Yen surges broadly today as the financial markets are back in risk-off mode. Or at least, rally in Chinese stocks is having a pause. Investors some what turned cautious ahead of the week. US Secretary of State Mike Pompeo announced sanctions on some Chinese officials, including a Politburo member, over gross violations of human rights in Xinjiang. That’s generally seen at the start of a wave of sanctions, as the US-China relations deteriorate further. Dollar and Euro are following as the next strongest. Meanwhile, Australian Dollar is additionally pressured by spike in coronavirus cases in Victoria. Canadian Dollar is weighed down by the selloff in oil overnight.

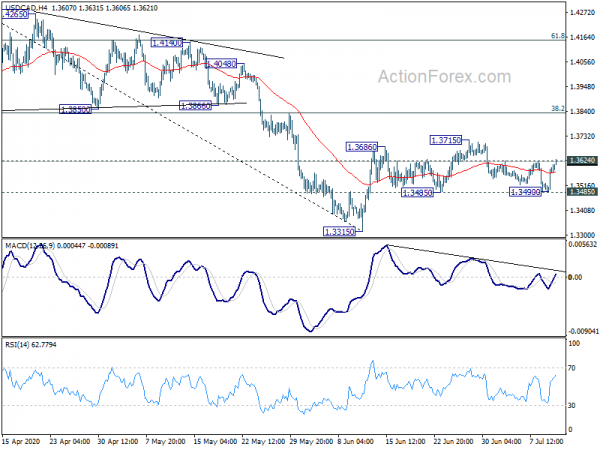

Technically, EUR/USD’s breach of 1.1258 minor support dampen the near term bullishness and open up further decline to test 1.1168 support. EUR/JPY’s break of 120.58 minor support should also bring deeper fall to 119.31. USD/CAD’s breach of 1.3624 minor resistance after defending 1.3485 support retains near term bullish for rally through 1.3715 resistance. A focus today would be on USD/JPY, which is eyeing 106.79 minor support. Break will suggest completion of rebound from 106.07 and bring retest of this low.

In Asia, Nikkei closed down -1.06%. Hong Kong HSI is down -2.36%. China Shanghai SSE is down -1.95%. Singapore Strait Times is down -0.63%. Overnight, DOW dropped -1.39%. S&P 500 dropped-0.56%. NASDAQ rose 0.53% to new record. 10-year yield dropped -0.048 to 0.605. 10-year JGB yield dropped -0.0008 to 0.019.

AUD/JPY tumbles as Victoria coronavirus cases spiked

Australian Dollar drops broadly today and selling pressure also intensified. Victoria state Premier Daniel Andrews confirmed that a total of 288 coronavirus cases were recorded in 24 hours, making a record daily increase since the start of the pandemic. Andrews requested the residents there to wear masks anywhere they can’t social distance. He’s also unsure whether the reimposed lockdown in metropolitan Melbourne would end in six weeks as planned.

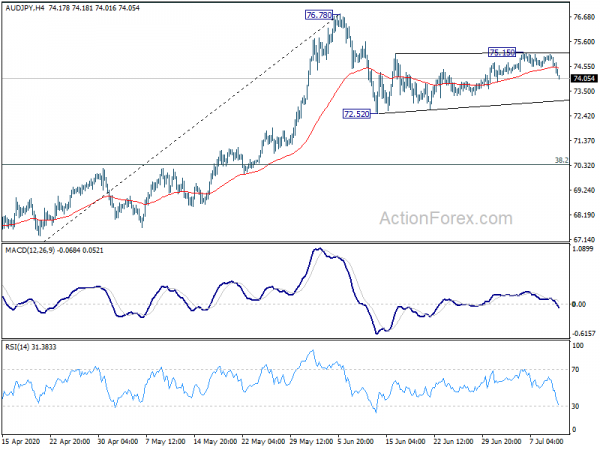

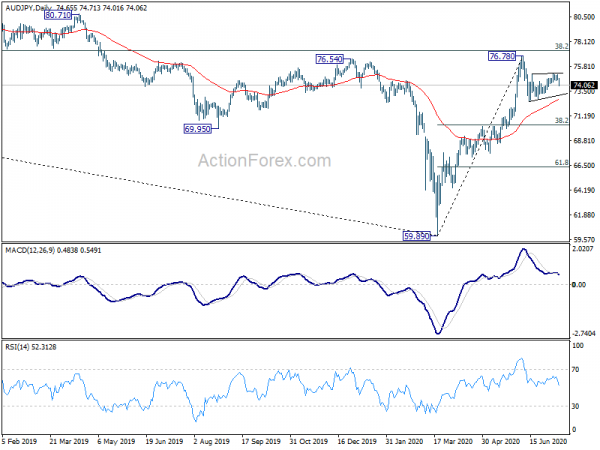

The Aussie is also weighed down by weakness in Asian stocks, as China Shanghai SSE ended its winning streak. Yen is back in control as the strongest one for today. AUD/JPY’s steep decline today argues that sideway pattern from 72.52 might have finally completed at 75.15. Correction from 76.78 is ready to resume. Focus will be on 72.52 support, probably next week. Break will extend the corrective fall from 76.78 to 38.2% retracement of 59.89 to 76.78 at 70.32.

