Risk appetite remains generally firm in European session but trading has turned a bit subdued with France, Germany and Swiss on bank holiday. Dollar is trying to recovery entering into US session, but remains one of the weakest, along with Yen and Swiss France. Australian Dollar is leading commodity currencies higher while Euro is losing some upside momentum. Gold dips mildly today and it’s back below 1740. If the greenback is to recovery, some deeper pull back in gold should be seen in according to confirm momentum.

Technically, Euro seems to be losing much of last week’s upside momentum. In particular, EUR/AUD is heading back to 1.6453 support break will resume the decline from 1.9799. More importantly sustained trading below 1.6597 key support level will carry larger bearish implication and target 1.6085. EURCAD is also back pressing 4 hour 55 EMA. Break will suggest that rebound form 1.5054 has completed. Corrective pattern from 1.5991 would then extend with another fall to retest 1.5054.

In Europe, currently, FTSE is up 1.06%. CAC is up 1.16%. Earlier in Asia, Nikkei rose 0.84%. Hong Kong HSI rose 3.36%. China Shanghai SSE rose 2.21%. Singapore Strait Times rose 1.60%. Japan 10-year JGB yield rose 0.0039 to 0.009.

UK PMI manufacturing finalized at 40.7, one of the toughest recovery environments manufacturers have to face

UK PMI Manufacturing was finalized at 40.7 in May, up from record low of 32.6 in April. Output, new orders and employment fell sharply. Input price and output charge inflation remained moderate.

Rob Dobson, Director at IHS Markit: “Those who typically see the glass half empty will note that the UK manufacturing sector remained mired in its deepest downturn in recent memory. Output, new orders and employment fell sharply again in May as restrictions to combat the spread of COVID-19 caused further widespread disruptions to economic activity, demand and global supply chains.

“However, the glass-half-full perspective is one where the rate of contraction has eased considerably since April, meaning – absent a resurgence of infections – the worst of the production downturn may be behind us. Pressure on manufacturers should ease further as lockdown restrictions are loosened, customers return to work and global activity restarts.

“However, changes to working practices, uncertainty about how long the COVID-19 restrictions may be in place for, weak demand and Brexit worries all suggest the UK is set for a drawn-out economic recovery. This will make the “new normal” one of the toughest recovery environments many manufacturers will ever have to face.”

Eurozone PMI manufacturing finalized at 39.4, at least some stabilization, potentially return to growth

Eurozone PMI Manufacturing was finalized at 39.4 in May, up from April’s 33.4. Markit noted that while there was a rebound in the headline PMI, there were sharp falls in new orders and output recorded. Also, job losses mount as manufacturers remained downbeat about outlook. Among the member states, all readings stayed below 50, with Germany at 36.6, Spain at 38.3, Austria at 40.4, France at 40.6, Greece at 41.1, Italy at 45.4.

Chris Williamson, Chief Business Economist at IHS Markit said: “The manufacturing downturn looks to have bottomed-out in April, with production falling at a markedly slower rate in May. The improvement in part merely reflects the comparison against a shockingly steep fall in April, but more encouragingly was also linked to companies restarting work as virus lockdowns were eased. The further lifting of COVID-19 restrictions in coming months should provide a further boost to manufacturers.

“While we are still set to see unprecedented falls in industrial production and GDP in the second quarter, the survey brings hope that the goodsproducing sector may at least see some stabilisation – and even potentially a return to growth – in the third quarter. Whether growth can achieve any serious momentum remains highly uncertain, however, as demand – both domestically and in export markets – looks set to remain subdued by social distancing measures, high unemployment and falling corporate profits for some time to come.

China Caixin PMI manufacturing rose to 50.7, sluggish exports remained a big drag on demand

China’s Caixin PMI Manufacturing rose to 50.7 in May, up from 49.4, back in expansion territory. Markit said that “Supply was generally stronger than demand in the manufacturing sector, as production continued its expansion amid a broader economic rebound while demand had yet to recover.

Wang Zhe, Senior Economist at Caixin Insight Group added: “Sluggish exports remained a big drag on demand as the virus continued spreading overseas. Stabilizing the job market is a top priority on policymakers’ agenda this year, as shown in last month’s government work report. Boosting employment is not an easy task, as the employment subindex in the Caixin manufacturing PMI survey has remained in contractionary territory for five months in a row.”

Released over the weekend, the official China PMI Manufacturing dropped to 50.6 in May, down from 50.8, missed expectation of 51.1. PMI Non-Manufacturing rose to 53.6, up from 53.2, beat expectation of 53.5.

