Sterling tumbles broadly today, appeared to be weighed down by UK Prime Minister Boris Johnson’s plan to double down on public investments. The selloff is particularly apparent against Euro, as the latter was lifted mildly by improvements in Eurozone confidence indicators, and better than expected Germany CPI. The developments also took Swiss Franc higher. On the other hand, Yen and Dollar are following the Pound as next weakest.

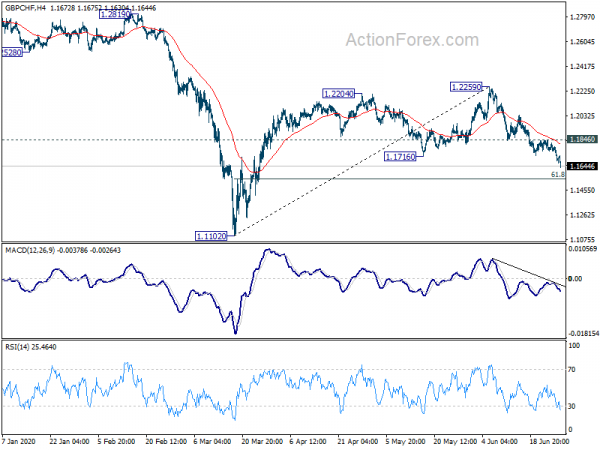

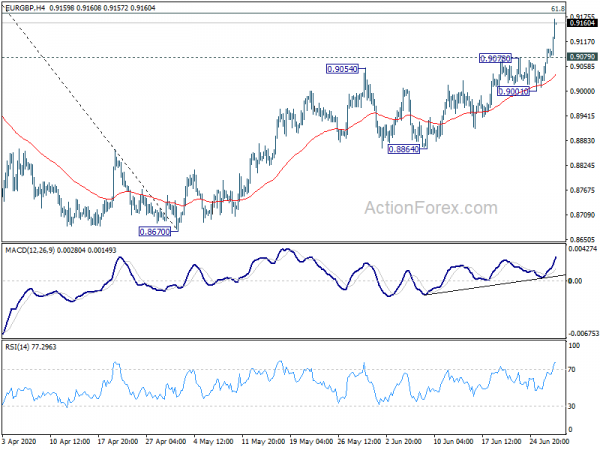

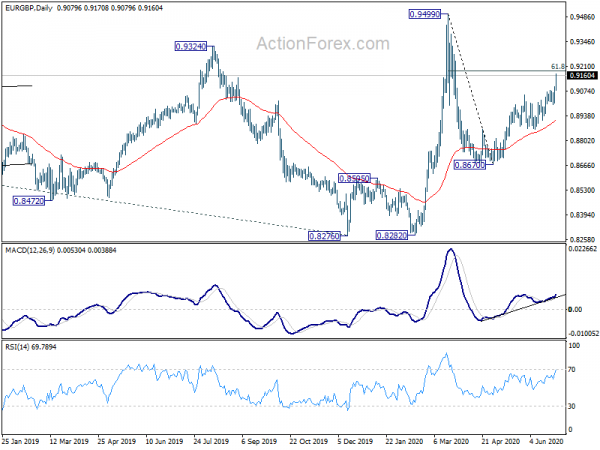

Technically, EUR/GBP is showing clear upside acceleration now. Sustained break of 0.9182 fibonacci level could pave the way back to 0.9499 high. GBP/CHF is on track to corresponding fibonacci support at 1.1544. Sustained break will pave the way to retest 1.1102 low. Also, note that EUR/USD rebounds well ahead of 1.1168 support and focus is back on 1.1348 resistance. Break will likely extend recent rally through 1.1422 high. Such development could trigger more broad based rally in Euro elsewhere.

In Europe, currently, FTSE is up 0.60%. DAX is up 0.35%. CAC is up 0.28%. Germany 10-year yield is up 0.0214 at -0.459. Earlier in Asia, Nikkei dropped -2.30%. Hong Kong HSI dropped -1.01%. China Shanghai SSE dropped -0.61%. Singapore Strait Times dropped -1.17%. Japan 10-year JGB yield rose 0.0053 to 0.016.

