Asian markets open the week with risk-on sentiments, carrying forward the optimism over coronavirus treatment. Dollar and Yen are back under pressure again while Australian Dollar, Euro and Sterling are trading generally higher. Gold also firms up above 1800 handle, riding on Dollar’s softness. The economic calendar is rather light today and focuses will be on the three central bank meetings this week, plus loads of important data.

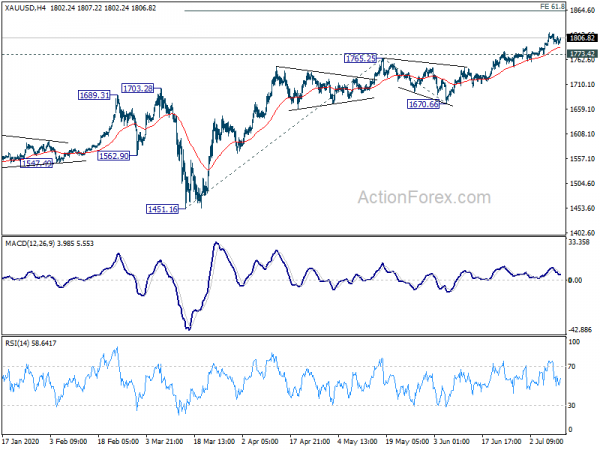

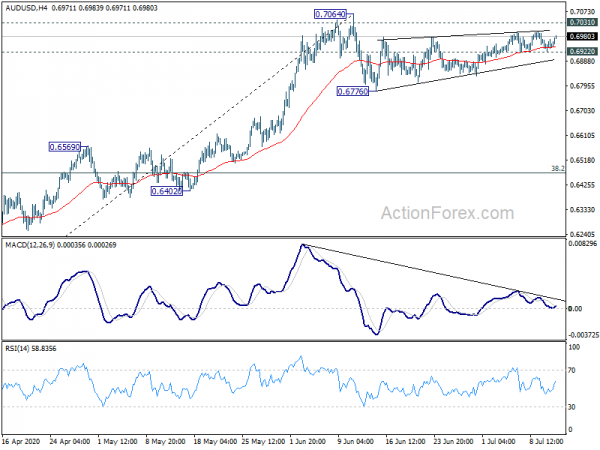

Technically, Dollar was rejected by near term resistance level against both Euro and Aussie last week. Attention is back on 1.1370 minor resistance in EUR/USD and 0.7001 minor resistance in AUD/USD. Break will resume recent rebound. Yet, EUR/USD would be close to 1.1422/1496 key resistance zone on next rise. AUD/USD is even closer to 0.7064 high. Thus, upside potential might be limited. On the other hand, there is more room for Gold. Break of 1817.91 temporary top would target 61.8% projection of 1451.16 to 1765.25 from 1670.66 at 1864.76. Upside acceleration in Gold could be a hint on intensified selloff in Dollar elsewhere.

In Asia, currently, Nikkei is up 2.06%. Hong Kong HSI is up 1.26%. China Shanghai SSE is up 1.81%. Singapore Strait times is down -0.18%. Japan 10-year JGB yield is up 0.012 at 0.031.

Australia Frydenberg: Effective unemployment at around 13.3%, second phase of income support coming

Australian Treasurer Josh Frydenberg said the effective unemployment rate is “around 13.3% right now” and ” “that is a large number of people reflecting the economic challenges that we see right now.” His number is nearly double of the official data of 7.1%.

“We have seen a big reduction in hours worked in the months since the Covid pandemic first hit in Australia,” Frydenberg further explained. “That just reflects the enormous economic challenge that we face and the impact it’s having on the unemployment rate.”

Frydenberg added that there will be a “second phase of income support” to be delivered with the fiscal and economic statement on July 23. “It will be governed by the same principles that have defined our economic measures to date, namely that our support will be targeted, it will be temporary, it will be designed based on existing systems and it will also be demand driven,”

Half of American business in HK extremely concerned with the national security law

WSJ reported that the US President Donald Trump’s team would discuss the options on sanctioning China and Hong Kong again early this week. Sanctions and other measures could be announced. But at this point, the options seemed to be limited. Targeted sanctions against Chinese officials and trade measures against Hong Kong would likely have little impact. Yet, more drastic economic measures could hurt the interests of both Americans businesses and Hong Kong people.

