Dollar rebounds broadly as markets turned into risk-off mode overnight. It remains firm in quiet trading in Asia, with China and Hong Kong on holiday. The movements in the forex markets are not decisive enough yet. Major pairs and crosses are back inside last week’s range. Job and durable goods data from US today might trigger some volatility. But traders could take more time to gauge the odds and severity of coronavirus second wave before taking some commitments.

Technically, it’s still early to tell if Dollar could sustain and extend the current rebound. The levels to watch include 1.1168 support in EUR/USD, 1.2334 support in GBP/USD, 0.6776 support in AUD/USD, 0.9554 resistance in USD/CHF, 107.64 resistance in USD/JPY and 1.3686 resistance in USD/CAD.

In Asia, currently, Nikkei is down -1.33%. Japan 10-year JGB yield is down -0.0068 at 0.010. Singapore Strait Times is down -1.07%. Hong Kong and China are on holiday. Overnight, DOW dropped -2.72%. S&P 500 dropped -2.59%. NASDAQ dropped -2.19%. 10-year yield dropped -0.025 to 0.684.

DOW dropped -710pts as near term consolidations extend

DOW dropped -710.16 pts, or -2.72%, overnight on worries of resurgence of coronavirus infections and transatlantic trade war. The technically development was not surprising though as the index remains bounded in consolidation from 27580.21 short term top. 55 day EMA (now at 25177) will be the first line of defense. But the key near term support level will be 38.2% retracement of 18213.65 to 27580.21 at 24002.18.

As long as 24002.18 holds, we’d still expect the rise from 18213.63 to resume sooner or later to retest 29568.57 record high. However, sustained break of 24002.18 will argue that consolidation pattern from 29568.57 is starting the third leg. Deeper fall would be seen to 61.8% retracement at 21791.67 and below.

EU: US tariffs inflict unnecessary economic damage on both sides of the Atlantic

In response to new tariff intention of the US, EU warned in a statement that “it creates uncertainty for companies and inflicts unnecessary economic damage on both sides of the Atlantic.”

“By potentially targeting new products, the US is increasing this damaging impact due to the cost of new disruptions to supply chains for the products potentially subject to new duties.” “This is particularly the case as companies are now trying to overcome the economic difficulties in the aftermath of the Covid-19 crisis.”

USTR announced earlier this week a list of 30 product lines that could be subjected to new tariffs. The news items, equivalent to around USD 3.1B of imports from EU annually, could be hit will tariffs of as much as 100%.

Fed Evans: Some previously expected trend growth has been permanently lost

Chicago Fed President Charles Evans said in a speech yesterday that real GDP would return to pre-pandemic level sometime in 2022. That is, “even after three years, my projected recovery places us below where the economy would have been had the virus not occurred”. Additionally, “some previously expected trend growth has been permanently lost.”

Also, despite the surprised job growth in May and recent positive economic data, it is too early to tell “how much of the improvement is simply timing” and “how much represents stronger underlying demand”. The outlook is highly uncertain and “other forecasts with more severe effects on economic activity are almost equally as plausible”. Regarding inflation, “some of the extreme price declines in March and April are likely behind us”. Besides, he expects “downward pressure on prices from resource slack to diminish in 2021 and 2022”.

Overall, while fiscal and monetary policy actions have already done a lot “more may be necessary.”

New Zealand trade surplus down slightly to NZD 1253m

In May, New Zealand goods exports dropped -6.1% yoy, or NZD -350m to NZD 5.4B. Imports dropped -25.6% yoy, or NZD -1.4B, to NZD -4.1B. Trade surplus shrank slightly to NZD 1253m, down from NZD 1339m.

Looking at the details, exports to all major partners except Japan (unchanged), were down, including EU (NZD -95m), US (NZD -87m), China (NZD -77m), Australia (NZD – 72m). Imports from all partners, except China (up NZD 1.9m), were also down, including EU (NZD -231m), Japan (NZD – 223m), USA (NZD – 172m), Australia (NZD -108m).

