Dollar remains generally weak in Asian session, with notable selloff against Yen too. Markets generally turned cautious as US President Donald Trump is set to announce his new China policies on Friday. This is in response to China’s passing of national security law to forcibly impose on Hong Kong. With that Secretary of State Mike Pompeo certified to the US Congress that Hong Kong has effectively lost its autonomy and no longer warrants special treatment by the US. Trump is expected to announce a range of penalties but the scope is unclear for now.

Staying in the currency markets, Yen is currently the strongest one for today, followed by Euro. New Zealand Dollar is the weakest, followed by Dollar and then Canadian. For the week, Dollar is the weakest one, followed by Yen. Kiwi is the strongest followed by Euro. Judging from the picture, Euro might extend the “New Generation EU” triggered rally to close the week strongly. Yen has a possibility to turn around and end the week mixed if markets turn more risk-off today.

In Asia, currently, Nikkei is down -0.35%. Hong Kong HSI is down -0.71%. China Shanghai SSE is up 0.01%. Singapore Strait Times is down -0.40%. Japan 10-year JGB yield is up 0.0030 at 0.003. Overnight, DOW dropped -0.58%. S&P 500 dropped -0.21%. NASDAQ dropped -0.46%. 10-year yield rose 0.025 to 0.705.

Japan industrial production plunged -9.1% in April, auto sector particularly severe

Japan’s industrial production plunged -9.1% mom in April, even worse than expectation of -5.1% mom. That’s the biggest decline since comparable data became available back in 2013. “Conditions among manufacturers particularly in the auto sector are severe, but production has already restarted in China and I think that they will be resumed in the United States and Europe as well,” said Economy Minister Yasutoshi Nishimura after the release of the data.

Also from Japan, unemployment rate edged up by 0.1% to 2.6% in April, better than expectation of 2.7%. Retail sales dropped -13.7% yoy, worse than expectation of -11.5% yoy. Housing starts dropped -12.9% yoy versus expectation of -12.0% yoy. On the other hand, consumer confidence rose to 24.0, up form 21.6 and beat expectation of 19.2. Tokyo CPI core turned positive to 0.2% yoy in May, up from -0.1% yoy.

New Zealand consumer confidence improved to 97.3, success in fighting coronavirus

New Zealand ANZ Consumer Confidence rebounded by 12pts to 97.3 in May, but remained at “very subdued levels”. Consumers’ perceptions regarding next year’s economic outlook lifted 10 pts -46, still at very low level.

ANZ said: We absolutely should celebrate our success in beating back COVID-19, but the wreckage lies all around us. The loss of jobs in international tourism in particular is a hole that won’t be filled easily or quickly. We see elevated unemployment affecting household sentiment and spending for a long time yet.”

The government relaxed the coronavirus restrictions further today, allowing gatherings of up to 100 people. Finance Minister Grant Robertson said New Zealand “now has some of the most relaxed settings in the world. Because of our success in fighting this virus, our public health efforts to go hard and go early have allowed us to open up our economy much quicker than many other countries,” he said.”

Fed Williams: Negative rates don’t make sense given the situation

New York Fed President John Williams dismissed the idea of negative rates again and said “we have other tools that I think are more effective and more powerful to stimulate the economy”. He added, “I don’t think negative rates is something that makes sense given the situation we’re in because we have these other tools that can be used,” referring to the low interest rates, forward guidance and the balance sheet. Regarding the economy, “over time, the biggest question mark is how the consumer is going to behave,” Williams said. “How long will people take to really want to take advantage of tourism and other things.”

Separately, Dallas Fed President Robert Kaplan said he expected growth in H2 and 2021. His forecasts are based on assumption that consumers would travel, eat out and broadly re-engage in the economy again. But risks are to the downside if the US doesn’t ramp up coronavirus testing. His baseline is that unemployment rate would fall to 10-11% by year-end and dip further to below 7% by end of 2021.

Looking ahead

The economic calendar is rather busy today. Eurozone CPI will be a major focus in European session. Eurozone M3, German import price and retail sales, France GDP and Swiss KOF will also be featured.

Later in the day, US personal income and spending will be a focus, together with trade balance, Chicago PMI and wholesale inventories. Canada will also release GDP, IPPI and RMPI.

