The financial markets turned into mixed mode today. While European indices open broadly lower, they quickly reversed early losses and turned positive. US markets open lower again but loss in DOW is relatively limited. Dollar is trying to extend yesterday’s rebound against European majors and Yen. Yet, it struggles to have decisive gains against commodity currencies. Overall, major Dollar pairs remain range bound.

Technically, Dollar’s underlying momentum for sustainable rally remains in question. Focus will stay on 1.1168 support in EUR/USD, 1.2334 support in GBP/USD, 0.6776 support in AUD/USD, 0.9554 resistance in USD/CHF, 107.64 resistance in USD/JPY and 1.3686 resistance in USD/CAD. These levels need to be taken out before confirming a comeback of the greenback.

In Europe, currently, FTSE is up 0.06%. DAX is up 0.41%. CAC is up 0.66%. German 10-year yield is down -0.0362 at -0.473. Earlier in Asia, Nikkei dropped -1.22%. Japan 10-year JGB yield rose 0.0009 to 0.018. Singapore Strait Times dropped -1.46%. Hong Kong and China were on holiday.

US initial jobless claims dropped to 1.48m, continuing claims at 19.5m

US initial jobless claims dropped -60k to 1480k in the week ending June 20, above expectation of 1300k. Four-week moving average of initial claims dropped -160.75k to 1621k. Continuing claims dropped to 767k to 19522k in the week ending June 13. Four-week moving average of continuing claims dropped -330k to 20421k.

Durable goods orders rose 15.8% mom to USD 194.4B in May, well above expectation of 10.3% mom. Ex-transport orders rose 4.0% mom, above expectation of 2.8% mom. Ex-defense orders rose 1.5.5%. Transportation equipment rose 80.7%.

Good trade surplus deficit widened to USD -74.3B in May, larger than expectation of USD -68.0B.

Q1 GDP was finalized at -5.0% annualized. Price index finalized at 1.4%.

ECB stand ready to adjust all instruments including PEPP, TLTROs, interest rates and forward guidance

In the accounts of June 3-4 ECB monetary policy meeting it’s noted there was “broad agreement” among Governing Council member to reiterate that the central bank “continued to stand ready to adjust all of its instruments, as appropriate”. This include further adjusting the size and composition of the PEPP, as well as the full range of instruments including the TLTROs, policy interest rates and forward guidance.

Governing Council members underlined that the sharp of economy recovery would “depend crucially on how consumption and investment evolved under the present uncertainties.” That also depends on whether the coronavirus pandemic leads to “longer-lasting changes in the behaviour of economic agents”.

In particular, he expected pattern of the “saving ratio” was seen as a “key issue”. Some concerns was expressed that “expecting a full unwinding of higher savings might be too optimistic, as protracted uncertainty might keep the ratio higher for longer”.

German Gfk consumer sentiment rose to -9.6, faint light getting somewhat brighter

Germany Gfk Consumer Sentiment for July rose to -9.6, up from -18.6, beat expectation of -11.0. Economic expectations rebounded strongly to 8.5, up from -10.4, back in positive territory. Income expectations also turned positive to 6.6., up from -5.7.

“The faint light at the end of the tunnel, which was already apparent last month, is apparently getting somewhat brighter,” explains Rolf Bürkl, GfK consumer expert. “The extensive support provided by the economic stimulus packages, such as the announcement of a temporary reduction in value-added tax (VAT), is certainly a contributing factor. Provided that retailers and manufacturers also pass these reductions on to consumers, it can be assumed that one or two planned purchases will instead be made in the second half of 2020, thereby supporting consumption this year.”

UK CBI realized sales rose to -37, slower pace of decline

UK CBI Realized Sales rose to -37 in June, up from -50, worst than expectation of -35, indicating the retail sales dropped at a slower pace. Decline for July is expected to be even worse at -48.

New Zealand trade surplus down slightly to NZD 1253m

In May, New Zealand goods exports dropped -6.1% yoy, or NZD -350m to NZD 5.4B. Imports dropped -25.6% yoy, or NZD -1.4B, to NZD -4.1B. Trade surplus shrank slightly to NZD 1253m, down from NZD 1339m.

Looking at the details, exports to all major partners except Japan (unchanged), were down, including EU (NZD -95m), US (NZD -87m), China (NZD -77m), Australia (NZD – 72m). Imports from all partners, except China (up NZD 1.9m), were also down, including EU (NZD -231m), Japan (NZD – 223m), USA (NZD – 172m), Australia (NZD -108m).

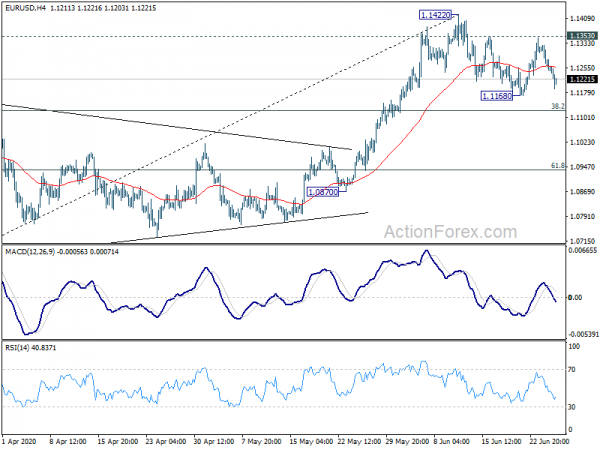

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1223; (P) 1.1274; (R1) 1.1301; More….

EUR/USD is staying in range of 1.1168/1353 and intraday bias remains neutral first. On the downside, break of 1.1168 will resume the decline from 1.1422 to 38.2% retracement of 1.0635 to 1.1422 at 1.1121. Sustained break there will argue that whole rebound from 1.0635 has completed and bring deeper fall to 61.8% retracement at 1.0936. On the upside, break of 1.1353 will suggest that larger rebound from 1.0635 is resuming. Intraday bias will be back on the upside for 1.1422 and then 1.1496 key resistance.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 1253M | 1279M | 1267M | 1339M |

| 04:30 | JPY | All Industry Activity Index M/M Apr | -6.40% | -6.50% | -3.80% | -3.40% |

| 06:00 | EUR | Germany Gfk Consumer Confidence Jul | -9.6 | -11 | -18.9 | -18.6 |

| 10:00 | GBP | CBI Realized Sales Jun | -37 | -35 | -50 | |

| 12:30 | USD | GDP Annualized Q1 F | -5.00% | -5.00% | -5.00% | |

| 12:30 | USD | GDP Price Index Q1 F | 1.40% | 1.40% | 1.40% | |

| 12:30 | USD | Initial Jobless Claims (Jun 19) | 1480K | 1300K | 1508K | 1540K |

| 12:30 | USD | Durable Goods Orders May | 15.80% | 10.30% | -17.70% | |

| 12:30 | USD | Durable Goods Orders ex Transportation May | 4.00% | 2.80% | -7.70% | |

| 12:30 | USD | Wholesale Inventories May P | -1.20% | 0.40% | 0.30% | |

| 12:30 | USD | Goods Trade Balance (USD) May | -74.3B | -68.0B | -69.7B | -69.7B |

| 14:30 | USD | Natural Gas Storage | 108B | 85B |