Separately, the American Chamber of Commerce said a majority of US companies in Hong Kong are concerned about the new national security law. 36.6% of the respondents surveyed were “somewhat concerned” and 51% were “extremely” concerned about the legislation. 65% said they’re concerned with the “ambiguity in its scope and enforcement” and roughly 61% were concerned Hong Kong’s judicial independence. 49% said the law would have a negative impact on their businesses and about half said they would personally consider leaving the city.

BoJ, BoC and ECB to meet while loads of data to watch

Three central banks will meet this week BoJ is expected to maintain negative interest rate at -0.1% as well as the unlimited QE to keep 10 year yield at around 0%. The central bank is generally expected to downgrade economic forecasts for fiscal 2020. BoC is expected to keep policy rate unchanged at 0.25%. the main focus will be on the updated forecasts in the July MPR. ECB is also widely expected to keep monetary policies unchanged. ECB has already ramped up the pandemic asset purchase program by EUR 600b last month. It’s time for the stimulus to work its way through to the economy. Fed will also release Beige book economic report.

The economic data calendar is very business too. Some of the focuses include US retail sales and CPI; Germany ZEW; UK GDP, production, employment and CPI; Australia employment; New Zealand CPI and manufacturing index; and, China GDP, investment, production and retail sales. Here are some highlights for the week.

- Monday: Japan tertiary industry index; US federal budget balance.

- Tuesday: Australia NAB business confidence; China trade balance; UK GDP, trade balance, productions; Germany CPI final, ZEW economic sentiment. ; Swiss PPI; Eurozone industrial production; US CPI.

- Wednesday: Australia Westpac consumer sentiment; BoJ rate decision; UK CPI, PPI; Canada manufacturing sales, BoC rate decision; US Empire state manufacturing, import price, industrial production, Fed’s Beige book.

- Thursday: New Zealand CPI; Australia employment; China GDP, fixed asset investment, industrial production, retail sales; UK employment; Eurozone trade balance, ECB rate decision; Canada ADP employment; US retail sales, Philly Fed survey, jobless claims, business inventories, NAHB housing index.

- Friday: New Zealand BusinessNZ manufacturing; Eurozone CPI final; Canada wholesale sales, US building permits and housing starts, U of Michigan sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6925; (P) 0.6947; (R1) 0.6970; More…

Intraday bias in AUD/USD remains neutral for the moment. Further rise cannot be ruled out. But we’d still expect correction from 0.7064 to extend with another falling leg. On the downside, below 0.6922 minor support will turn bias to the downside for 0.6776 support. Break there will target 38.2% retracement of 0.5506 to 0.7064 at 0.6469. Nevertheless, sustained break of 0.7064 will resume whole rise from 0.5506 instead.

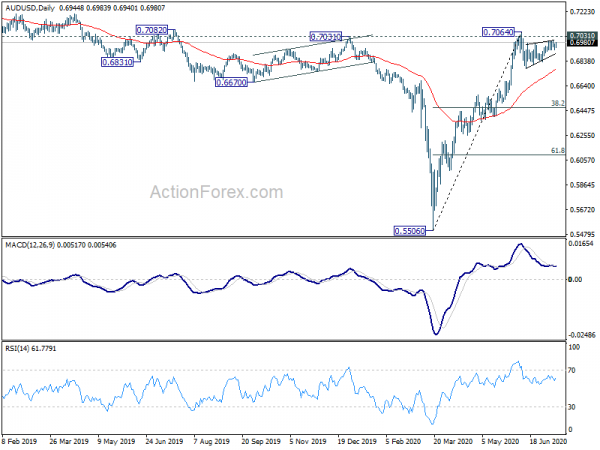

In the bigger picture, rebound from 0.5506 medium term bottom could be correcting whole long term down trend from 1.1079 (2011 high). Further rally would be seen to 55 month EMA (now at 0.7311). This will remain the preferred case as long as it stays above 55 week EMA (now at 0.6750). Sustained trading below 55 week EMA will turn focus back to 0.5506 low instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M May | -2.10% | -3.70% | -6.00% | -7.70% |

| 18:00 | USD | Monthly Budget Statement Jun | -350.0B | -398.8B |