Yen and Swiss Franc rise broadly today as global stock markets look set for a pull back after recent strong run. Major European indices are trading generally in red while US futures point to a lower open. On the other hand, commodity currencies are trading broadly lower, as led by Australian Dollar. Sterling, Euro and Dollar are mixed, somewhat caught in between.

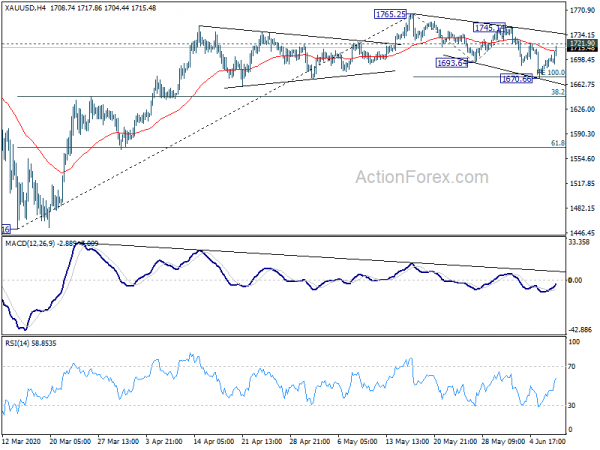

Technically, though, it’s still too early to even call a top in US stocks, not to mention a major pull back or a reversal. 3090.41 support in S&P 500 and 9560.41 support in NASDAQ need to be violated first before confirming short term topping. Gold, on the other hand, is near to a near term resistance level at 1721.90. Break will indicate completion of the correction from 1765.25, which is a sign of return of risk aversion.

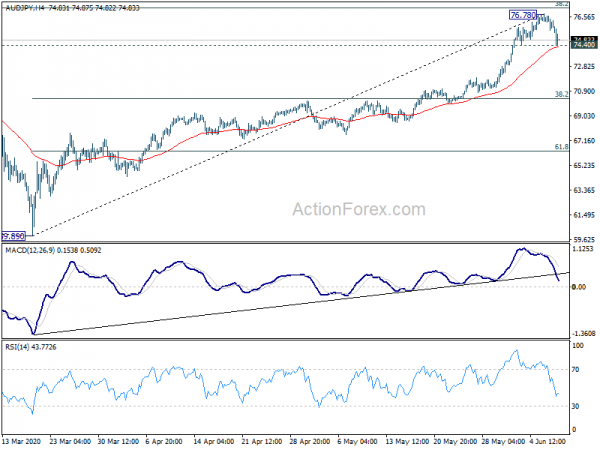

In the currency markets, we’d maintained that 0.6856 minor support in AUD/USD and 1.3572 minor resistance in USD/CAD should be taken out if commodity currencies are ready to pull back. 74.40 support in AUD/JPY should be broken before confirming short term topping too. EUR/CHF will also need to break 1.0744 minor support to violate near term bullishness. For now, we’ll have to wait and see.

ECB: Euro remains unchallenged as the second most used currency globally

ECB said Euro remains “unchallenged as second most used currency globally”, after US Dollar. Role of Euro remained “stable” as global reserve currency”. The international role declined after the global financial crisis but has now “bottomed out”. At the end of 2019, Euro accounted for 20.5% of global FX reserves, up from 20.3% a year earlier. Share in outstanding international debt securities, dropped -0.3% to 22.1%.

President Christine Lagarde also noted, “the recent COVID-19 pandemic underlines the urgency of these policies and reform efforts, which are paramount to raising the attractiveness of the euro globally”. Executive Board member Fabio Panetta said, “the swift implementation of an EU taxonomy of sustainable economic activities would provide a credible and standardised framework, ensure greater investor confidence and could thereby also contribute to strengthening the international role of the euro”.

Eurozone GDP contracted -3.6% in Q1, worst in France, Spain and Italy

Eurozone’s Q1 GDP contraction was revised up to -3.6% qoq, up from initial estimate of -3.8% qoq. That was still the sharpest decline on record since 1995. For EU, GDP contracted -3.2% qoq, also the worst since 1995.

Household final consumption expenditure had a strong negative contribution to GDP growth in both Eurozone and the EU (-2.5% and -2.3%, respectively) . Contribution from gross fixed capital formation was also negative in both zones (-1.0% and -0.9% respectively) as was the contribution of the external balance. Contribution of changes in inventories was positive for both zones (+0.3% for Eurozone and +0.4% for EU).

Among Member States for which data are available, Ireland (+1.2%), Bulgaria and Romania (both +0.3%) as well as Sweden (+0.1%) still recorded positive growth compared with the previous quarter. GDP fell in all other EU Member states, with the highest declines in France and Italy (both -5.3%) as well as Spain and Slovakia (both -5.2%).

Also released, Germany trade surplus narrowed to EUR 3.2B in April versus expectation of EUR 11.9B. France trade deficit widened to EUR -5.4B in April versus expectation of EUR -3.4B. Swiss unemployment rate rose to 3.4% in May, up from 3.3%, better than expectation of 3.6%.

S&P downgrades Japan’s rating outlook as weak government finances deteriorated due to pandemic

S&P Global Ratings affirmed Japan’s A+ long-term and A-1 short-term sovereign credit ratings. However, outlook is downgraded from positive to stable as the “weak government finances have deteriorated further in fiscal 2020 owing to the COVID-19 pandemic”.

“The fiscal position should improve materially once the outbreak recedes and economic growth returns. Nevertheless, we expect the fiscal deficit will remain relatively high” in fiscal 2021 through 2023, it said.

