Dollar and Yen are both trading as the weakest ones for the week for now. FOMC minutes released overnight gave little support to the greenback, nor that ADP job number and ISM manufacturing. Focus is turning to non-farm payrolls report to be released today. Sterling’s roller coaster ride continues and it’s now the strongest one for the week, followed by Kiwi and Aussie.

Technically, Sterling could steal the show from Dollar today. GBP/JPY’s break of 133.98 minor resistance suggests short term bottoming at 131.68 and hints on further rebound. EUR/GBP is eying 0.9001 support and break will indicate near term bearish reversal for 0.8864 support and below. GBP/USD is also eyeing 1.2542 resistance and break will indicate completion of recent correction and target 1.2813 resistance again.

In Asia, Nikkei closed up 0.11%. Hong Kong is up 1.85%. China Shanghai SSE is up 1.85%. Singapore Strait Times is up 0.33%. Japan 10-year JGB yield is down -0.010 at 0.041. Overnight, DOW dropped -0.30%. S&P 500 rose 0.50%. NASDAQ rose 0.95%. 10-year yield rose 0.029 to 0.682.

FOMC minutes revealed discussions in forward guidance

The FOMC minutes for the June meeting revealed that the members had rigorous discussion about forward guidance, asset purchases and yield curve caps/targets. We expect the framework review will be completed this month, allowing the Fed to announce changes in forward guidance and the asset purchase program at the September meeting.

It appears that many members were still skeptical about adoption of yield curve caps/targets, although a number of them showed favor in the Australian model.

More in FOMC Minutes: Changes in Forward Guidance and Asset Purchases could Come in September

Fed Bullard: A wave of substantial bankruptcies could feed into a financial crisis

St. Louis Fed President James Bullard warned that the risk of a financial crisis remains. He said”without more granular risk management on the part of the health policy, we could get a wave of substantial bankruptcies and could feed into a financial crisis,”

Hence, “it’s probably prudent to keep our lending facilities in place for now, even though its true that liquidity has improved dramatically in financial markets.” The idea to is to make sure that markets don’t freeze up entirely in the twists and turns of a crisis.

Australia trade surplus widened to AUD 8.03B as imports and exports plunged

Australia exports of goods and services dropped -4% mom, or AUD -1604m, to AUD 35.74B in May. Imports dropped -6% mom, or AUD -ADU 1799m, to AUD 27.71B. Trade surplus rose 2% mom to AUD 8.03B, below expectation of AUD 9.0B.

The trade surplus is seen as remaining elevated and has some how been lifted by the impacts of the coronavirus pandemic. Though, the down trend in both imports and exports showed sluggish domestic and external demands.

Looking ahead

Eurozone will release unemployment rate and PPI. Later in the day US non-farm payroll will take center stage. Jobless claims, trade balance and factory orders will be released. Canada will release trade balance and PMI manufacturing.

GBP/USD Daily Outlook

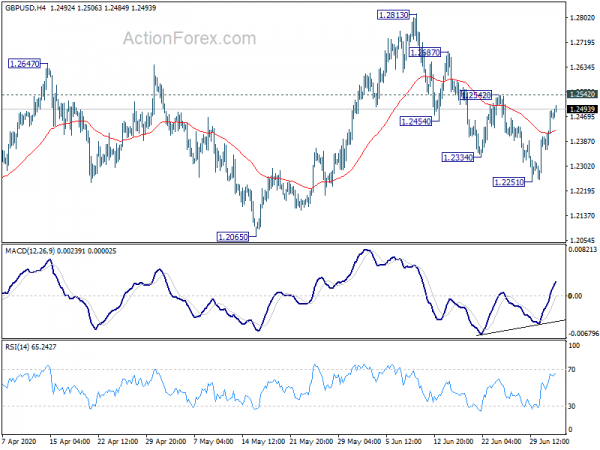

Daily Pivots: (S1) 1.2394; (P) 1.2442; (R1) 1.2525; More….

Focus is now back on 1.2542 in GBP/USD with today’s rebound. Firm break there will suggest completion of the pullback from 1.2813. Intraday bias will be turned back to the upside to retest 1.2813 and break will resume the whole rise from 1.1409. On the downside, break of 1.2251 will resume the decline to 1.2065 key near term support instead.

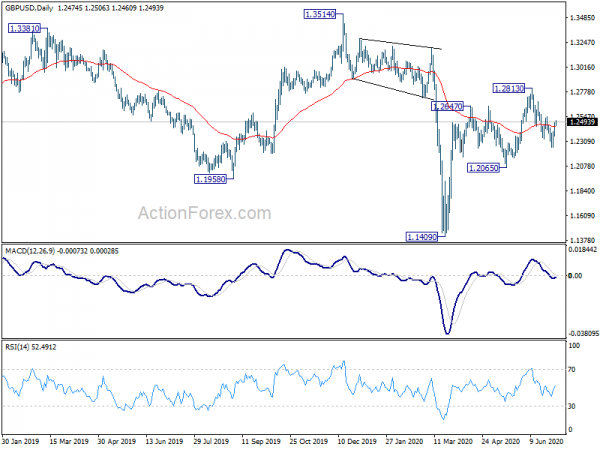

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Jun | 6.00% | 3.90% | ||

| 1:30 | AUD | Trade Balance (AUD) May | 8.03B | 9.00B | 8.80B | 7.83B |

| 6:30 | CHF | CPI M/M Jun | 0.10% | 0.00% | ||

| 6:30 | CHF | CPI Y/Y Jun | -1.20% | -1.30% | ||

| 9:00 | EUR | Eurozone Unemployment Rate May | 7.70% | 7.30% | ||

| 9:00 | EUR | PPI M/M May | -0.40% | -2.00% | ||

| 9:00 | EUR | PPI Y/Y May | -4.80% | -4.50% | ||

| 12:30 | USD | Initial Jobless Claims (Jun 26) | 1350B | 1480K | ||

| 12:30 | USD | Nonfarm Payrolls Jun | 3000K | 2509K | ||

| 12:30 | USD | Unemployment Rate Jun | 12.20% | 13.30% | ||

| 12:30 | USD | Average Hourly Earnings M/M Jun | -0.60% | -1.00% | ||

| 12:30 | USD | Trade Balance (USD) May | -52.5B | -49.4B | ||

| 12:30 | CAD | International Merchandise Trade (CAD) May | -3.3B | |||

| 13:30 | CAD | Manufacturing PMI Jun | 40.6 | |||

| 14:00 | USD | Factory Orders M/M May | 8.50% | -13.00% | ||

| 14:30 | USD | Natural Gas Storage | 120B |