Eurozone economic sentiment rose to 75.7 in June, record mom rise

Eurozone Economic Sentiment Indicator rose to 75.7 in June, up form 67.5, but missed expectation of 80.0. Nevertheless, the +8.2pts rise was still the largest month-on-month increase on record. ESI has recovered some 30% of the combined losses of march and April.

Looking at some details, industry confidence rose from -27.5 to -21.7. Services confidence rose from -43.6 to -35.6. Consumer confidence rose from -18.8 to -14.7. Retail trade confidence rose from -29.8 to -18.4. Construction confidence rose from -17.3 to -12.4.

Also, Employment Expectations Indicator continued last month’s steep recovery and jumped from 70.1 to 82.8. Depending on the sector, employment plans have so far recovered some 40% to 60% of the recorded losses incurred in March and April.

Germany CPI jumped to 0.9% in June, above expectations

In preliminary readings, Germany CPI rose 0.6% mom in June, above expectations of 0.3% mom. Annually, CPI accelerated to 0.9% yoy, up from 0.6% yoy, beat expectation of 0.6% yoy.

Looking at some details, goods CPI rose 0.2% yoy. Goods including energy dropped -6.2% yoy. Goods including food rose 4.4% yoy. Services CPI rose 1.4% yoy. Services including rents rose 1.4% yoy.

Japan retail sales dropped -12.3% yoy in May

Japan retail sales dropped -12.3% yoy in May, below expectation of -11.6% yoy. It’s also the second straight month of double-digit contraction, due to coronavirus pandemic and corresponding lockdown measures. Back in April, retail sales contracted -13.9% yoy, the worst since March 1998.

BoJ Governor Haruhiko Kuroda warned last Friday that the second-round effects of the coronavirus pandemic could still hurt the economy “considerably”. Yet for now, it is “not necessary” to act to “further lower the entire yield curve”.

RBNZ Orr: Coronavirus economic disruption expected to persist well into 2021 at least

RBNZ Governor Adrian Orr said the global economic disruption caused by the coronavirus pandemic is “expected to persist and lead to lower economic growth, employment, and inflation well into 2021 at the least.”

The central bank and New Zealand’s financial system and institutions are “well positioned to both weather this economic storm and support and prosper in the inevitable recovery”.

He’s confident of the position because “the banking system was required, by us, to hold more capital, liquidity, and lower risk mortgage loans during the ‘good times’ of recent years.” And, banks can now be part of the economic recovery.”

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.9045; (P) 0.9073; (R1) 0.9120; More…

EUR/GBP’s rally accelerates to as high as 0.9170 so far. Intraday bias remains on the upside for 61.8% retracement of 0.9499 to 0.8670 at 0.9182 first. Sustained trading above there will pave the way to retest 0.9499 high. On the downside, below 0.9079 minor support will turn intraday bias neutral first. But outlook will stay cautiously bearish as long as 0.9001 support holds.

In the bigger picture, while the pull back from 0.9499 was deep, there is no sign of trend reversal yet. The up trend from 0.6935 (2015 low) should resume at a later stage to 61.8% projection of 0.6935 to 0.9263 from 0.8276 at 0.9715. This will remain the favored case as long as 0.8276 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | -12.30% | -11.60% | -13.90% | |

| 08:30 | GBP | Mortgage Approvals May | 9K | 25K | 16K | |

| 08:30 | GBP | M4 Money Supply M/M May | 2.00% | 1.60% | 1.50% | |

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Jun | 75.7 | 80 | 67.5 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jun | -21.7 | -20.5 | -27.5 | |

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -14.7 | -14.7 | -14.7 | |

| 09:00 | EUR | Eurozone Services Sentiment Jun | -35.6 | -27 | -43.6 | |

| 09:00 | EUR | Eurozone Business Climate Jun | -2.26 | -3.91 | -2.43 | -2.41 |

| 12:00 | EUR | Germany CPI M/M Jun P | 0.60% | 0.30% | -0.10% | |

| 12:00 | EUR | Germany CPI Y/Y Jun P | 0.90% | 0.60% | 0.60% | |

| 12:30 | CAD | Industrial Product Price M/M May | 1.20% | -0.50% | -2.30% | |

| 12:30 | CAD | Raw Material Price Index May | 16.40% | -7.50% | -13.40% | |

| 14:00 | USD | Pending Home Sales M/M May | 19.90% | -21.80% |