Japan PMI Manufacturing finalized at 38.4, conditions to remain fragile until sustained demand improvement

Japan PMI Manufacturing is finalized at 38.4 in May, down from April’s 41.9, lowest since March 2009. Markit said production fell at sharper rate as coronavirus disruption continued. New orders plummeted to an extend not seen since the global financial crisis. Suppliers’ delivery times lengthened sharply once again.

Joe Hayes, Economist at IHS Markit, said: “While easing lockdown measures will be positive for the economic environment, it is clear that dislocations will remain, which will continue to hinder supply chains, impact global trade and make operating conditions challenging for manufacturers. Until we see a sustained improvement in demand, manufacturing conditions are likely to remain fragile.”

Also from released, capital spending rose 4.3% in Q1, versus expectation of -4.2% decline.

Australia AiG PMI rose to 41.6, but exports dropped to record low

Australian AiG Performance of Manufacturing Index rose to 41.6 in May, up from 35.8. The manufacturing sector still contracted in the month, but at a slow pace. Production improved by 7.1pts to 42.4. Employment rose 6.4 pts to 40.7. New orders rose just 2.4 to 35.1. However, exports index dropped -11.5 pts to 31.1, hitting a new record low.

AIG noted: Exporters noted that many overseas markets have essentially shut down. They also noted higher prices for air freight into international markets that are still open to them. … Many manufacturers reported that orders from their regular customers have been delayed or cancelled altogether because of the pandemic.”

Also released TD securities inflation dropped -1.2% mom in May, down form -0.1% mom.

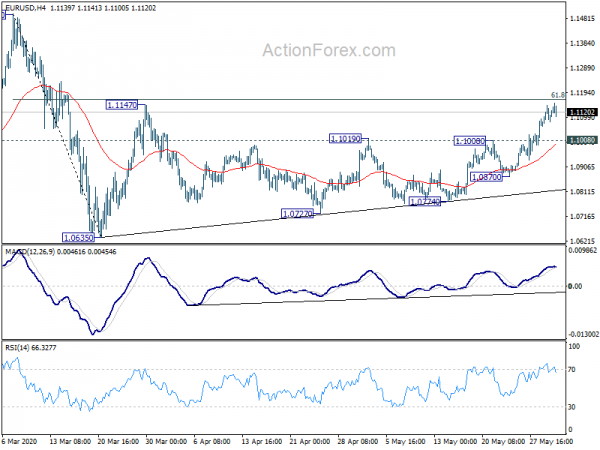

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1070; (P) 1.1108; (R1) 1.1145; More…

Intraday bias in EUR/USD remains mildly on the upside at this point. Price actions from 1.0635 are seen as corrective pattern. Upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, below 1.1008 resistance turned support will turn intraday bias to the downside for 1.0870 support. However, sustained break of 1.1167 will pave the way to 1.1496 key resistance next.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:00 | CNY | Manufacturing PMI May | 50.6 | 51.1 | 50.8 | |

| 1:00 | CNY | Non-Manufacturing PMI May | 53.6 | 53.5 | 53.2 | |

| 22:30 | AUD | AiG Performance of Mfg Index May | 41.6 | 35.8 | ||

| 23:50 | JPY | Capital Spending Q1 | 4.30% | -4.20% | -3.50% | |

| 0:30 | JPY | Manufacturing PMI May F | 38.4 | 38.4 | 38.4 | |

| 1:00 | AUD | TD Securities Inflation M/M May | -1.20% | -0.10% | ||

| 1:45 | CNY | Caixin Manufacturing PMI May | 50.7 | 49.6 | 49.4 | |

| 7:45 | EUR | Italy Manufacturing PMI May | 45.4 | 35.5 | 31.1 | |

| 7:50 | EUR | France Manufacturing PMI May F | 40.6 | 40.3 | 40.3 | |

| 7:55 | EUR | Germany Manufacturing PMI May F | 36.6 | 36.8 | 36.8 | |

| 8:00 | EUR | Eurozone Manufacturing PMI May F | 39.4 | 39.5 | 39.5 | |

| 8:30 | GBP | Manufacturing PMI May | 40.7 | 40.7 | 40.6 | |

| 13:30 | CAD | Manufacturing PMI May | 33 | |||

| 13:45 | USD | Manufacturing PMI May F | 39.8 | 39.8 | ||

| 14:00 | USD | ISM Manufacturing PMI May | 42.5 | 41.5 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid May | 33.3 | 35.3 | ||

| 14:00 | USD | ISM Manufacturing Employment Index May | 34.1 | 27.5 | ||

| 14:00 | USD | Construction Spending M/M Apr | -5.30% | 0.90% |