Yen and Dollar remains the strongest ones for today while commodity currencies are weakest, led by Aussie. There was no follow through buying in Dollar and Yen beyond Asian session. The panic selloff in Hong Kong stocks didn’t spillover to other markets and even US futures are pointing to slightly higher on. US response to China’s move to impose its own national security laws on the highly autonomous Hong Kong was relatively mild. Secretary of State Mike Pompeo just issued a statement condemning the “disastrous proposal:, and urged the Chinese Communist Party to “abide by its international obligations, and respect Hong Kong’s high degree of autonomy, democratic institutions, and civil liberties, which are key to preserving its special status under U.S. law.”

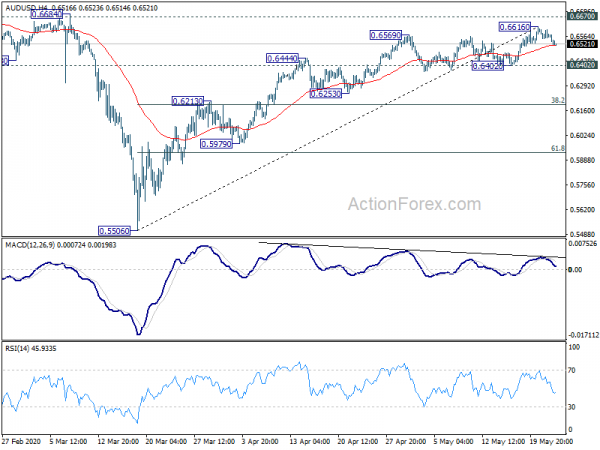

Technically, AUD/USD is still holding on to 4 hour 55 EMA (now at 0.6513) and thus maintaining near term bullishness. Sustained break of the EMA, will firstly indicate short term topping and turn focus to 0.6402 support for confirmation. 1.4140 resistance in USD/CAD will be a level to watch in case of resurgence of risk aversion in risk aversion.

In Europe, currently, FTSE is down -0.34%. DAX is up 0.50%. CAC is up 0.48%. German 10-year yield is up 0.009 at -0.484. Earlier in Asia, Nikkei dropped -0.80%. Hong Kong HSI dropped -5.56%. China Shanghai SSE dropped -1.89%. Singapore Strait Times dropped -2.17%. Japan 10-year JGB yield dropped -0.0086 to -0.007.

Canada retail sales dropped record -10% in March

Canada retail sales dropped -10.0% to CAD 47.1B in March, slightly better than expectation of -10.3% mom. That’s also the first decline in five months, and the largest on record. Ex-auto sales, on the other hand, -0.4% mom.

StatCAN said that about 40% of retailers closed their doors during March. The average length of shutdowns was five business days. In the clothing and clothing accessories stores subsector, 91% of retailers were closed in March for an average of 13 days. Sales were down in 6 of 11 subsectors, representing 39.2% of retail trade.

ECB fully prepared to expand PEPP in June

Accounts of April 29-30 ECB monetary policy meeting indicated that it’s ready to expanding easing measures in the upcoming June meeting. The Governing Council was “fully prepared to increase the size of the PEPP and adjust its composition, and potentially its other instruments, if, in the light of information that became available before its June meeting, it judged that the scale of the stimulus was falling short of what was needed.”

The minutes also said that it’s Eurozone economy was “heading towards a decline in activity that was unprecedented in recent history.” June’s Eurosystem staff economic projections would be “revised down significantly” compared with March ECB staff projections. Present situations was also “characterised by Knightian or ‘radical’ uncertainty, implying unquantifiable risks.”

Also, it’s generally considered that, of the three coronavirus scenarios, the “mild” scenario was probably already too optimistic. But it’s “too early” to conclude that the “severe” scenario” was the “most likely. Still a “swift V-shaped recovery could probably already be ruled out at this stage.”

BoE Ramsden: Certainly not rule out expanding asset purchase next week

BoE Deputy Governor Dave Ramsden said he’s “certainly not going to rule out” an increase in the asset purchase program at the meeting next week. “It’s quite possible that we could do more at that meeting or at subsequent meetings. But we will make that decision at the time,” he said.

He added that BoE still had “quite a lot of headroom” in terms of gilt purchases, and “we have the potential to flex any purchases program.

On the topic of negative rates, he said “we are keeping out whole tool-set under active review”. It was “perfectly reasonable to have an open mind on negative rates,” he said.

Released from UK, retail sales dropped -18.1% mom, -22.6% yoy in April. Ex-fuel sales dropped -15.2% mom, -18.4% yoy. Public sector net borrowing surged to GBP 61.4B, up from GBP 14.0.

