Dollar turns mixed in early US session as selloff turns to Euro today. New Zealand Dollar is the second weakest as the country’s coronavirus -free days ended. Yen, Dollar and Swiss Fran are not performing well, though, as markets remains in strong risk-on mode. On the other hand, Sterling is currently the strongest ones, followed by Canadian. Focus will turn to Fed Chair Jerome Powell’s testimony, but he’s unlikely to give Dollar any lift.

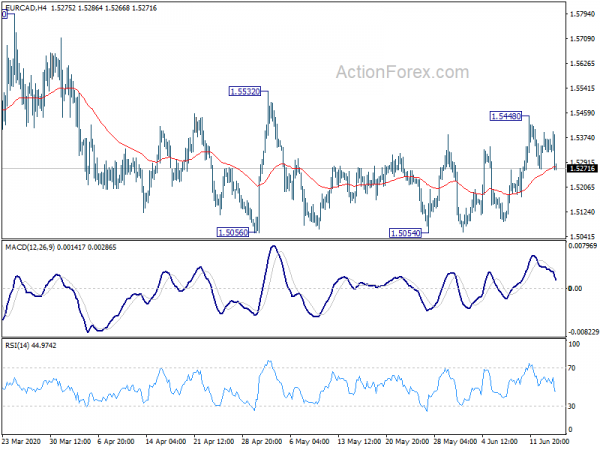

Technically, it remains to be seen in Euro’s weakness today will sustain. In particular, EUR/GBP’s focus is back on 0.8866 support with today’s decline. Break will indicate completion of rebound from 0.8670 and bring near term reversal. EUR/JPY’s recovery is limited below 122.91 minor resistance so far. Break of 120.25 temporary low will resume the decline from 124.43. EUR/CAD is also pressing 4 hour 55 EMA. Sustained break will start another leg in recent sideway trading, towards 1.5054 support.

Currently in Europe, FTSE is up 3.50%. DAX is up 3.82%. CAC is up 3.46%. German 10-year yield is up 0.0292 at -0.415. Earlier in Asia, Nikkei rose 4.88%. Hong Kong HSI rose 2.39%. China Shanghai SSE rose 1.44%. Singapore Strait Times rose 2.03%. Japan 10-year JGB yield rose 0.0147 to 0.022.

US retail sales rose 17.7% in May, ex-auto sales rose 12.4%

US retail sales rose 17.7% to USD 465.5B in May, wall above expectation of 7.6% mom. Ex-auto sales rose 12.4% mom, above expectation of 5.1% mom. Ex-gasoline sales rose 18.0% mom. Ex-auto, ex-gasoline sales rose 12.5%. For the period Mar through May, headline sales dropped -10.5% yoy from the same period a year ago.

Also released, industrial production rose 1.4% mom in May, below expectation of 2.5% mom. Capacity utilization rose to 64.8%, below expectation of 66.5%.

Germany ZEW rose to 63.4, growing confidence that the economy will bottom out by summer

Germany ZEW Economic Sentiment rose further to 53.4 in June, up from 51.0, beat expectation of 60.0. That’s the third consecutive month of increase. Current Situation improved slightly to -83.1, up from 83.5, above expectation of -84.8. Eurozone ZEW economic sentiment rose to 58.6, up from 46.0, beat expectation of 53.4. Eurozone Current Situation rose 5.4 pts to -89.6.

“There is growing confidence that the economy will bottom out by summer 2020. This is reflected in the renewed rise of the ZEW Indicator of Economic Sentiment as well as the more optimistic assessment of the current situation. The expected earnings for the individual sectors in Germany still vary greatly. Earnings expectations are strongly negative for export-oriented sectors such as automotive and mechanical engineering, as well as the financial sector. In contrast, forecasts are fairly positive for information technologies, telecommunications and consumer-oriented services. The financial market experts continue to expect only a slow increase in economic value added in the third and fourth quarters,” comments ZEW President Achim Wambach.

UK unemployment rate unchanged at 3.9% in Apr, claimant count surged another 529k in May

UK unemployment rate was unchanged 3.9% in the three months to April, much better than expectation of a surge to 4.5%. Average earnings including bonus rose 3.0% 3moy, sharply lower from April’s 2.3%, missed expectation of 1.3%. Average earnings excluding bonus rose 1.7% 3moy, down from 2.7%, missed expectation of 1.8%.

In May, claimant counts rose 528.9k, larger than expectation of 370k. April’s claimant count increase was revised to 1032.7k. Combined, The total 2801.7k claimant account as recorded in May was as 125.9% increase since March, i.e., the start of the coronavirus pandemic.

RBA: Downturn shallower than expected, accommodative approach to stay

Minutes of June 2 RBA board meeting noted that while Australian economy was experiencing the “biggest economic contraction since the 1930s”, the downturn would be “shallower than earlier expected”. Though, outlook remained “highly uncertain” and the pandemic was “likely to have long-lasting effects” on the economy.

The policy package was “working broadly as expected”. The “substantial, coordinated and unprecedented easing of fiscal and monetary policy” was also helping the economy through this difficult period. Both fiscal and monetary support “would be required for some time”. This accommodative approach would be “maintained as long as required”.

The policy package included keeping cash rate at 0.25%, 3 year AGB yield target at 0.25%, Term Funding Facility to support credits and 10bps interest rate on Exchange Settlement balances.

Also released, Australia house price index rose 1.6% qoq in Q1, below expectation of 2.7% qoq. New Zealand Westpac consumer sentiment dropped to 97.2 in Q2, down from 104.2.

