Asian markets are relatively quiet as another week starts. There is no follow through from Friday’s strong rally in the US. Trade data from China released over the weekend also provide little inspirations. There is also practically no reaction to the massive global “Black Lives Matter” protests, nor intensifying US-China spats. NASDAQ hit new intraday record high last week and a focus will be whether it could power through to extend the record run, or have a set back this week.

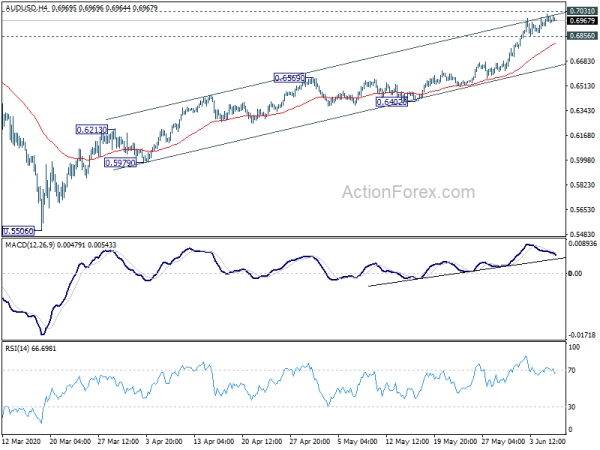

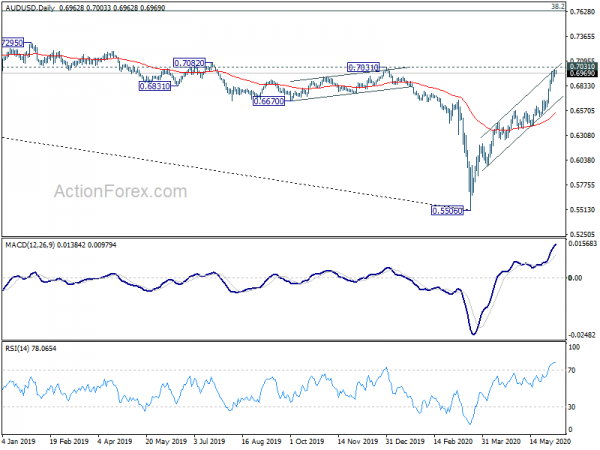

Technically, in the currency markets, commodity currencies appear to be losing momentum since late last week. In particular, a focus will be on whether AUD/USD would surge through 0.7031 key resistance level (which is close to 0.7 psychological level). Or it would have a set back by breaking 0.6856 minor support. Another focus in on 0.8866 minor support in EUR/GBP, and break will confirm completion of rebound from 0.8670, signalling reverse in Euro and Sterling’s fortune. One more thing to watch is 0.9647 minor resistance in USD/CHF. Firm break there could indicate completion of consolidation pattern from 0.9901 and raise the chance of retesting this high ahead. It’s pretty much every pairs for itself.

In Asia, currently, Nikkei is up 1.08%. Hong Kong HSI is down -0.14%. China Shanghai SSE is up 0.32%. Singapore Strait Times is up 1.10%. Japan 10-year JGB yield is up 0.0054 at 0.046.

Japan Nishimura: Efforts to stimulate consumption should wait a bit more

Japan Economy Minister Yasutoshi Nishimura said in the an interview that it’s “premature to consider fiscal, monetary steps aimed at stimulating consumption as Japan is still focusing on containing coronavirus pandemic.” And, ‘what’s most important now is to protect jobs and help businesses survive the pandemic.”

For now, “we’re not at a stage yet where we want to stimulate consumption and encourage people to travel a lot,” he added. “Efforts to stimulate consumption should wait a bit more”.

Though, he’s relatively optimistic as “we’re already reopening business,” and “so the economy will probably hit bottom from April through mid-May.”

Capital injection into companies should be “an area the government can handle”. BoJ should instead “plays its part in helping financial institutions meet corporate funding strains.”

Japan GDP finalized at -0.6% qoq in Q1, capital spending unexpectedly grew

Japan GDP contraction was finalized at -0.6% qoq in Q1, better than earlier estimate of -0.9% qoq, marginally missed expectation of -0.5% qoq. In annualized term, GDP contracted -2.2%, revised up from -3.4%. The upward revision was largely thanks to capital expenditure, which rose 1.9% qoq, reversing from a preliminary -0.5% qoq decline.

The data, nevertheless, confirmed that Japan was already in recession, with -1.8% qoq, -7.1% annualized GDP contraction back in Q4. The slump is expected to deepen again in Q2 with coronavirus pandemic impacts. Another -9% annualized contraction could be seen in Q2, reflecting the worst economic crisis since WWII.

Also released form Japan, current account surplus narrowed to JPY 0.25T in April versus expectation of JPY 0.33T. Bank lending rose 4.8% yoy in May versus expectation of 3.2% yoy.