However, “should real interest rates increase sharply at some point, this would severely strain the government’s debt dynamics,” it added. “This could occur if investors demand a higher risk premium and push up nominal interest rates. But we believe the greater risk is from renewed and persistent deflation.”

Released from Japan, labor cash earnings dropped -0.6% yoy in April versus expectation of -1.0% yoy. M2 rose 5.1% mom in May versus expectation of 3.8% yoy.

Australia NAB business confidence rose to -20, key factor in how businesses recover

Australia NAB Business Confidence rose to -20 in May, up from April’s -45. Business Conditions rose to -24, up from 34. Looking at some details, trading conditions rose to -14, up from -31. Profitability rose to -19, up form -35. Employment rose just slightly to -31, up from -34.

According to Alan Oster, NAB Group Chief Economist said negative conditions indicates that “activity was still extremely weak in May.” Also, “forward orders suggest that in the short-term activity is likely to remain weak in the business sector and combined with low capacity utilisation and still very weak confidence points to ongoing restraint in Capex spending”. Recovery in confidence will likely be a “key factor” in how businesses recovery from the largest downturn since 1930s.

New Zealand ANZ business confidence rose to -33, still a huge tourism-shaped hole

New Zealand ANZ Business Confidence rose another 9 pts to -33 in June’s preliminary reading, up from may’s -41.8. Activity outlook rose to -29.1, up from -38.7. Looking at some details, export intentions rose to 17.1, from -32.2. Investment intentions rose to -21.6, up from -31.7. Employment intentions rose to -34.0, from -42.4.

The improvement reflected New Zealand’s “continued steady progress out of lockdown”, but “levels remain very low”. ANZ also noted, emerging into Level 1 lockdown, “disruption has waned, and normality beckons”. But “there is a huge tourism-shaped hole” in the economy. Also, “people will feel comfortable going into a shop or restaurant – that’s a huge win – but whether they’ll feel comfortable spending money is another question again.”

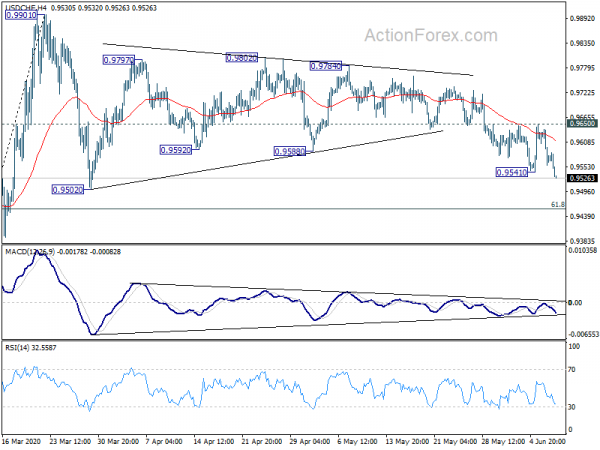

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9542; (P) 0.9591; (R1) 0.9625; More…

USD/CHF’s break of 0.9541 suggests resumption of correction from 0.9901. Intraday bias is back on the downside for 0.9502 support. But still, downside should be contained by 61.8% retracement of 0.9181 to 0.9901 at 0.9456 to rebound. On the upside, break of 0.9650 resistance should turn bias back to the upside for 0.9784 resistance first.

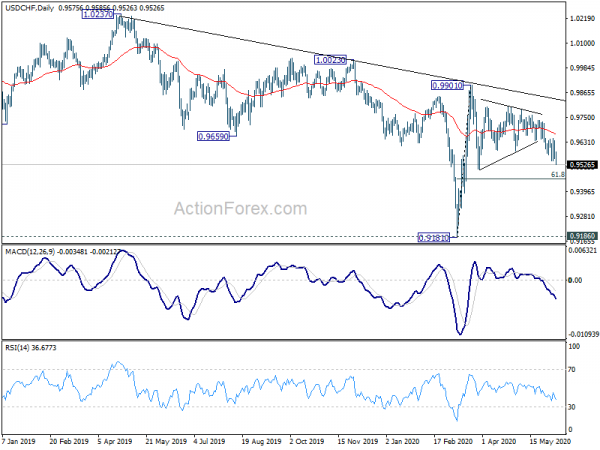

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). It could have completed at 0.9181 after hitting 0.9186 key support (2018 low). Break of 0.9901 will extend the rebound form 0.9181 through 1.0023 resistance. After all, medium term range trading will likely continue between 0.9181/1.0237 for some more time.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y May | 7.90% | 5.70% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | -0.60% | -1.00% | 0.10% | |

| 23:50 | JPY | Money Supply M2+CD Y/Y May | 5.10% | 3.80% | 3.70% | |

| 1:30 | AUD | NAB Business Conditions May | -24 | -34 | ||

| 1:30 | AUD | NAB Business Confidence May | -20 | -46 | -45 | |

| 5:45 | CHF | Unemployment Rate May | 3.40% | 3.60% | 3.30% | |

| 6:00 | JPY | Machine Tool Orders Y/Y May P | -52.80% | -48.30% | ||

| 6:00 | EUR | Germany Trade Balance (EUR) Apr | 3.2B | 11.9B | 12.8B | |

| 6:45 | EUR | France Trade Balance (EUR) Apr | -5.4B | -3.4B | -3.3B | -2.8B |

| 9:00 | EUR | Eurozone GDP Q/Q Q1 | -3.60% | -3.80% | -3.80% | |

| 9:00 | EUR | Eurozone Employment Change Q/Q Q1 F | -0.20% | -0.20% | -0.20% | |

| 14:00 | USD | Wholesale Inventories Apr | 0.40% | 0.40% |