Dollar is sold off broadly while Yen is following as the second weakest. Sentiments are apparently lifted by stimulus hopes despite surge in global coronavirus cases. European majors are leading the way higher, with Sterling having a touch more strength. Commodity currencies, on the other hand, somewhat lag behind. In particular, Australian Dollar is troubled by the risk of return to lockdown.

Technically, EUR/USD’s break of 1.1348 minor resistance suggests that larger rebound from 1.0635 is ready to resume through 1.1422 short term top. Focus will quickly turn to 1.1496 key medium term structural resistance. USD/CHF has already resumed the decline from 0.9901, for 0.9337 projection level. Sustained break there will pave the way to retest 0.9181 low.

In Asia, currently, Nikkei is up 0.96%. Hong Kong HSI is up 0.47%. China Shanghai SSE is up 1.03%. Singapore Strait Times is down -0.32%. Japan 10-year JGB yield is up 0.0004 at 0.020. Overnight, DOW rose 0.68%. S&P 500 rose 0.78%. NASDAQ rose 1.44%. 10-year yield rose 0.003 to 0.653.

BoJ Kuroda: Severe situation to continue but economy will gradually resume

In the branch managers’ meeting, BoJ Governor Haruhiko Kuroda said “economic activity is expected to gradually resume”. But, for the time being “severe situation will continue due to the impact of infectious diseases both inside and outside Japan”.

“If the impact of the infectious disease then subsides, pent-up demand (restricted demand) is expected to emerge and recovery production is expected. As a result, the Japanese economy is expected to improve,” he added.

As for monetary policy, Kuroda said “we will closely monitor the effects of the new coronavirus infection and, if necessary, take additional monetary easing measures without hesitation. It is assumed that the policy interest rate will remain at or below the current level of long and short interest rates.”

Released from Japan, M2 rose 7.2% yoy in June. Machine orders rose 1.7% mom in May, much better than expectation of -5.4% mom decline.

New Zealand ANZ business confidence rose to -29.8, activity outlook jumped to -6.8

New Zealand ANZ Business Confidence rose 4.6 pts from -34.4 to -29.8 in the preliminary July reading. Own Activity Outlook rose even sharply by 19.1 pts from -25.9 to -6.8. Looking at some other details, investment intentions rose from -20.5 to -4.5. Employment intentions rose from -34.7 to -15.3. Profit expectations rose from -46.8 to -25.8.

ANZ said: “New Zealand is in an enviable position (touch wood), with activity largely back to normal, as demonstrated by traffic and spending data and many other indicators. After the rigorous of lockdown we deserve a pat on the back and a little splurge…. Uncertainty is extreme and the global outlook dire. But for now, we’re getting on with our economic lives, and that’ll be helping to repair business’ balance sheets.”

Fed Rosengren: Economy to remain weaker than hoped through summer and fall

Boston Fed President Eric Rosengren said yesterday that “I do expect unfortunately that the economy is going to remain weaker than many had hoped through the summer and fall”. He added the Fed’s Main Street Lending program could grow over time and the program will be “an important way to make sure that firms don’t close.”

Richmond Fed President Thomas Barkin said “businesses like construction had pretty good pipelines and kept going”. But “new orders are not coming on line in the same way. We have fiscal payments … that are coming to an end and it is not clear what is going to replace them.”

St. Louis Fed President James Bullard said he’s “still pretty optimistic in my base case about the recovery”. “Masks will become ubiquitous throughout the economy and… fatalities will go way down.” He expected unemployment rate to drop to “maybe even 7%” by year end.

Elsewhere

China CPI rose to 2.5% yoy in June, matched expectation. PPI rose to -3.0% yoy, above expectation of -3.2% yoy. Germany will release trade balance in European session. Later in the day, Canada will release housing starts. US will release wholesale inventories final.

EUR/USD Daily Outlook

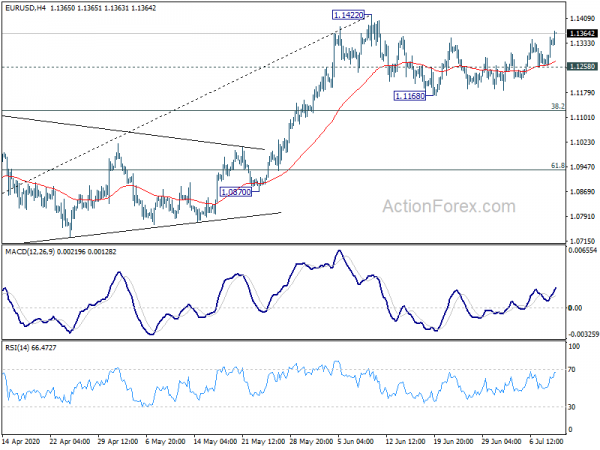

Daily Pivots: (S1) 1.1279; (P) 1.1315; (R1) 1.1368; More….

EUR/USD’s break of 1.1348 resistance argues that consolidation pattern from 1.1422 short term top might be over. Intraday bias is back on the upside for 1.1422 first. Break will resume whole rise from 1.0635 to test 1.1496 key resistance. On the downside, though, break of 1.1258 minor support will turn bias back to the downside, to extend the consolidation to 38.2% retracement of 1.0635 to 1.1422 at 1.1121.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS Housing Price Balance Jun | -15% | -25% | -32% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y Jun | 7.20% | 5.10% | ||

| 23:50 | JPY | Machinery Orders M/M May | 1.70% | -5.40% | -12.00% | |

| 01:30 | CNY | CPI Y/Y Jun | 2.50% | 2.50% | 2.40% | |

| 01:30 | CNY | PPI Y/Y Jun | -3.00% | -3.20% | -3.70% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Jun P | -52.80% | |||

| 06:00 | EUR | Germany Trade Balance (EUR) May | 6.6B | 3.2B | ||

| 12:15 | CAD | Housing Starts Jun | 192.5K | 193.5K | ||

| 14:00 | USD | Wholesale Inventories May F | -1.20% | -1.20% | ||

| 14:30 | USD | Natural Gas Storage | 60B | 65B |