The forex markets are rather consolidative today as traders are waiting for the next direction. European and Asian stock display some mild strength but that is far from being impressive. US futures are also mixed as NASDAQ might has a little retreat before deciding to extend the record run. New Zealand and Australian Dollar are the stronger once for now. Dollar and European majors are relatively softer. Though, the picture could be clear once US traders enter in the market.

Technically, USD/CHF retreats after failing to break through 0.9647 minor resistance, leaving no confirmation of short term bottoming. EUR/GBP also recovers already of 0.8866 minor support and gives us no confirmation of near term bearish reversal. While AUD/USD and USD/CAD continue to lose momentum, there is no sign of a sustainable pull back yet. The clearly development might be retreats in USD/JPY, EUR/JPY and GBP/JPY as treasury yield pares back some of last week’s strong rallies.

In Europe, currently, FTSE is currently up 0.26%. DAX is up 0.31%. CAC is up 0.11%. German 10-year yield is down -0.0228 at -0.299. Earlier in Asia, Nikkei rose 1.37%. Hong Kong HSI rose 0.03%. China Shanghai SSE rose 0.24%. Singapore Strait Times rose 1.65%. Japan 10-year JGB yield rose 0.0052 to 0.046.

Eurozone Sentix investor confidence rose to -24.8, an upswing but reversals not yet assured

Eurozone Sentix Investor Confidence improved to -24.8 in June. That’s the second straight month of rebound, from April’s -42.9 then May’s -41.8. Current situation index rose from -73.0 to -61.5. Expectations index jumped from -3.0 to 21.8, turned positive, and hit the highest level since November 2017.

Sentix questioned: “But what do these numbers mean? Is there a “normal” upswing that will soon bring us back to a normal, good economic situation? To get a better understanding of these figures, we conducted a special survey among investors. We wanted to know how much of the economic slump caused by the Corona pandemic will be made up within a year. So where does the recovery go?!”

They then added: “The result is likely to disappoint optimists. For the eurozone, investors expect that within a year, just over 50% of the slump can be made up. This means that in a year’s time we would still be noticeably below the pre-crisis level. And this despite all the stimulus measures, the fiscal packages and monetary easing. An upswing has begun, but a real trend reversal is not yet assured.”

German industrial production plunged record -17.9%, economy ministry said low point was reached

Germany industrial plunged -17.9% mom in April, worse than expectation of -15.5% mom. That’s also a record decline, due to coronavirus pandemic and responding containment measures. Looking at some details, intermediate goods dropped -13.8% mom. Consumer goods dropped -8.7%. Capital goods dropped -35.5%. Automotive dropped -74.6%.

Nevertheless, in response to the release, Economic Ministry said “The low point has been reached. With the gradual easing of protective measures and the resumption of production in the automotive industry, the economic recovery is beginning now.”

Japan Nishimura: Efforts to stimulate consumption should wait a bit more

Japan Economy Minister Yasutoshi Nishimura said in the an interview that it’s “premature to consider fiscal, monetary steps aimed at stimulating consumption as Japan is still focusing on containing coronavirus pandemic.” And, ‘what’s most important now is to protect jobs and help businesses survive the pandemic.”

For now, “we’re not at a stage yet where we want to stimulate consumption and encourage people to travel a lot,” he added. “Efforts to stimulate consumption should wait a bit more”. Though, he’s relatively optimistic as “we’re already reopening business,” and “so the economy will probably hit bottom from April through mid-May,”

Capital injection into companies should be “an area the government can handle”. BoJ should instead “plays its part in helping financial institutions meet corporate funding strains.”

Japan GDP finalized at -0.6% qoq in Q1, capital spending unexpectedly grew

Japan GDP contraction was finalized at -0.6% qoq in Q1, better than earlier estimate of -0.9% qoq, marginally missed expectation of -0.5% qoq. In annualized term, GDP contracted -2.2%, revised up from -3.4%. The upward revision was largely thanks to capital expenditure, which rose 1.9% qoq, reversing from a preliminary -0.5% qoq decline.

The data, nevertheless, confirmed that Japan was already in recession, with -1.8% qoq, -7.1% annualized GDP contraction back in Q4. The slump is expected to deepen again in Q2 with coronavirus pandemic impacts. Another -9% annualized contraction could be seen in Q2, reflecting the worst economic crisis since WWII.

Also released form Japan, current account surplus narrowed to JPY 0.25T in April versus expectation of JPY 0.33T. Bank lending rose 4.8% yoy in May versus expectation of 3.2% yoy.

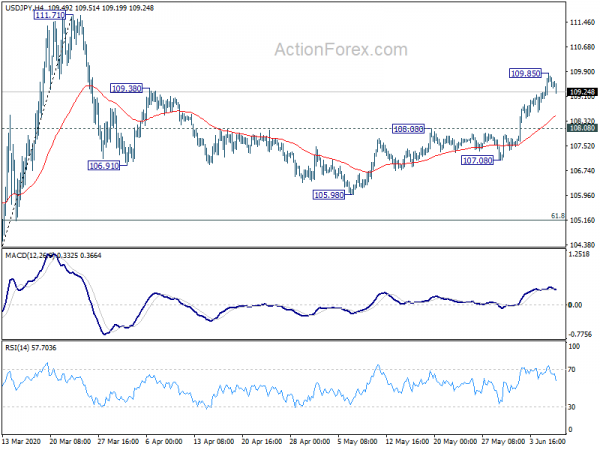

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.15; (P) 109.50; (R1) 109.95; More..

A temporary top is formed at 109.85 with today’s retreat. Intraday bias in USD/JPY is turned neutral for some consolidations first. Downside should be contained above 108.06 resistance turned support to bring another rally. On the upside, break of 109.85 will resume the rise from 105.98 to retest 111.71/112.22 resistance zone. Decisive break there will carry larger bullish implications.

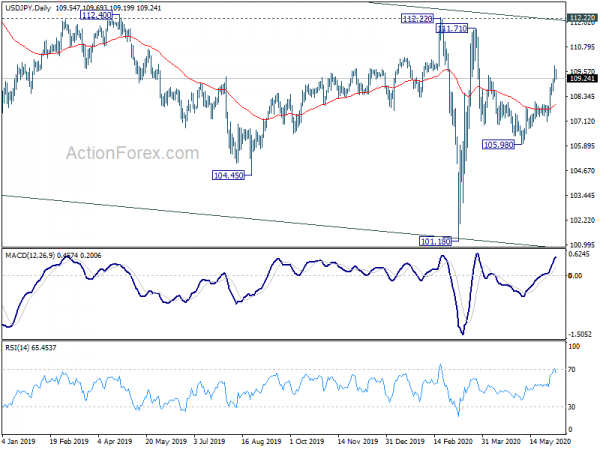

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec2016). Hence, there is clear indication of trend reversal yet. Break of 105.98 support would extend the down trend through 101.18 low. However, sustained break of 112.22 should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y May | 4.80% | 3.20% | 3.00% | 2.90% |

| 23:50 | JPY | Current Account (JPY) Apr | 0.25T | 0.33T | 0.94T | |

| 23:50 | JPY | GDP Q/Q Q1 | -0.60% | -0.50% | -0.90% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 0.90% | 0.90% | 0.90% | |

| 05:00 | JPY | Eco Watchers Survey: Current May | 15.5 | 10.7 | 7.9 | |

| 06:00 | EUR | Germany Industrial Production M/M Apr | -17.90% | -15.50% | -9.20% | -8.90% |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jun | -24.8 | -22 | -41.8 | |

| 12:15 | CAD | Housing Starts May | 193K | 110.0K | 171.3K | 166K |