Dollar is set to end the week as the second weakest currency as slightly better than expected growth data provides little support. Q2 GDP grew 2.6% annualized, up from prior 1.4% and versus consensus of 2.5%. However, GDP price index slowed to 1.0%, down from 1.9% and below expectation of 1.3%. Employment cost index rose 0.5% in Q2, also below expectation of 0.6%. Subdued inflation will affirm the case for Fed to starting shrinking the balance in September first, and leave another rate hike to December. This will give Fed more time to assess inflation and growth outlook before raising interest rates. Also from US session, Canada GDP rose 0.6% mom in May, much stronger than expectation of 0.2% mom.

Skinny Obamacare repeal bill collapsed

Political uncertainty is also another factor that weighs on the Dollar. After a months-effort by Senate Republicans, another attempt at repealing Obamacare collapsed. The "skinny" version of the Obama repeal bill was voted down by John McCain and two more Republicans. Senate Majority Leader, Mitch McConnell said that "this is clearly a disappointing moment" and "it’s time to move on." US President Donald Trump is now expected to move on to his expansive fiscal policies. However, the lack of political leadership aside, the failure of border tax and Obamacare repeal now raised questions on whether Trump could balance the books for tax reforms and infrastructure spending.

Eurozone data positive

Euro continues it’s march higher against Swiss Franc while staying in range against Dollar and Yen. Economic data from Eurozone are generally positive. German CPI rose 0.4% mom 1.7% yoy in July, picked up from prior 0.2% mom and 1.6%. That also beat expectation of 0.2% mom, 1.5% yoy. French GDP grew 0.5% qoq in Q2, in line with consensus. Eurozone business climate dropped to 1.05 in July. Economic confidence rose to 111.2, industrial confidence was unchanged at 4.5, services confidence rose to 14.1, consumer confidence dropped to -1.7. Also from Europe, Swiss KOF leading indicator rose to 105.5 in July.

Japan national CPI core unchanged at 0.4% yoy

A bunch of economic data is released from Japan today. National CPI core was unchanged at 0.4% yoy in June. Tokyo CPI core rose to 0.2% yoy in July, up from 0.0% yoy and beat expectation of 0.1% yoy. Unemployment rate dropped to 2.8% in June versus expectation of 3.0%. Household spending rose 2.3% yoy, retail sales rose 2.1% yoy. Core inflation remained well below BoJ’s 2% target. Indeed, the central bank has lowered inflation forecast for the current fiscal year to 1.1% and pushed back the timing for hitting the target by a year. And the summary of opinions of the July meeting also showed that one member is concerned that repeated delays would hurt BoJ’s credibility. Based on current outlook, there is little chance for BoJ to follow other major global central banks to start exiting from stimulus.

USD/JPY Mid-Day Outlook

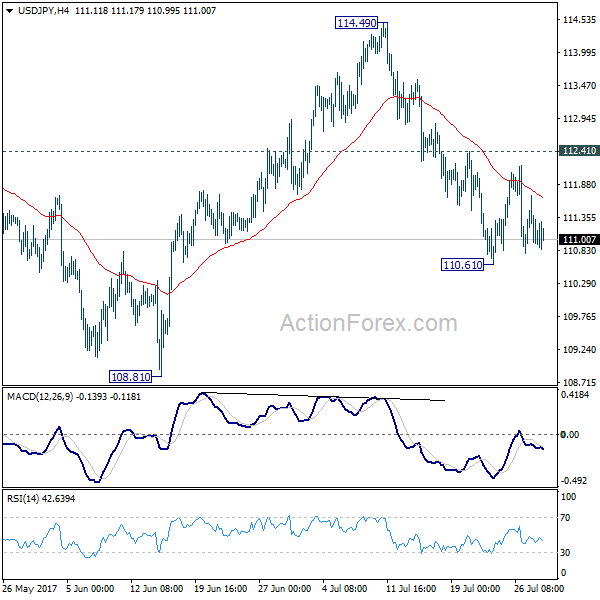

Daily Pivots: (S1) 110.79; (P) 111.25; (R1) 111.72; More…

USD/JPY is still bounded in consolidation above 110.61 temporary low and intraday bias remains neutral. As long as 112.41 resistance holds, further decline is expected. Break of 110.61 will target 108.81. Break there will resume whole correction from 118.65 and target 61.8% retracement of 98.97 to 118.65 at 106.48. Nonetheless, break of 112.41 will dampen this bearish view and turn focus back to 114.49 resistance instead.

