The markets opened the week with mild risk aversion, in response to continuously surging global coronavirus cases. Japanese stock was additionally weighed down by poor retail sales data. But outside of Japan, losses are relatively limited. European indices have indeed opened mixed only while US futures are slightly up. In the currency markets, Dollar turned mildly softer against European majors but appears to regain footing quickly. Overall, trading is rather subdued.

Technically, Gold is eyeing 1779.16 temporary top and break will resume recent up trend. Near term support WTI crude oil is also eyeing 36.87 temporary low and break will extend the corrective pull back from 41.39 to 34.36 support. Such developments might finally trigger downside break out in CAD/JPY through 78.02 support, and probably 72.52 support in AUD/JPY too. These development could be the indications of come back of risk aversion.

In Asia, Nikkei closed down -2.30%. Hong Kong HSI is down -0.98%. China Shanghai SSE is down -0.61%. Singapore Strait Times is down -1.07%. Japan 10-yaer JGB yield is up 0.0023 at 0.013.

Japan retail sales dropped -12.3% yoy in May

Japan retail sales dropped -12.3% yoy in May, below expectation of -11.6% yoy. It’s also the second straight month of double-digit contraction, due to coronavirus pandemic and corresponding lockdown measures. Back in April, retail sales contracted -13.9% yoy, the worst since March 1998.

BoJ Governor Haruhiko Kuroda warned last Friday that the second-round effects of the coronavirus pandemic could still hurt the economy “considerably”. Yet for now, it is “not necessary” to act to “further lower the entire yield curve”.

RBNZ Orr: Coronavirus economic disruption expected to persist well into 2021 at least

RBNZ Governor Adrian Orr said the global economic disruption caused by the coronavirus pandemic is “expected to persist and lead to lower economic growth, employment, and inflation well into 2021 at the least.”

The central bank and New Zealand’s financial system and institutions are “well positioned to both weather this economic storm and support and prosper in the inevitable recovery”.

He’s confident of the position because “the banking system was required, by us, to hold more capital, liquidity, and lower risk mortgage loans during the ‘good times’ of recent years.” And, banks can now be part of the economic recovery.”

FOMC Minutes, ISM and NFP (Thursday) to highlight a busy week

A lot of important economic data will be released in the final week of Q2 and June. US ISM manufacturing, consumer confidence and employment data will be the biggest features. Non-farm payrolls report will be released on Thursday this time, as Friday is a holiday in the US. Fed will on release FOMC minutes.

Elsewhere, Eurozone CPI, Japan Tankan survey, China PMIs; Australia trade balance and retail sales will be mostly watched.

Here are some highlights for the week:

- Monday: Japan retail sales; Germany CPI; UK M4 money supply, mortgage approvals; Canada building permits, IPPI and RMPI; US pending home sales.

- Tuesday: Japan unemployment rate, industrial production, housing starts; new Zealand ANZ business confidence; Australia private sector credit; China official PMIs; UK current account, Q1 GDP final; Swiss retail sales, KOF economic barometer; Eurozone CPI flash; US S&P CS 20 cities house price, Chicago PMI, consumer confidence.

- Wednesday: Australia AiG manufacturing, building approvals; New Zealand building consents; Japan Tankan survey, PMI manufacturing final, consumer confidence; China Caixin PMI manufacturing; Germany retail sales; Swiss PMI manufacturing; Eurozone PMI manufacturing final; UK PMI manufacturing final; US Challenger job cuts, ADP employment; ISM manufacturing, construction spending; FOMC minutes.

- Thursday: Australia trade balance; Japan monetary base; Eurozone PPI, unemployment rate; Canada trade balance; US non-farm payrolls, jobless claims, trade balance, factory orders. Canada PMI manufacturing.

- Friday: Australia AiG construction, retail sales; China Caixin PMI services; Eurozone PMI services final; UK PMI services final.

USD/CAD Daily Outlook

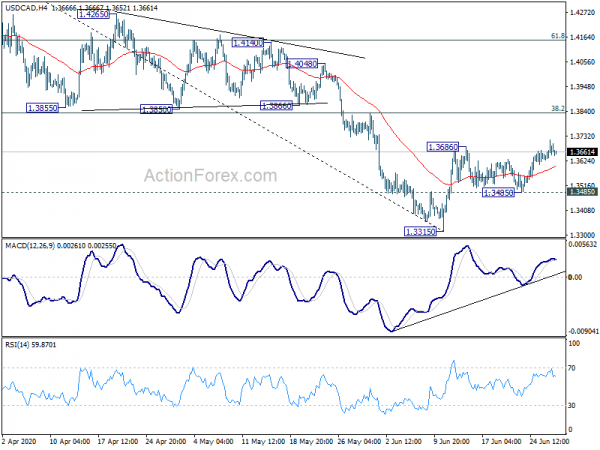

Daily Pivots: (S1) 1.3640; (P) 1.3678; (R1) 1.3728; More….

Intraday bias in USD/CAD remains mildly on the upside at this point. Rebound form 1.3315 is extending and should target 38.2% retracement of 1.4667 to 1.3315 at 1.3831. Sustained break there will argue that whole fall from 1.4667 has completed. Further rise should be seen to 61.8% retracement at 1.4151 and above. For now, further rise will remain in favor as long as 1.3485 support intact, in case of retreat.

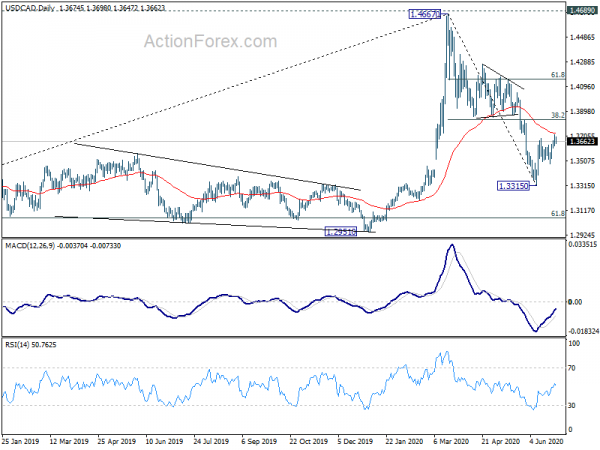

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement at 1.3056 and possibly below. This will now remain the favored case as long as 1.3855 support turned resistance holds. However, sustained break of 1.3855 will turn focus back to 1.4689 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | -12.30% | -11.60% | -13.90% | |

| 8:30 | GBP | Mortgage Approvals May | 25K | 16K | ||

| 8:30 | GBP | M4 Money Supply M/M May | 1.60% | 1.50% | ||

| 9:00 | EUR | Eurozone Economic Sentiment Indicator Jun | 80 | 67.5 | ||

| 9:00 | EUR | Eurozone Industrial Confidence Jun | -20.5 | -27.5 | ||

| 9:00 | EUR | Eurozone Consumer Confidence Jun F | -14.7 | -14.7 | ||

| 9:00 | EUR | Eurozone Services Sentiment Jun | -27 | -43.6 | ||

| 9:00 | EUR | Eurozone Business Climate Jun | -3.91 | -2.43 | ||

| 12:00 | EUR | Germany CPI M/M Jun P | 0.30% | -0.10% | ||

| 12:00 | EUR | Germany CPI Y/Y Jun P | 0.60% | 0.60% | ||

| 12:30 | CAD | Industrial Product Price M/M May | -0.50% | -2.30% | ||

| 12:30 | CAD | Raw Material Price Index May | -7.50% | -13.40% | ||

| 14:00 | USD | Pending Home Sales M/M May | 19.90% | -21.80% |