Dollar continues to stay firm in early US session as supported by strength against Sterling, Yen and to a lesser extent Canadian. Yet, the moves are rather indecisive elsewhere. The greenback remains bounded in range against Euro and Aussie, and even Swiss Franc. Euro receives no support from stronger than expected inflation data. The common currency is reversing some of this weak’s gain, in particular against the Swiss Franc.

Technically, focus could be back on 1.0623 temporary low in EUR/CHF. Break will resume the fall from 1.0915 to retest 1.0503 low. Selloff in EUR/CHF could trigger selloff in Euro elsewhere. Break of 1.1168 support in EUR/USD will resume the decline from 1.1422.

In Europe, currently, FTSE is down -0.94%. DAX is down -0.01%. CAC is down -0.42%. German 10-year yield is down -0.0136 at -0.482. Earlier in Asia, Nikkei rose 1.33%. Hong Kong HSI rose 0.52%. China Shanghai SSE rose 0.78%. Singapore Strait Times rose 0.61%. Japan 10-year JGB yield rose 0.0152 to 0.032.

Canada GDP dropped -11.6% mom in April, prelim info points to 3% recovery in May

Canada GDP contracted -11.6% mom in April, slightly better than expectation of -12.3% mom. That followed -7.5% mom decline in March. All 20industrial sectors of the economy were down, producing the largest monthly decline on record since 1961. Nevertheless, preliminary information indicates an approximate 3% increase in GDP for May as output across server industrial sectors including manufacturing, retail and wholesale as well as the public sector, improved.

Germany DIHK: No quick recovery insight, the V is off the table

Germany’s industry group DIHK said there is “no quick recovery in sight” for the economy. “Half of the companies expect a return to normality at the earliest next year. Only a third expect normalization this year,” says DIHK CEO Martin Wansleben said. “This shows that the way back for the economy will be long and hard.”

According to a survey, four out of fives companies expect sales to decline for the year as a whole. Companies are “very concerned that their business will not get going again quickly, even though the shutdown in Germany and other partner countries has been eased.” “The V is off the table,” feared Wansleben.

Eurozone CPI ticked up to 0.3% yoy in June

Eurozone CPI picked up to 0.3% yoy in June, from 0.1% yoy in May, beat expectation of -0.1% yoy. CPI core slowed to 0.8% yoy, down from 0.9% yoy, matched expectations.

Looking at the main components of Eurozone inflation, food, alcohol & tobacco is expected to have the highest annual rate in June (3.1%, compared with 3.4% in May), followed by services (1.2%, compared with 1.3% in May), non-energy industrial goods (0.2%, stable compared with May) and energy (-9.4%, compared with -11.9% in May).

Also released, France consumer spending rose 3.6.% mom in May, above expectation of 25.0%.

BoE Haldane: Two paths possible for economy in H2

BoE Chief Economist Andy Haldane said in a speech two paths are possible for the economy in H2. “One involves a negative feedback loop from higher unemployment to lower spending, the other a positive feedback loop from higher spending to lower unemployment.”

The first poses a downside risk to the outlook, the second an upside risk. “As things stand, it is unclear which of these scenarios, or feedback loops, will prove the more potent,” he added.

Haldane also said risks to the economy remain “considerable and two-sided”. “Of these risks, the most important to avoid is a repeat of the high and long-duration unemployment rates of the 1980s, especially among young people.”

UK Q1 GDP finalized at -2.2%, worst since 1970

UK GDP was finalized at -2.2% qoq in Q1, worse than initial estimate of -2.0% qoq. That’s the largest decline since Q3 1970, which also fell by -2.2% qoq. Over the year, GDP decreased by -1.7% yoy, revised down by -0.1%. Looking at some details, services output fell by a record -2.3%. Household consumption declined by -2.9%, revised downward by -1.2%, a record decline.

Jonathan Athow, deputy national statistician at the ONS, said: “Our more detailed picture of the economy in the first quarter showed GDP shrank a little more than first estimated. Information from government showed health activities declined more than we previously showed. All main sectors of the economy shrank significantly in March as the effects of the pandemic hit.”

Also from UK, current account deficit widened to GBP -21.1B in Q1, larger than expectation of GBP -15.9B.

Swiss KOF rose to 59.4, economic prospects remained very subdued

Swiss KOF Economic Barometer rose to 59.4 in June, up fro 49.6, but missed expectation of 77.0. That’s the first rise after three months of decline. But it remained “considerably below its long-term average”. The ” prospects of the Swiss economy are very subdued, but brightening up somewhat compared to the previous months,” KOF said.

Also from Swiss, retail sales rose 6.6% yoy in May.

RBA Debelle: Still quite likely to have long-lived economic impact from pandemic

RBA Deputy Governor Guy Debelle said “recent data indicate that the outcomes in the Australian economy have been better than earlier feared.” But he also urged not to “lose sight of the fact that the decline in the economy and the impact on households and businesses is historically large”. Fiscal and monetary support that has been provided was, and remains, “warranted.”