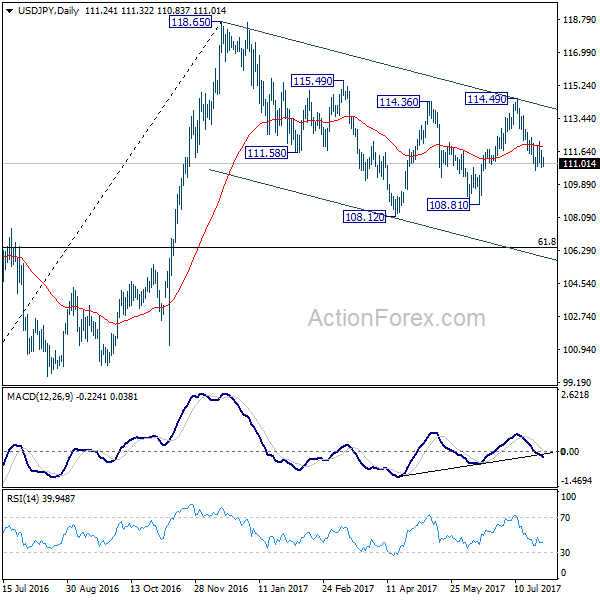

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, down side should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jul | -12 | -11 | -10 | |

| 23:50 | JPY | BOJ Summary of Opinions July Meeting | ||||

| 23:30 | JPY | National CPI Core Y/Y Jun | 0.40% | 0.40% | 0.40% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Jul | 0.20% | 0.10% | 0.00% | |

| 23:30 | JPY | Jobless Rate Jun | 2.80% | 3.00% | 3.10% | |

| 23:30 | JPY | Household Spending Y/Y Jun | 2.30% | 0.50% | -0.10% | |

| 23:50 | JPY | Retail Trade Y/Y Jun | 2.10% | 2.30% | 2.00% | 2.10% |

| 01:30 | AUD | PPI Q/Q Q2 | 0.50% | 0.60% | 0.50% | |

| 01:30 | AUD | PPI Y/Y Q2 | 1.70% | 1.30% | ||

| 05:30 | EUR | French GDP Q/Q Q2 A | 0.50% | 0.50% | 0.50% | |

| 07:00 | CHF | KOF Leading Indicator Jul | 106.8 | 106 | 105.5 | 105.8 |

| 09:00 | EUR | Eurozone Economic Confidence Jul | 111.2 | 110.8 | 111.1 | |

| 09:00 | EUR | Eurozone Business Climate Indicator Jul | 1.05 | 1.14 | 1.15 | 1.16 |

| 09:00 | EUR | Eurozone Industrial Confidence Jul | 4.5 | 4.3 | 4.5 | |

| 09:00 | EUR | Eurozone Services Confidence Jul | 14.1 | 13.4 | 13.4 | 13.3 |

| 09:00 | EUR | Eurozone Consumer Confidence Jul F | -1.7 | -1.7 | -1.7 | -1.3 |

| 12:00 | EUR | German CPI M/M Jul P | 0.40% | 0.20% | 0.20% | |

| 12:00 | EUR | German CPI Y/Y Jul P | 1.70% | 1.50% | 1.60% | |

| 12:30 | CAD | GDP M/M May | 0.60% | 0.20% | 0.20% | |

| 12:30 | USD | GDP (Annualized) Q2 A | 2.60% | 2.50% | 1.40% | |

| 12:30 | USD | GDP Price Index Q2 A | 1.00% | 1.30% | 1.90% | |

| 12:30 | USD | Employment Cost Index Q2 | 0.50% | 0.60% | 0.80% | |

| 14:00 | USD | U. of Michigan Confidence Jul F | 93.1 | 93.1 |