BoJ stands pat, economy to remain severe, CPI to stay negative

BoJ kept monetary policy unchanged today as widely expected. Under yield curve control, short term policy rate is kept at -0.1%. BOJ will also continue to purchase a “necessary amount”, “without setting an upper limit”, to to keep 10-year JGB yields at around 0%. The decision was made by 8-1 vote, With Goushi Kataoka dissented, pushing to ease further by lowering short- and long-term interest rates.

On outlook, BOJ said the economy is “likely to remain in a severe situation for the time being”. CPI is likely to be “negative for the time being”, affected by the coronavirus pandemic and decline in oil prices. But it’s expected to “turn positive and then increase gradually” as the economy improves.

On risks to outlook, BoJ said “there have been extremely high uncertainties over the consequences of COVID-19 and the magnitude of their impact on domestic and overseas economies”. Also, “it is necessary to pay close attention to whether, while the impact of COVID-19 remains, firms’ and households’ medium- to long-term growth expectations will not decline substantially and the smooth functioning of financial intermediation will be ensured with financial system stability being maintained.”

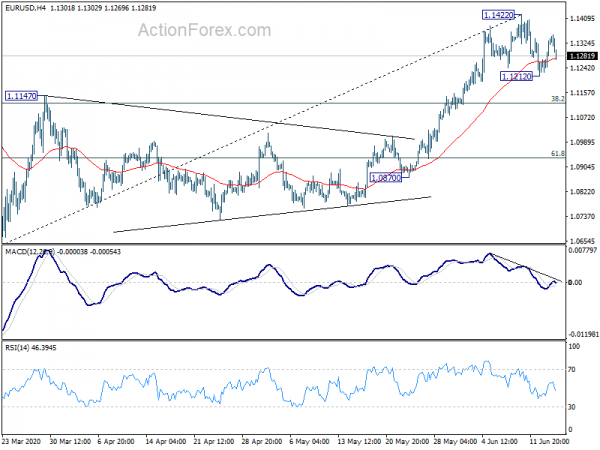

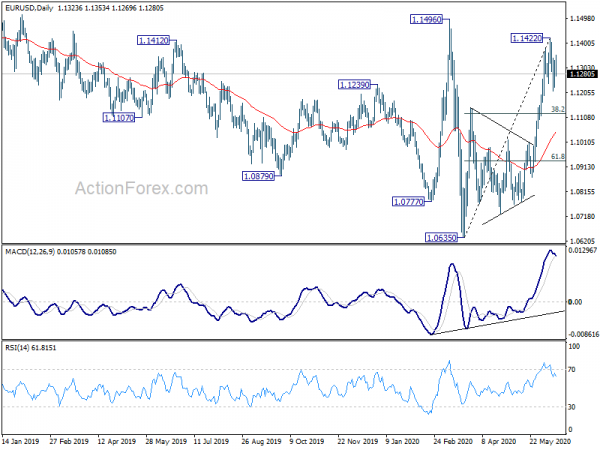

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1254; (P) 1.1294; (R1) 1.1360; More….

Intraday bias in EUR/USD is turned neutral again and the recovery lost momentum well below 1.1422 resistance. On the upside, break of 1.1422 will resume whole rebound from 1.0635 and target 1.1495 key resistance next. On the downside, break of 1.1212 will resume the fall from 1.1422 to 38.2% retracement of 1.0635 to 1.1422 at 1.1121.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | Westpac Consumer Survey Q2 | 97.2 | 104.2 | ||

| 01:30 | AUD | House Price Index Q/Q Q1 | 1.60% | 2.70% | 3.90% | |

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 03:00 | JPY | BoJ Monetary Policy Statement | ||||

| 05:45 | CHF | SECO Economic Forecasts | ||||

| 06:00 | GBP | ILO Unemployment Rate (3M) Apr | 3.90% | 4.50% | 3.90% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Apr | 1.00% | 1.30% | 2.40% | 2.30% |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Apr | 1.70% | 1.80% | 2.70% | |

| 06:00 | GBP | Claimant Count Rate May | 7.80% | 5.80% | ||

| 06:00 | GBP | Claimant Count Change May | 528.9K | 370.0K | 856.5K | 1032.7K |

| 06:00 | EUR | Germany CPI M/M May F | -0.10% | -0.10% | -0.10% | |

| 06:00 | EUR | Germany CPI Y/Y May F | 0.60% | 0.60% | 0.60% | |

| 09:00 | EUR | Germany ZEW Economic Sentiment Jun | 63.4 | 60 | 51 | |

| 09:00 | EUR | Germany ZEW Current Situation Jun | -83.1 | -84.8 | -93.5 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Jun | 58.6 | 53.4 | 46 | |

| 12:30 | USD | Retail Sales M/M May | 17.70% | 7.60% | -16.40% | -14.70% |

| 12:30 | USD | Retail Sales ex Autos M/M May | 12.40% | 5.10% | -17.20% | -15.20% |

| 12:30 | CAD | Foreign Securities Purchases (CAD) Apr | 49.04B | 5.00B | -9.78B | -9.82B |

| 13:15 | USD | Industrial Production M/M May | 1.40% | 2.50% | -11.20% | -12.50% |

| 13:15 | USD | Capacity Utilization May | 64.80% | 66.50% | 64.90% | 64.00% |

| 14:00 | USD | Fed’s Chair Powell testifies | ||||

| 14:00 | USD | Business Inventories Apr | -0.40% | -0.20% | ||

| 14:00 | USD | NAHB Housing Market Index Jun | 43 | 37 |