Looking ahead

ECB monetary policy accounts are the major focuses in European session. Germany will release Gfk consumer confidence while UK will release CBI realized sales. Later in the day, US durable goods orders and jobless claims will take center stage. Q1 GDP final and May goods trade balance will also be featured.

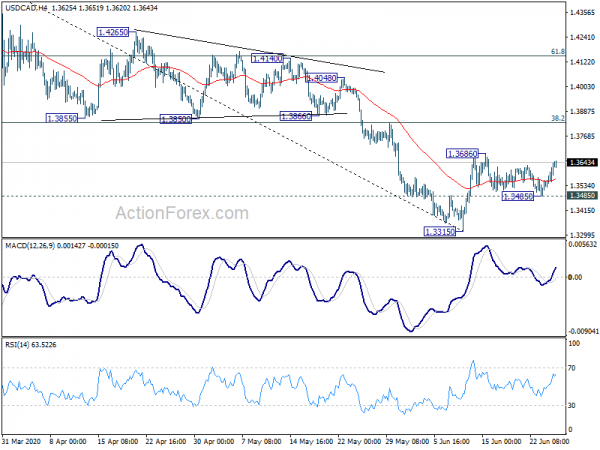

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3561; (P) 1.3601; (R1) 1.3673; More….

Intraday bias in USD/CAD remains neutral for the moment. Current strong rebound reaffirms near term bullishness that rebound from 1.3315 short term bottom is not over. On the upside, break of 1.3686 will turn bias to the upside for 38.2% retracement of 1.4667 to 1.3315 at 1.3831 next. However, break of 1.3485 minor support will turn bias back to the downside for retesting 1.3315 low. Decisive break of 1.3315 will resume whole decline from 1.4667.

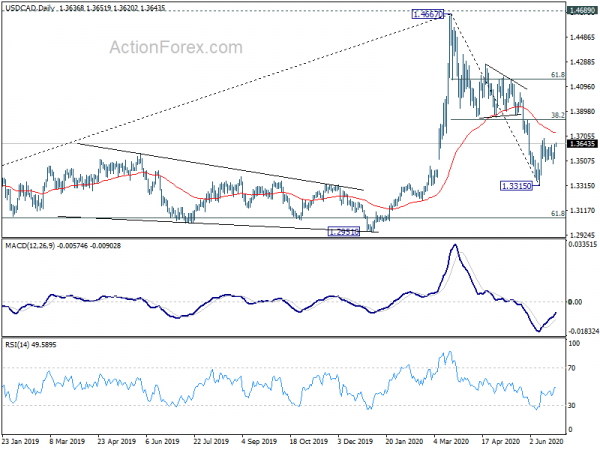

In the bigger picture, the rise from 1.2061 (2017 low) could have completed at 1.4667 after failing 1.4689 (2016 high). Fall from 1.4667 could be the third leg of the corrective pattern from 1.4689. Deeper fall is expected to 61.8% retracement at 1.3056 and possibly below. This will now remain the favored case as long as 1.3855 support turned resistance holds. However, sustained break of 1.3855 will turn focus back to 1.4689 key resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 1253M | 1279M | 1267M | 1339M |

| 04:30 | JPY | All Industry Activity Index M/M Apr | -6.50% | -3.80% | ||

| 06:00 | EUR | Germany Gfk Consumer Confidence (Jul) | -11 | -18.9 | ||

| 10:00 | GBP | CBI Realized Sales Jun | -35 | -50 | ||

| 12:30 | USD | GDP Annualized Q1 F | -5.00% | -5.00% | ||

| 12:30 | USD | GDP Price Index Q1 F | 1.40% | 1.40% | ||

| 12:30 | USD | Initial Jobless Claims (Jun 19) | 1300K | 1508K | ||

| 12:30 | USD | Durable Goods Orders May | 10.30% | -17.70% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation May | 2.80% | -7.70% | ||

| 12:30 | USD | Wholesale Inventories May P | 0.30% | |||

| 12:30 | USD | Goods Trade Balance (USD) May | -68.0B | -69.7B | ||

| 14:30 | USD | Natural Gas Storage | 108B | 85B |