The “considerable uncertainty” ahead and it’s “still quite likely” that the economic decline will have a “long-lived impact”. RBA will “maintain the current policies to keep borrowing costs low and credit available, and stands ready to do more as the circumstances warrant.”

Debelle also explained in the speech the details of RBA’s policy responses and the effectiveness.

Also from Australia, private sector credit dropped -0.1% mom in May, versus expectation of 0.2% mom rise.

New Zealand ANZ business confidence rose to -34.4, recession just starting to make itself felt

New Zealand ANZ Business Confidence rose to -34.4 in June, up from May’s -41.8, but down from preliminary reading of -33.0. Activity Outlook index rose to -25.9, up from May’s -38.7 and preliminary reading of -29.1.

ANZ said “New Zealand is the envy of the world, with no social distancing measures imposed upon us and restaurants, bars, sporting events, all able to carry on as normal. But the fact remains, New Zealand with a closed border is a significantly smaller economy, at least in the near term, and the recession is just starting to make itself felt.”.

Also from Asian session, Japan unemployment rate rose to 2.9% in May, up from 2.6%, above expectation of 2.8%. Industrial production dropped -8.4% mom in may, worse than expectation of -5.6% mom. Housing starts dropped -12.3% yoy in May, better than expectation of -15.9% yoy. China official PMI manufacturing rose to 50.9 in June, up from 50.6. Official PMI non-manufacturing rose to 54.4, up from 534.6.

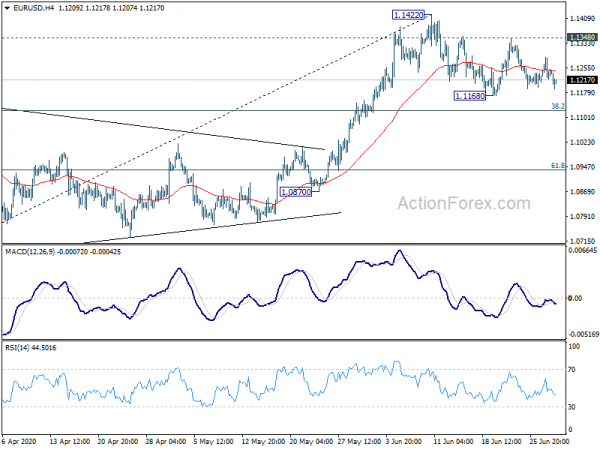

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1210; (P) 1.1249; (R1) 1.1281; More….

Intraday bias in EUR/USD remains neutral first. On the downside, break of 1.1168 will target 38.2% retracement of 1.0635 to 1.1422 at 1.1121. Sustained break there will argue that whole rebound from 1.0635 has completed and bring deeper fall to 61.8% retracement at 1.0936. On the upside, break of 1.1348 will likely resume the rise from 1.0635 through 1.1422 to 1.1496 key resistance.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Unemployment Rate May | 2.90% | 2.80% | 2.60% | |

| 23:50 | JPY | Industrial Production M/M May P | -8.40% | -5.60% | -9.80% | |

| 01:00 | CNY | Manufacturing PMI Jun | 50.9 | 50.4 | 50.6 | |

| 01:00 | CNY | Non-Manufacturing PMI Jun | 54.4 | 53.3 | 53.6 | |

| 01:00 | NZD | ANZ Business Confidence Jun | -34.4 | -33 | ||

| 01:30 | AUD | Private Sector Credit M/M May | -0.10% | 0.20% | 0.00% | |

| 05:00 | JPY | Housing Starts Y/Y May | -12.30% | -15.90% | -12.90% | |

| 06:00 | GBP | GDP Q/Q Q1 F | -2.20% | -2% | -2% | |

| 06:00 | GBP | Current Account (GBP) Q1 | -21.1B | -15.0B | -5.6B | |

| 06:30 | CHF | Real Retail Sales Y/Y May | 6.60% | -19.90% | -18.80% | |

| 06:45 | EUR | France Consumer Spending M/M May | 36.60% | 25.00% | -20.20% | |

| 07:00 | CHF | KOF Economic Barometer Jun | 59.4 | 77 | 53.2 | 49.6 |

| 09:00 | EUR | Eurozone CPI Y/Y Jun P | 0.30% | -0.10% | 0.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jun P | 0.80% | 0.80% | 0.90% | |

| 12:30 | CAD | GDP M/M Apr | -11.60% | -12.30% | -7.20% | -7.50% |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Apr | 4.00% | 3.70% | 3.90% | |

| 13:45 | USD | Chicago PMI Jun | 44.5 | 32.3 | ||

| 14:00 | USD | Consumer Confidence Jun | 90.1 | 86.6 | ||

| 16:30 | USD | Fed’s Chair Powell testifies |