Sterling appears to be under some selling pressure today, without any special driver. A possible reason is some repositioning ahead of next week’s Brexit talks. Meanwhile, Yen appears to be regaining some growth, together with Swiss Franc. There is some upside potential on risk-off traders ahead of the weekly close, as US futures point to mildly lower open.

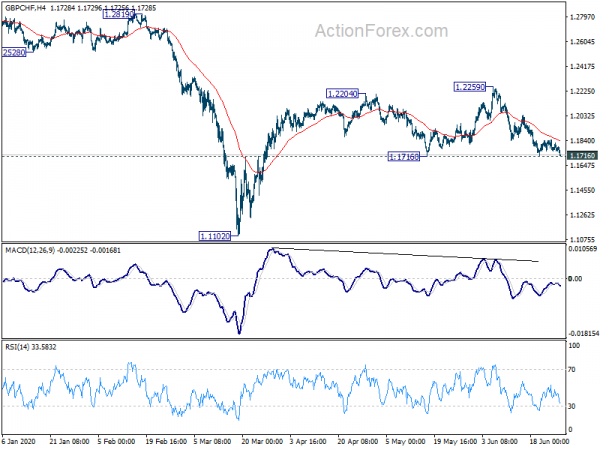

Technically, GBP/CHF is now eying 1.1716 key near term support again after today’s decline. Sustained break there would confirm completion of the whole rebound from 1.1102. USD/CAD is another one to watch and break of 1.3686 resistance will resume the rebound from 1.3315 short term bottom.

In Europe, currently, FTSE is up 1.51%. DAX is up 0.78%. CAC is up 1.42%. German 10-year yield is down -0.0041 at -0.470. Earlier in Asia, Nikkei rose 1.13%. Hong Kong HSI dropped -0.93%. China Shanghai SSE rose 0.30%. Singapore Strait Times rose 0.55%. Japan 10-year JGB yield dropped -0.0053 to 0.011.

US personal income dropped -4.2%, spending rose 8.2%

US personal income dropped -4.2% mom, or USD 874.2B in May, better than expectation of -6.0% mom. Spending, on the other hand, rose 8.2% or USD 994.5B, below expectation of 9.0% mom. Headline PCE price index slowed to 0.5% yoy, down from 0.6% yoy. Core PCE price index was unchanged at 1.0% yoy.

ECB Lagarde: Probably past the lowest point but recovery will be restrained and incomplete

ECB President Christine Lagarde said today “we probably are past the lowest point and I say that with some trepidation because of course there could be a severe second wave” of coronavirus infections. Also, the recovery will be “restrained” and “incomplete”.

“The airline industries, the hospitality industries, the entertainment industries are going to come out of that recovery process in a different shape, and some of them will probably be hurt irremediably,” She added. And trade is unlikely to return to pre-crisis levels.

Released from Eurozone, M3 money supply rose 8.9% yoy in May, versus expectation of 8.5% yoy. Private loans rose 3.0% yoy, below expectation of 3.2% yoy.

BoJ Kuroda: No need to further lower the entire yield curve for now

BoJ Governor Haruhiko Kuroda said today that “at this moment, we didn’t see the need to further lower the entire yield curve”. The economy has been in a “extremely severe situation” with “considerable negative growth” in Q2. Nevertheless, “once the impact of COVID-19 on the economy has subsided, the economy starts to recover and comes back to a normal growth path, then of course our extraordinary measures may be gradually curtailed.”

But he also noted that “there are significant uncertainties over the outlook for the economy.” The coronavirus pandemic “continues on a global basis, and concern about a second wave of the virus has increased recently.”

He added that 2% inflation target is “unlikely to be met in the short run”. Also, “the BOJ’s expanded balance sheet would not be normalized until 2% inflation is achieved.”

Released from Japan, Tokyo CPI was unchanged at 0.2% yoy in June, matched expectations.

GBP/USD Mid-Day Outlook

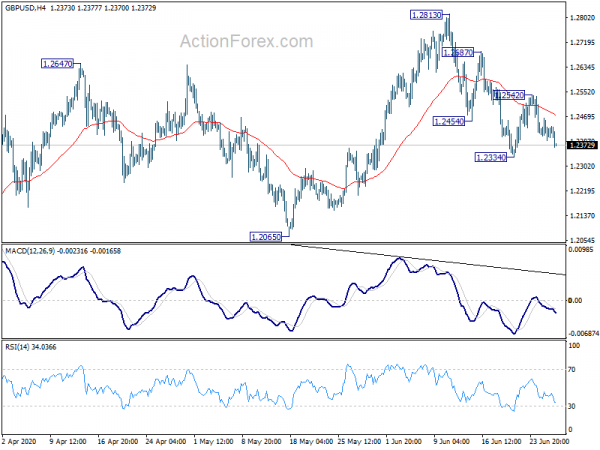

Daily Pivots: (S1) 1.2383; (P) 1.2424; (R1) 1.2458; More….

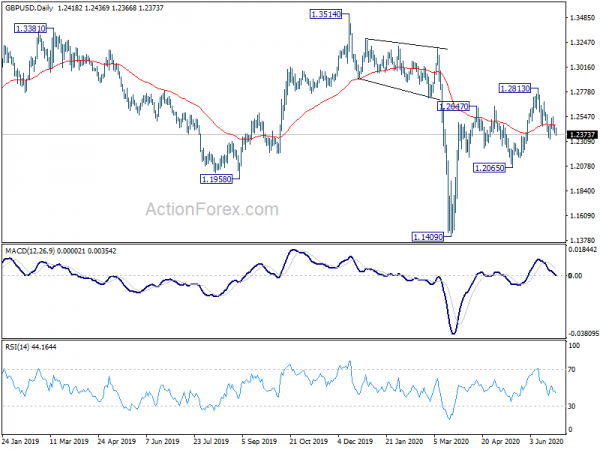

Intraday bias in GBP/USD remains neutral at this point but fall from 1.2813 is in favor to continue. Break of 1.2334 will target 1.2065 support first. Firm break there will confirm completion of rebound from 1.1409 at 1.2813. However, on the upside, break of 1.2542 will argue that the fall from 1.2813 might be completed. Intraday bias will be turned back to the upside for 1.2587/2813 resistance zone.

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Jun | 0.20% | 0.20% | 0.20% | |

| 08:00 | EUR | Eurozone Private Loans Y/Y May | 3.00% | 3.20% | 3.00% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y May | 8.90% | 8.50% | 8.30% | 8.20% |

| 12:30 | USD | Personal Income M/M May | -4.20% | -6.00% | 10.50% | 10.80% |

| 12:30 | USD | Personal Spending May | 8.20% | 9.00% | -13.60% | -12.60% |

| 12:30 | USD | PCE Price Index M/M May | 0.10% | -0.50% | ||

| 12:30 | USD | PCE Price Index Y/Y May | 0.50% | 0.50% | 0.60% | |

| 12:30 | USD | Core PCE Price Index M/M May | 0.10% | 0.00% | -0.40% | |

| 12:30 | USD | Core PCE Price Index Y/Y May | 1.00% | 0.90% | 1.00% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Jun F | 79 | 78.9 |