The markets remain generally steady today, with UK and US markets on holiday. Sterling is mildly higher, followed by commodity currencies. On the other hand, Yen, Dollar and Euro are the relatively weaker ones. But after all, major pairs and crosses are stuck inside Friday’s range. Investors would probably need to wait until tomorrow before taking a direction.

In Europe, currently, DAX is up 2.40%. CAC is up 1.67%. German 10-year yield is up -0.0152 at -0.495. UK is on holiday. Earlier in Asia, Nikkei rose 1.73%. Hong Kong HSI reversed earlier loss and closed up 0.10%. China Shanghai SSE rose 0.15%. Singapore was on holiday. Japan 10-year JGB yield rose 0.0102 to 0.004.

Germany Ifo business climate recovered to 79.5, gradual lockdown easing offers a glimmer of hope

Germany ifo Business Climate recovered to 79.5 in May, up from 74.2, slightly above expectation of 78.8. Expectations gauge also jumped to 80.1, up from 69.4, beat expectation of 75.0. But Current Assessment gauge dropped to 78.9, down from 79.4, missed expectation of 81.9.

Looking at some details, all sector indexes improved but stayed negative. Manufacturing index rose fro m-44.5 to -36.4 .Service index rose from -34.2 to -21.0. Trade index rose from -48.4 to -30.5. Contraction index also rose fro -17.7 to -12.0.

Ifo President Clemens Fuest said: “Even though companies once again assessed their current situation as slightly worse, their expectations for the coming months improved considerably. Nevertheless, many companies are still pessimistic about their business. The gradual easing of the lockdown offers a glimmer of hope.”

German Q1 GDP contraction finalized at -2.2%

Germany’s GDP contraction was finalized at -2.2% qoq in Q1, unrevised from initial estimate. That was the largest decline since the global financial and economic crisis of 2008/2009. It’s also the second worst since reunification.

Looking at some details, consumption expenditure dropped -1.0% yoy. Gross capital formation dropped -1.6% yoy. Domestic uses dropped -1.1% yoy. Exports dropped -3.2% yoy. Imports dropped -1.7% yoy.

Australia goods exports dropped -12%, imports dropped -5% in Apr

In April’s preliminary data, Australia’s goods exports dropped -12% mom from March’s record high of AUD 35.8B to AUD 31.4B. The contraction was driven by exports of non-rural goods (down -8% mom) and non-monetary gold (down -47% mom).

Imports dropped -5% mom to AUD 23.1B. The decrease in imports were driven by intermediate and other goods (down -6% mom), non-monetary gold (down -42% mom) and capital goods (down -7% mom).

GBP/USD Mid-Day Outlook

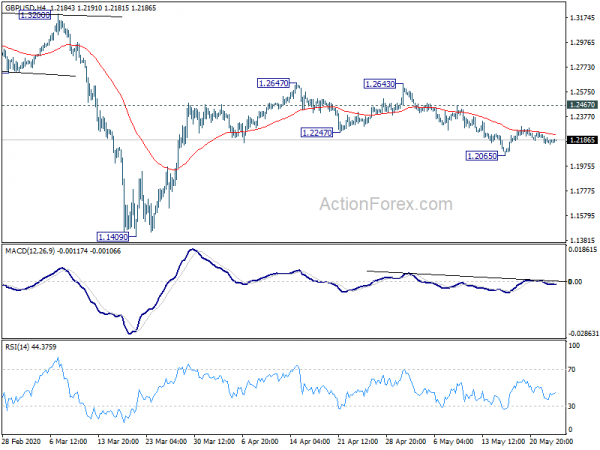

Daily Pivots: (S1) 1.2142; (P) 1.2188; (R1) 1.2214; More….

GBP/USD is staying in consolidation above 1.2065 and intraday bias remains neutral. Outlook remains bearish as long as 1.2467 resistance holds. Rebound form 1.1409 should have completed. On the downside, break of 1.2065 will pave the way to retest 1.1409 low. Nevertheless, on the upside, break of 1.2467 will turn bias to the upside for 1.2647 resistance.

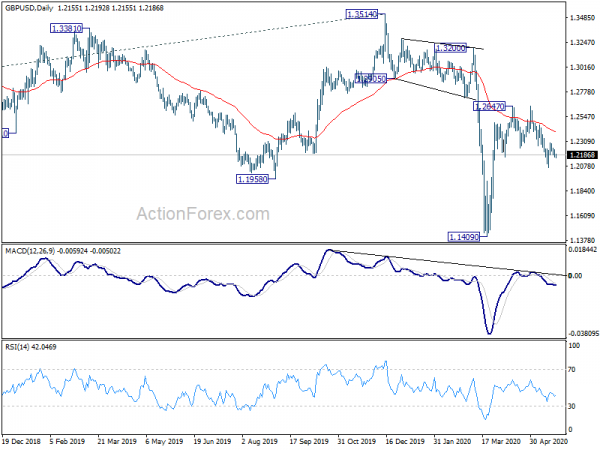

In the bigger picture, while the rebound from 1.1409 is strong, there is no indication of trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. Next medium term target will be 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273. In any case, outlook will remain bearish as long as 1.3514 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | Germany GDP Q/Q Q1 F | -2.20% | -2.20% | -2.20% | |

| 08:00 | EUR | Germany IFO – Business Climate May | 79.5 | 78.8 | 74.3 | 74.2 |

| 08:00 | EUR | Germany IFO – Current Assessment May | 78.9 | 81.9 | 79.5 | 79.4 |

| 08:00 | EUR | Germany IFO – Expectations May | 80.1 | 75 | 69.4 |