Selloff in Swiss Franc continued overnight and weakness extends into Asian session. EUR/CHF is trading up over 300 pts, or 2.75% for the week. As we noted before, the strong break of 1.12 handle is now setting up the stage for EUR/CHF to head back to prior SNB floor at 1.2. USD/CHF’s break of 0.9699 resistance also argues that the down trend from 1.0342 has completed and reversed after defending 0.9443 key support level. Oversold condition could start to limit selling in the Swiss Franc and we might see Franc crosses slow down a little bit before ending the week. Focus will be turned back to US with Q2 GDP data featured.

Japan national CPI core unchanged at 0.4% yoy

A bunch of economic data is released from Japan today. National CPI core was unchanged at 0.4% yoy in June. Tokyo CPI core rose to 0.2% yoy in July, up from 0.0% yoy and beat expectation of 0.1% yoy. Unemployment rate dropped to 2.8% in June versus expectation of 3.0%. Household spending rose 2.3% yoy, retail sales rose 2.1% yoy. Core inflation remained well below BoJ’s 2% target. Indeed, the central bank has lowered inflation forecast for the current fiscal year to 1.1% and pushed back the timing for hitting the target by a year. And the summary of opinions of the July meeting also showed that one member is concerned that repeated delays would hurt BoJ’s credibility. Based on current outlook, there is little chance for BoJ to follow other major global central banks to start exiting from stimulus.

Also released in Asian session, Australia PPI rose 0.5% qoq, 1.7% yoy in Q2. UK Gfk consumer confidence dropped to -12 in July.

US GDP to watch today

US GDP data will be the main focus for today. The US economy is expected to grow 2.5% annualized in Q2, a notable rebound from Q1’s sluggish 1.4% growth. GDP price index, however is expected to slow to 1.3%. US will also release Q2 employment cost index. Dollar has been under selling pressure after the dovish FOMC statement. But that just confirmed markets view that Fed is concerned with the slowdown in inflation. And it will likely opt for starting to shrinking the balance sheet first in September. Fed will hold its card on rate hike and do it in December after seeing a few more months of data.

The dollar index is staying weak with recent fall from 103.82 still on course for 91.91 key support level. But for the moment, downside is held by the medium term channel support, indicating no further acceleration. There is prospect for a rebound should today’s GDP data meets expectations.

Elsewhere, France will also release Q2 GDP in European session. German CPI, Eurozone confidence indicators and Swiss KOF will be featured. Canada will also release GDP.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9538; (P) 0.9600; (R1) 0.9709; More…