China trade surplus widened to record USD 62.9B as both exports and imports plunged

In May, in US term, China’s exports dropped -3.3% yoy to USD 206.8B, better than expectation of -7.0% mom decline. Imports dropped -16.7% yoy to USD 143.9B, worst than expectation of -9.7% yoy. Trade surplus widened to USD 62.9B, up from USD 45.3B. That’s also a record monthly trade surplus, with much help from decline in prices of crud oil and commodities like soy beans.

Year-to May, total exports dropped -7.7% yoy to USD 885.0B. Total imports dropped -8.2% to USD 763.6B. Trade surplus for the first give months of the year was at USD 121.4B.

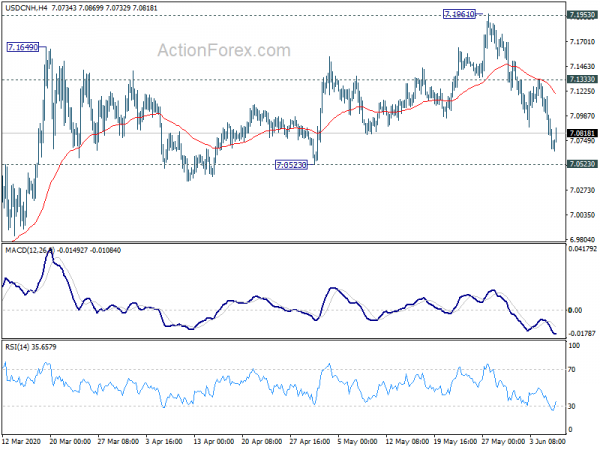

USD/CNH recovers mildly today but there is no sign of near term bottoming yet. Further decline is expected as long as 7.1333 minor resistance holds. Fall from 7.1961 is seen as the third leg of the consolidation form 7.1953. Break of 7.0523 support will pave the way to retest 6.8452/9040 support zone.

Week ahead – Fed might talk about yield curve control while standing pat

FOMC rate decision and press conference would be the major focus for the week. There is no doubt that Fed will keep interest rate unchanged at 0-0.25%. Yet, given the sign of bottoming in the economy, in particular from the rebound in May’s employment data, policymakers might start to sound a bit more easy regarding the economy outlook. That could also be translated into preparation for market to transit from the current crisis emergency measures, into something longer term. Yield curve control is a key phrases popping around in the past week and it’s something that Fed might adopt.

On the data front, April’s production data from Germany, France, Italy, Eurozone, and UK will catch much attention. Confidence data from Eurozone, Australia, New Zealand, will be watched too. The US calendar is relatively light but we’ll still have CPI and PPI in addition to FOMC.

Here are some highlights for the week:

- Monday: Japan GDP final, current account, bank lending; Germany industrial production; Eurozone Sentix investor confidence; Canada housing starts.

- Tuesday: UK BRC retail sales; Japan average cash earnings, machine tools orders; New Zealand ANZ business confidence; Australia NAB business confidence; Swiss unemployment rate; France trade balance; Eurozone GDP revision, employment change.

- Wednesday: New Zealand manufacturing sales; Japan PPI, machine orders; Australia Westpac consumer sentiment; China CPI and PPI; French industrial production; US CPI, FOMC rate decision.

- Thursday: UK RICS house price balance; Australia inflation expectations; US PPI, jobless claims.

- Friday: New Zealand BusinessNZ manufacturing index; UK GDP, industrial and manufacturing production, trade balance; Eurozone industrial production; US import prices, U of Michigan sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6927; (P) 0.6970; (R1) 0.7009; More…

Intraday bias in AUD/USD remains neutral first with focus on 0.7031 key resistance. On the downside, break of 0.6856 minor support will suggest short term topping, after rejection by 0.79031. Intraday bias will be turned back to the downside for pull back towards 0.6569 resistance turned support. Nevertheless, decisive break of 0.7031 will extend the rise from 0.5506

In the bigger picture, the firm break of 0.6826 (2016 low) now suggests that 0.5506 is a medium term bottom. Rebound from there is likely correcting whole long term down trend form 1.1079 (2011 high). Further rally would be seen to 55 month EMA (now at 0.7326). This will remain the preferred case as long as it stays above 55 week EMA (now at 0.6721).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y May | 4.80% | 3.20% | 3.00% | 2.90% |

| 23:50 | JPY | Current Account (JPY) Apr | 0.25T | 0.33T | 0.94T | |

| 23:50 | JPY | GDP Q/Q Q1 | -0.60% | -0.50% | -0.90% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 0.90% | 0.90% | 0.90% | |

| 5:00 | JPY | Eco Watchers Survey: Current May | 15.5 | 10.7 | 7.9 | |

| 6:00 | EUR | Germany Industrial Production M/M Apr | -15.50% | -9.20% | ||

| 8:30 | EUR | Eurozone Sentix Investor Confidence Jun | -22 | -41.8 | ||

| 12:15 | CAD | Housing Starts May | 110.0K | 171.3K |