Dollar is attempting to rebound today together with Yen and Swiss Franc, while Kiwi and Aussie weaken. European stocks and US futures are down mildly on resurging number of global coronavirus crisis cases. Also, the US Trade Representative said wants to impose new tariffs on USD 3.1B of exports from France, Germany, Spain and UK. Investors are concerned with risks of transatlantic trade war. But overall, there is no committed direction in the markets, except in NASDAQ and Gold, which extended up trend this week.

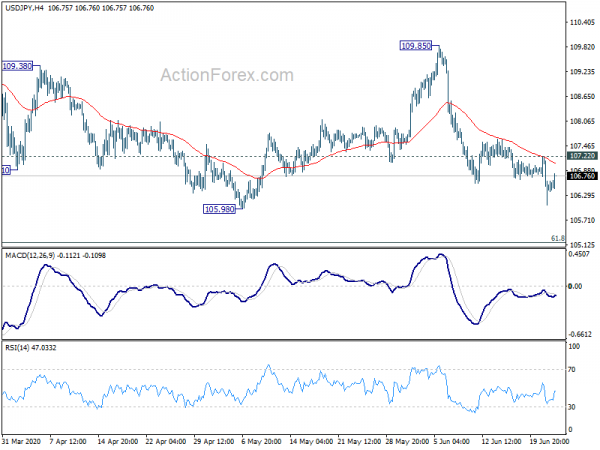

Technically, selloff in Dollar this week appears to be losing momentum quickly. Even EUR/USD was held below 1.1353 minor resistance. USD/CHF also recovers well ahead of 0.9376 low. Recoveries in EUR/JPY and GBP/JPY also lost steam after hitting 4 hour 55 EMA. A focus will be on USD/JPY today. As long as 107.22 minor resistance holds, further fall should be seen to 105.98 support and below. That could drag other yen crosses into decline resumption too.

In Europe, currently, FTSE is down -2.11%. DAX is down -1.88%. CAC is down -1.86%. German 10-year yield is up 0.042 at -0.395. Earlier in Asia, Nikkei dropped -0.07%. Hong Kong HSI dropped -0.50%. China Shanghai SSE rose 0.30%. Singapore Strait Times dropped -0.24%. Japan 10-year JGB yield rose 0.0054 to 0.016.

German Ifo business climate rose to 86.2, business sees light at the end of the tunnel

Germany Ifo Business Climate rose to 86.2, up from 79.7, above expectation of 85.0. The 6.5 pts rise is the strongest increase ever recorded. Current Assessment index rose to 81.3, up from 78.9, but missed expectation of 84.0. Expectations index rose to 91.4, up from 80.5, above expectation of 85.2. Ifo said, “German business sees light at the end of the tunnel.”

Indices of all sectors improved but stayed negative. Manufacturing index rose from -36.0 to -22.9. Services index rose fro -21.0 to -6.0. Trade index rose from -30.5 to -14.2. Construction index rose from -12.3 to -7.5.

ECB Lane: Net impact of coronavirus shock to be disinflationary to a substantial degree

In a speech, ECB Chief Economist Philip Lane said as coronavirus containment measures lifted, there were “some signs of an initial recovery”. But this process is expected to be “quite gradual”, since it will “take time for consumers and businesses to recover” from the coronavirus shock. Incomes losses and precautionary savings “continue to weigh on consumption”. Weak demand, continued supply constraints and ongoing social-distancing restrictions are “hampering the normalization of economic activity”.

He added that the net impact of the coronavirus shock on medium-term inflation outlook is expected to be “disinflationary to a substantial degree”. “Forces associated with greater economic slack are likely to outweigh any inflationary pressures stemming from damage to supply capacity”. The sharp drop in activity and fall in oil prices has “already left its mark” on Eurozone inflation.

On monetary policy tools, Lane said long term sovereign yields become “virtually unresponsive to rate cuts in stressed conditions owing to the subdued portfolio rebalancing effects”. Rate cuts are “unlikely to be as effective at the current juncture as they are in non-stressed conditions” . Policy that “directly intervene on sovereign yields may in fact become more effective. Hence, “evidence tilts the balance towards asset purchases as the more efficient tool in current circumstances.”