US 10-year yield breaking 0.6 while stocks were mixed

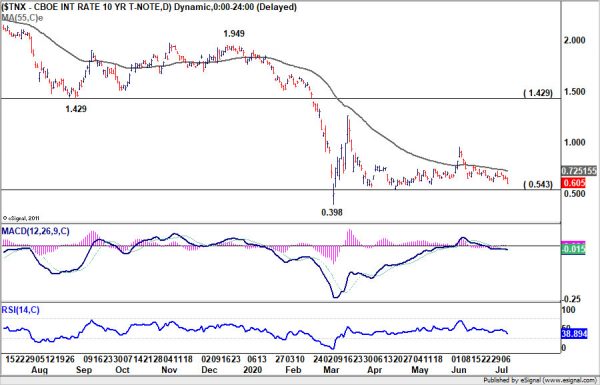

The US stock markets continued to display some divergence overnight. DOW ended down sharply by -361.19 pts or -1.39%. S&P 500 also dropped -17.89 pts or -0.56%. Yet, NASDAQ scored another record high, rose 55.25pts or 0.53% to close at 10547.75. However, the steep decline in 10-year yield could be a sign that risk aversion is sneaking back.

TNX hit at s low at 0.599, breached 0.6 handle, before closing at 0.605, down -0.048. In Asia, TNX remains pressured, down -0.0172 at 0.591 at the time of writing. Near term focus is back on 0.543 support, which TNX might attempt to test next week. There shouldn’t be any serious trouble for the markets if this 0.543 would remain intact. But a strong break there could bring steep decline back towards to spike low of 0.398. That would be a strong sign of risk aversion if happens.

French industrial production rose 19.6% in May, still down -21.2% from Feb

France industrial production rose 19.6% mom in May, above expectation of 15.0%. It also nearly recovered all of April’s -20.6% decline. Nevertheless, compared to February, the last month before the start of general lockdown, outlook was still down -21.2%.

Elsewhere

Italy will release industrial production in European session. US will release PPI later in the day. But major focus will be on Canada employment.

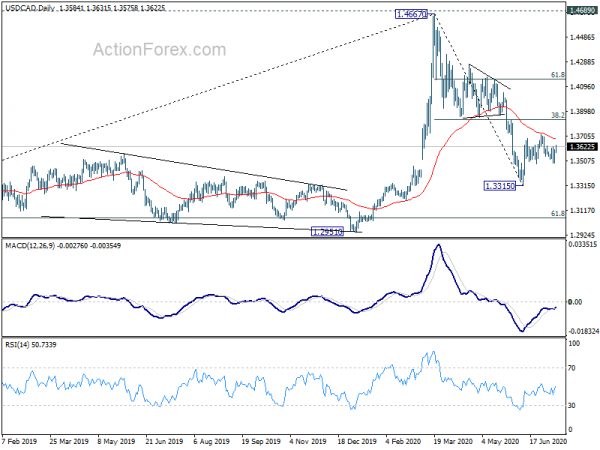

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3517; (P) 1.3556; (R1) 1.3621; More….

The breach of 1.3642 minor resistance in USD/CAD suggests completion of the pull back from 1.3715. Also, with 1.3485 support defended, near term bullishness is retained and further rise is in favor. Intraday bias is back on the upside for 1.3715 resistance first. Break will extend the rebound from 1.3315 to 38.2% retracement of 1.4667 to 1.3315 at 1.3831. On the downside, however, break of 1.3485 will argue that the rebound has completed and turn bias back to the downside for retesting 1.3315 low.

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement at 1.3056 and possibly below. This will now remain the favored case as long as 1.3855 support turned resistance holds. However, sustained break of 1.3855 will turn focus back to 1.4689 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Jun | -1.60% | -1.90% | -2.70% | -2.80% |

| 6:45 | EUR | France Industrial Output M/M May | 19.60% | 15.00% | -20.10% | -20.60% |

| 8:00 | EUR | Italy Industrial Output M/M May | 19.20% | -19.10% | ||

| 12:30 | USD | PPI M/M Jun | 0.40% | 0.40% | ||

| 12:30 | USD | PPI Y/Y Jun | -0.40% | -0.80% | ||

| 12:30 | USD | PPI Core M/M Jun | 0.10% | -0.10% | ||

| 12:30 | USD | PPI Core Y/Y Jun | 0.50% | 0.30% | ||

| 12:30 | CAD | Net Change in Employment Jun | 675.0K | 289.6K | ||

| 12:30 | CAD | Unemployment Rate Jun | 11.90% | 13.70% |