USD/JPY Daily Outlook

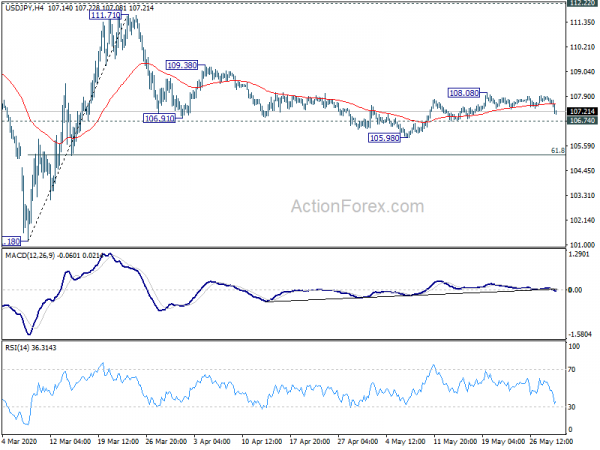

Daily Pivots: (S1) 107.50; (P) 107.70; (R1) 107.82; More..

USD/JPY drops notably today but stays above 106.74 support so far. Intraday bias remains neutral first and outlook is unchanged. . We’re favoring the case that corrective fall from 111.71 has already completed at 105.98. Break of 108.08 will turn bias to the upside for 109.38 resistance. However, break of 106.74 support will dampen our bullish view and turn bias to the downside for 105.98 instead.

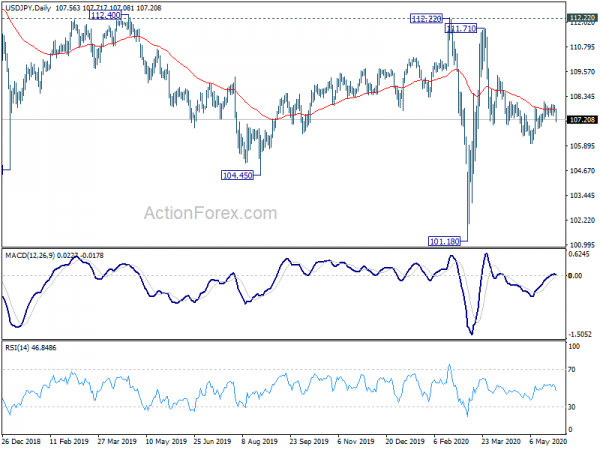

In the bigger picture, at this point, whole decline from 118.65 (Dec 2016) continues to display a corrective look, with well channeling. There is no clear sign of completion yet. Break of 101.18 will target 98.97 (2016 low). Meanwhile, sustained break of 112.22 should confirm completion of the decline and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y May | 0.20% | -0.20% | -0.10% | |

| 23:30 | JPY | Unemployment Rate Apr | 2.60% | 2.70% | 2.50% | |

| 23:50 | JPY | Industrial Production M/M Apr P | -9.10% | -5.10% | -3.70% | |

| 23:50 | JPY | Retail Trade Y/Y Apr | -13.70% | -11.50% | -4.70% | |

| 1:30 | AUD | Private Sector Credit M/M Apr | 0.00% | 0.60% | 1.10% | |

| 5:00 | JPY | Housing Starts Y/Y Apr | -12.90% | -16.00% | -7.60% | |

| 5:00 | JPY | Consumer Confidence Index May | 24 | 19.2 | 21.6 | |

| 6:00 | EUR | Germany Import Price Index M/M Apr | -1.50% | -3.50% | ||

| 6:00 | EUR | Germany Retail Sales M/M Apr | -11.00% | -5.60% | ||

| 6:45 | EUR | France GDP Q/Q Q1 | -5.80% | -5.80% | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Apr | 7.60% | 7.50% | ||

| 8:00 | CHF | KOF Leading Indicator May | 70.2 | 63.5 | ||

| 9:00 | EUR | Eurozone CPI Y/Y May P | 0.20% | 0.30% | ||

| 9:00 | EUR | Eurozone CPI – Core Y/Y May P | 0.90% | 0.90% | ||

| 12:30 | CAD | Raw Material Price Index Apr | -23.90% | -15.60% | ||

| 12:30 | CAD | Industrial Product Price M/M Apr | -2.00% | -0.90% | ||

| 12:30 | CAD | GDP Annualized Q/Q Q1 | 0.30% | |||

| 12:30 | CAD | GDP M/M Mar | -9.00% | 0.00% | ||

| 12:30 | USD | Personal Income M/M Apr | -7.00% | -2.00% | ||

| 12:30 | USD | Personal Spending Apr | -12.60% | -7.50% | ||

| 12:30 | USD | PCE Price Index M/M Apr | -0.30% | |||

| 12:30 | USD | PCE Price Index Y/Y Apr | 1.30% | |||

| 12:30 | USD | Core PCE Price Index M/M Apr | -0.10% | |||

| 12:30 | USD | Core PCE Price Index Y/Y Apr | 1.70% | |||

| 12:30 | USD | Wholesale Inventories Apr P | -0.80% | |||

| 12:30 | USD | Goods Trade Balance (USD) Apr | -64.1B | -64.2B | ||

| 13:45 | USD | Chicago PMI May | 40 | 35.4 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index May F | 73.7 | 73.7 |