BoJ launches new program to support SMEs, keeps interest rate and unlimited QE

At a unscheduled monetary policy meeting today, BoJ announced to introduce a new Fund-Provisioning Measure to support financing of small and medium-sized businesses. With the new facility, zero-interest loans are offered to financial institutions that boost lending to SMEs by tapping government guarantee programs. It also offers to pay 0.1% interest to lenders that boost such loans.

At the same meeting, BoJ also kept monetary policy unchanged. Under the yield curve control framework, short-term policy rate is held at -0.1%. BoJ will also purchase JGBs, without upper limit” to keep 10-year yield at around 0%. Kataoka Goushi dissented the decision and pushed for lowering short- and long-term interest rates further, in response to a possible increase in downward pressure on prices.

Japan CPI core turned negative for the first time since 2016

Japan slipped back into deflation as data released today show. All item CPI slowed to 0.1% yoy in April, down form 0.4% yoy. CPI core (all-item less fresh food), dropped to -0.2% yoy, down from 0.4% yoy. That’s the first negative core CPI reading since December 2016. CPI core-core (all-item less energy, fresh food) slowed to 0.2%, down from 0.6% mom.

The data suggests clear downward pressure on prices due to coronavirus containment pressure. Also, core CPI could head deeper into negative territory as services and energy inflation wane ahead.

RBNZ Orr: QE program highly effective, a very simple story to continue

RBNZ Governor Adrian Orr said the QE program had been “highly effective” in lowering wholesale interest rates. Given the nation of the coronavirus shocks, the central bank had “plenty of assets to purchase while maintaining our operational independence”.If the program remained effective, “then ongoing large-scale asset purchases would be a very simple story, subject to the markets functioning well”.

He also said a negative OCR could be “efficient” and “effective”, but there was a “limit” to what it could do. FX intervention might lead to currency depreciation “but that could be very short-lived”. Also, the foreign exchange markets are “very large markets”, he added. “You don’t want to stand in front of them. You want to work with them.”

Separately released, New Zealand retail sales dropped -0.7% qoq in Q1, better than expectation of -1.5% qoq. Ex-auto sales rose 0.6% qoq.

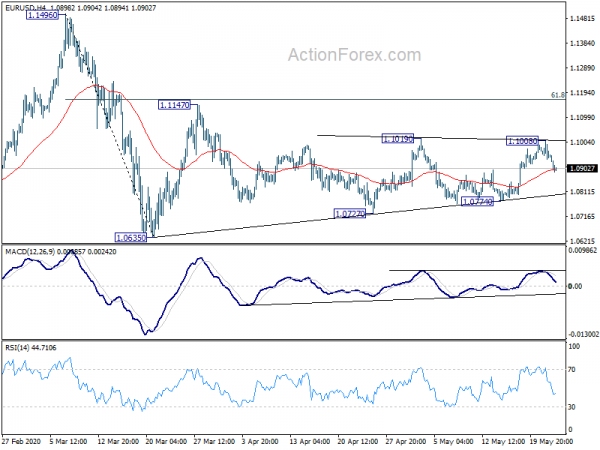

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0922; (P) 1.0965; (R1) 1.0993; More…

EUR/USD is staying in range of 1.0774/1008 and intraday bias remains neutral at this point. Outlook is unchanged that corrective pattern from 1.0635 is in place. On the upside, above 1.1008 will target 1.1147 resistance. Upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, break of 1.0774 should turn bias back to the downside for retesting 1.0635 low.

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Retail Sales Q/Q Q1 | -0.70% | -1.50% | 0.70% | 0.00% |

| 22:45 | NZD | Retail Sales ex Autos Q/Q Q1 | 0.60% | 0.50% | -0.10% | |

| 23:30 | JPY | National CPI Core Y/Y Apr | -0.20% | -0.10% | 0.40% | |

| 01:00 | JPY | BOJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 06:00 | GBP | Retail Sales M/M Apr | -18.10% | -16.00% | -5.10% | |

| 06:00 | GBP | Retail Sales Y/Y Apr | -22.60% | -5.80% | ||

| 06:00 | GBP | Retail Sales ex-Fuel M/M Apr | -15.20% | -15.00% | -3.70% | |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Apr | -18.40% | -18.60% | -4.10% | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Apr | 61.4B | 30.7B | 2.3B | 14.0B |

| 12:30 | CAD | Retail Sales M/M Mar | -10.00% | -10.30% | 0.30% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Mar | -0.40% | -4.80% | 0.00% |