BoJ: Desirable to confirm and examine the effects of adopted easing measures for now

In the summary of opinions of BoJ’s June 15-16 meeting, it’s noted that the economy is “likely to remain in a severe situation for the time being” due to coronavirus pandemic. But the economy “recently appears to have bottomed out. But the “pace of economic recovery will likely be slow”. regarding prices, it’s “unlikely at present that the inflation rate will approach 2 percent with momentum in the foreseeable future”.

It’s also noted that the current three monetary easing measures, the financing program, provision of yen and foreign currency funds, and asset purchases, are “flexible” and “highly adaptable” to various developments. The measures adopted since March “have been exerting their intended effects”. It’s “desirable to carefully confirm and examine their effects for the time being”.

Also from Japan, corporate service price index rose 0.8% yoy in May, below expectation of 1.1% yoy.

NZD falls after dovish RBNZ hints on additional easing

New Zealand Dollar weakens broadly after RBNZ kept policy unchanged and issued a dovish statement, which hinted at further easing ahead. OCR was kept at 0.25% while quantum of the LSAP QE program was held at NZD 60B. In the discussions of the board meeting, the committee acknowledged the “improvements” in the outlook as the country has moved to coronavirus Alert Level 1 sooner than assumed. The government’s spending intentions was also larger than assumed and would provide more spending support than previously estimated.

However, members were concerned that the “positives could be short-lived given the fragile nature of the global pandemic containment”. It’s “not yet clear whether the monetary stimulus delivered to date is sufficient” and risks remain “skewed to the downside”. More importantly, members discussed the pros and cons of “expanding” the LSAP program, which would be driven by the outlook. A change in asset purchase size needs to be of “sufficient magnitude”. Staff are also “working towards ensuring a broader range of monetary policy tools would be deployable in coming months, including a term lending facility, reductions in the OCR, and foreign asset purchases, as well as reassessing the appropriate quantum of the current LSAP.”

Suggested reading: RBNZ Pledged to Expand QE and other Stimulus if Needed, as Risk to Outlook Skewed to Downside

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 105.99; (P) 106.61; (R1) 107.14; More...

With 107.22 minor resistance intact, intraday bias in USD/JPY stays on the downside. Current fall is part of the corrective pattern from 111.71, and should target 105.98 support and below. But downside should be contained by 61.8% retracement of 101.18 to 111.71 at 105.20 to bring rebound. On the upside, break of 107.22 minor resistance will turn bias back to the upside for rebound.

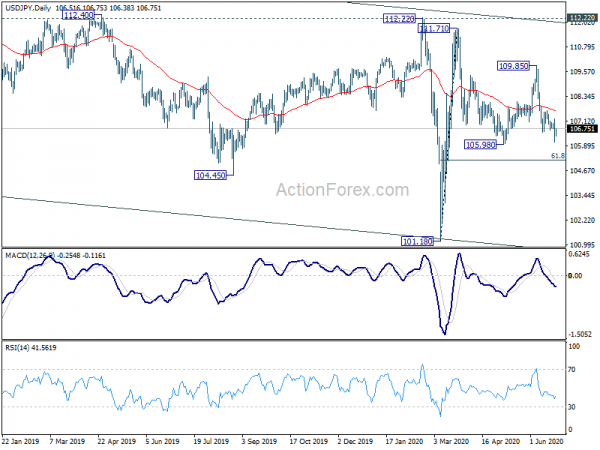

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec2016). Hence, there is no clear indication of trend reversal yet. Break of 105.98 support could extend the down trend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y May | 0.80% | 1.10% | 1.00% | 0.80% |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 2:00 | NZD | RBNZ Rate Decision | 0.25% | 0.25% | 0.25% | |

| 8:00 | CHF | ZEW Expectations Jun | 48.7 | 31.3 | ||

| 8:00 | EUR | Germany IFO Business Climate Jun | 86.2 | 85 | 79.5 | |

| 8:00 | EUR | Germany IFO Current Assessment Jun | 81.3 | 84 | 78.9 | |

| 8:00 | EUR | Germany IFO Expectations Jun | 91.4 | 85.2 | 80.1 | |

| 13:00 | CHF | SNB Quarterly Bulletin Q2 | ||||

| 13:00 | USD | Housing Price Index M/M Apr | 0.00% | 0.10% | ||

| 14:30 | USD | Crude Oil Inventories | 1.2M |