytd yoy to USD 177.6B. Imports dropped -4.8% ytd yoy to USD 56.4B.

Elsewhere

Germany CPI was finalized at 0.6% mom, 0.9% yoy in June. Swiss PPI came in at 0.6% mom, -3.5% yoy. Eurozone will release industrial production. Germany will release ZEW economic sentiment. US CPI will be the main focus later today.

GBP/USD Daily Outlook

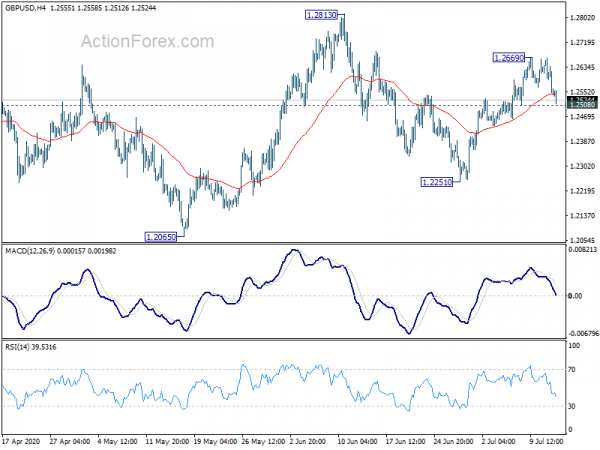

Daily Pivots: (S1) 1.2513; (P) 1.2589; (R1) 1.2628; More….

Intraday bias in GBP?USD stays neutral first with focus back on 1.2508 minor support. Break there will indicate completion of rebound from 1.2251. In this case, intraday bias is turned back to the downside for 1.2251 support. Break there should then confirm completion of whole rebound from 1.1409. on the upside, above 1.2669 temporary will turn bias back to the upside for 1.2813 resistance instead.

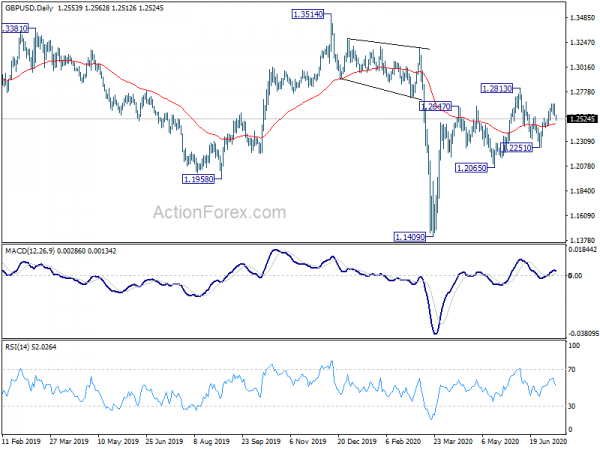

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jun | 10.90% | 7.90% | ||

| 1:30 | AUD | NAB Business Conditions Jun | -7 | -24 | ||

| 1:30 | AUD | NAB Business Confidence Jun | 1 | -20 | ||

| 2:55 | CNY | Trade Balance (USD) Jun | 46.4B | 58.3B | 62.9B | |

| 2:55 | CNY | Exports (USD) Y/Y Jun | 0.50% | -3.30% | ||

| 2:55 | CNY | Imports (USD) Y/Y Jun | 2.70% | -16.70% | ||

| 2:55 | CNY | Trade Balance (CNY) Jun | 329B | 410B | 443B | |

| 2:55 | CNY | Exports (CNY) Y/Y Jun | 4.30% | 1.40% | ||

| 2:55 | CNY | Imports (CNY) Y/Y Jun | 6.20% | -12.70% | ||

| 4:30 | JPY | Industrial Production M/M May F | -8.90% | -8.40% | -8.40% | |

| 6:00 | GBP | GDP M/M May | 1.80% | 5.00% | -20.40% | -20.30% |

| 6:00 | GBP | Industrial Production M/M May | 6.00% | 6.00% | -20.30% | -20.20% |

| 6:00 | GBP | Industrial Production Y/Y May | -20.00% | -21.00% | -24.40% | -23.80% |

| 6:00 | GBP | Manufacturing Production M/M May | 8.40% | 8.00% | -24.30% | -24.40% |

| 6:00 | GBP | Manufacturing Production Y/Y May | -22.80% | -24.00% | -28.50% | -28.20% |

| 6:00 | GBP | Index of Services 3M/3M May | -18.90% | -16.90% | -9.90% | -10.70% |

| 6:00 | GBP | Goods Trade Balance (GBP) May | -2.8B | -8.2B | -7.5B | -4.8B |

| 6:00 | EUR | Germany CPI M/M Jun F | 0.60% | -0.10% | 0.60% | |

| 6:00 | EUR | Germany CPI Y/Y Jun F | 0.90% | 0.90% | 0.90% | |

| 6:30 | CHF | Producer and Import Prices M/M Jun | 0.50% | -0.90% | -0.50% | |

| 6:30 | CHF | Producer and Import Prices Y/Y Jun | -3.50% | -5.00% | -4.50% | |

| 9:00 | EUR | Eurozone Industrial Production M/M May | 13.40% | -17.10% | ||

| 9:00 | EUR | Germany ZEW Economic Sentiment Jul | 60 | 63.4 | ||

| 9:00 | EUR | Germany ZEW Current Situation Jul | -64 | -83.1 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Jul | 55.8 | 58.6 | ||

| 10:00 | USD | NFIB Business Optimism Index Jun | 90.9 | 94.4 | ||

| 12:30 | USD | CPI M/M Jun | 0.50% | -0.10% | ||

| 12:30 | USD | CPI Y/Y Jun | 0.30% | 0.10% | ||

| 12:30 | USD | CPi Core M/M Jun | 0.10% | -0.10% | ||

| 12:30 | USD | CPi Core Y/Y Jun | 1.10% | 1.20% |