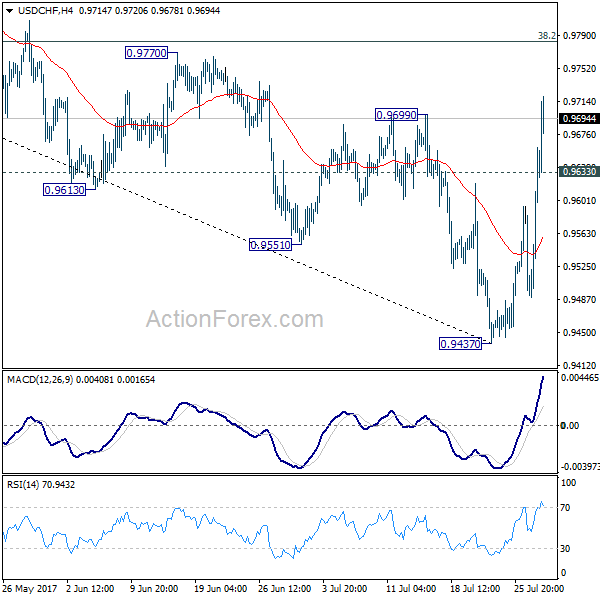

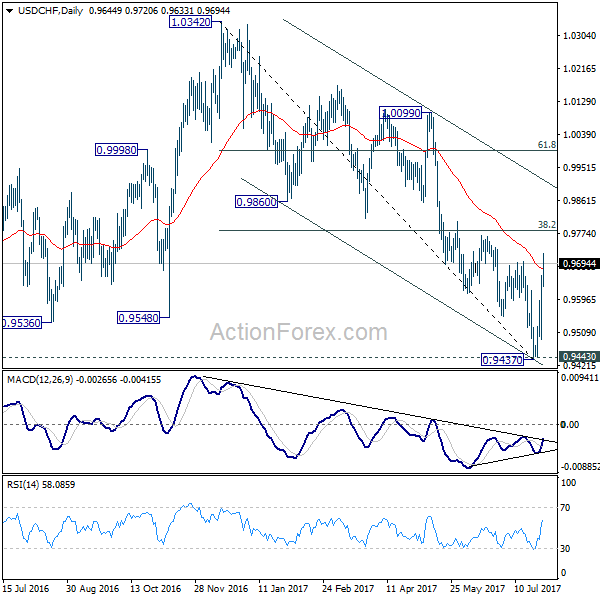

USD/CHF’s rebound from 0.9437 accelerated to as high as 0.9720 so far. The break of 0.9699 resistance now suggests that it has bottomed at 0.9437 after defending 0.9443 key support level. This is also supported by bullish convergence condition in daily MACD. Intraday bias is on the upside for 38.2% retracement of 1.0342 to 0.9437 at 0.9783 first. Break will target channel resistance (now at 0.9912). On the downside, below 0.9633 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, current development argues that USD/CHF has successfully defended 0.9443 key support level. And long term range trading in 0.9443/1.0342 is extending with another rising level. At this point, there is no sign of an up trend yet. Hence, while further rise is expected in USD/CHF, we’ll start to be cautious on loss of momentum above 61.8% retracement of 1.0342 to 0.9437 at 0.9996.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jul | -12 | -11 | -10 | |

| 23:50 | JPY | BOJ Summary of Opinions July Meeting | ||||

| 23:30 | JPY | National CPI Core Y/Y Jun | 0.40% | 0.40% | 0.40% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Jul | 0.20% | 0.10% | 0.00% | |

| 23:30 | JPY | Jobless Rate Jun | 2.80% | 3.00% | 3.10% | |

| 23:30 | JPY | Household Spending Y/Y Jun | 2.30% | 0.50% | -0.10% | |

| 23:50 | JPY | Retail Trade Y/Y Jun | 2.10% | 2.30% | 2.00% | 2.10% |

| 1:30 | AUD | PPI Q/Q Q2 | 0.50% | 0.60% | 0.50% | |

| 1:30 | AUD | PPI Y/Y Q2 | 1.70% | 1.30% | ||

| 5:30 | EUR | French GDP Q/Q Q2 A | 0.50% | 0.50% | ||

| 7:00 | CHF | KOF Leading Indicator Jul | 106 | 105.5 | ||

| 9:00 | EUR | Eurozone Economic Confidence Jul | 110.8 | 111.1 | ||

| 9:00 | EUR | Eurozone Business Climate Indicator Jul | 1.14 | 1.15 | ||

| 9:00 | EUR | Eurozone Industrial Confidence Jul | 4.3 | 4.5 | ||

| 9:00 | EUR | Eurozone Services Confidence Jul | 13.4 | 13.4 | ||

| 9:00 | EUR | Eurozone Consumer Confidence Jul F | -1.7 | -1.7 | ||

| 12:00 | EUR | German CPI M/M Jul P | 0.20% | 0.20% | ||

| 12:00 | EUR | German CPI Y/Y Jul P | 1.50% | 1.60% | ||

| 12:30 | CAD | GDP M/M May | 0.20% | 0.20% | ||

| 12:30 | USD | GDP (Annualized) Q2 A | 2.50% | 1.40% | ||

| 12:30 | USD | GDP Price Index Q2 A | 1.30% | 1.90% | ||

| 12:30 | USD | Employment Cost Index Q2 | 0.60% | 0.80% | ||

| 14:00 | USD | U. of Michigan Confidence Jul F | 93.1 | 93.1 |