Sterling surges notably today after UK announced new tariff regime after Brexit, allowing 60% of trade to be tariff free. In the background, markets are supported by solid risk appetite, on coronavirus vaccine optimism. New Zealand and Australian Dollar are both strong together with the Pound. On the other hand, Yen, Swiss Franc and Dollar are staying under some selling pressure. Focus will turn to Fed Chair Jerome Powell’s testimony. But he’s unlikely to provide any inspiration to the greenback.

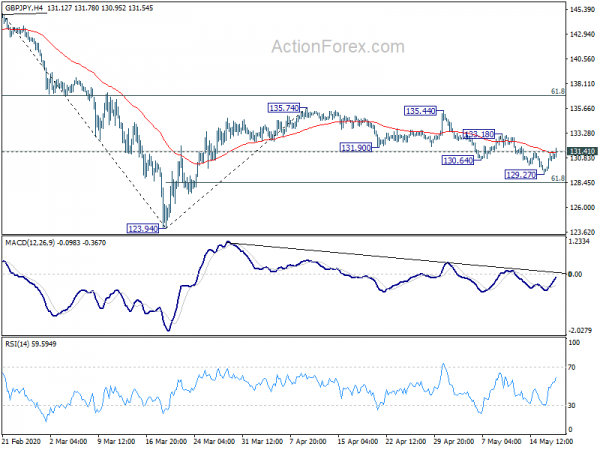

Technically, GBP/JPY’s break of 131.41 minor resistance, as well as the 4 hour 55 EMA, suggests that a temporary low is at least formed at 129.27. Focus will be back on 133.18 resistance. Break there will invalidate our bearish view and argue that whole rebound from 123.94 is not finished, Further rise should be seen then to 135.74. AUD/USD is now eyeing 0.6569 resistance with today’s rally. Break will resume whole rise from 0.5506 to 0.6670 key resistance level.

In Asia, Nikkei closed up 1.49%. Hong Kong HSI is up 2.09%. China Shanghai SSE is up 0.70%. Singapore Strait Times is up 2.05%. Japan 10-year JGB yield is up 0.0108 at 0.001. Overnight, DOW rose 3.85%. S&P 500 rose 3.15%. NASDAQ rose 2.44%. 10-year yield rose 0.104 to 0.744.

60% trade will come into UK tariff free with new UKGT regime

UK announced a new post-Brexit MFN tariff regime today, called the UK Global Tariff (UKGT). This will replace the EU’s Common External Tariff starting on January 1, 2021, at the end of the Brexit Transition Period.

Under the new regime, tariffs on a wide range of products will be eliminated. 60% of trade will come into UK tariff free on WTO terms, of through existing preferential access. Successful FTS negotiations will increase the total. Tariffs will be maintained on agricultural products such as lamb, beef and poultry. Car tariffs will be maintained at 10%.

“Our new Global Tariff will benefit UK consumers and households by cutting red tape and reducing the cost of thousands of everyday products,” International Trade Secretary Liz Truss said.

UK claimant counts jumped 8655k to 2.1m in April

In April, UK claimant count, a measure of number of people claiming unemployment benefits, jumped 865.5k to 2.097m. The range of forecasts for this data was wide, from 60k change to as many as 1.5m. The released data was slightly on the high side. Claimant count rate rose to 5.8%, highest in over two decades.

In the three month to March, unemployment rate unexpectedly dropped to 3.9%, down from 4.0%, better than expectation of 4.4%. Average earnings including bonus slowed to 2.4% 3moy, below expectation of 2.7% 3moy. Average earnings excluding bonus slowed to 2.7% 3moy, matched expectations.

RBA minutes: Best course of action was to maintain currency policy setting

In the minutes of May 5 meeting, RBA said the labor market s was expected to have “ongoing spare capacity”. Inflation was expected to stay below 2% “over the following few years. The continue to keep funding costs low and credits available to households and businesses. The “best course of action” was to maintain the currency policy setting, and monitor economic and financial outcomes.

RBA added that while outlook remained uncertain, if coronavirus infection rates continued to decline and restrictions were eased, “recovery could be expected to start later in 2020”. At the same time, the “substantial, coordinated and unprecedented fiscal and monetary response” was “softening” the “very significant economic contraction”.

Coronavirus job losses in Australia slowed

Australia’s Bureau of Statistics said today that coronavirus job losses has slowed down between mid-April and early May. Overall between March 14 and May 2, payroll jobs dropped by -7.3% and total wages paid dropped -5.4%. In the week between April 25 and May 2, jobs decreased by -1.1% only while wages even rose 0.9%.

Head of Labour Statistics at the ABS, Bjorn Jarvis, said: “The latest data shows a further slowing in the fall in COVID-19 job losses between mid-April and early May.” In addition to the fall in total jobs slowing, some industries were now showing a reduced impact in the most recent weeks.

RBNZ Bascand: We can re-evaluate if more stimulus is needed in three months time

RBNZ Deputy Governor Geoff Bascand said the central bank will know more about how the coronavirus shock is playing out in three months. And, “we can re-evaluate if we need to do more or take the foot off the pedal a little bit in three months’ time.”

He noted that negative interest rates were one of many monetary policy options available. “For now, we think the best thing we should be doing is large scale asset purchases and we’ve expanded that. We could expand it further if needed,” he added.

Separately, Assistant Governor Christian Hawkesby said the central bank is open to using all tools including buying foreign bonds. He added RBNZ’s economic projections assumed that New Zealand Dollar will depreciate.

Rleased from New Zealand, PPI inputs dropped -0.3% qoq in Q1. PPI output rose 0.1% qoq.

Powell: Fed committed to use full range of tools as part of broader public-sector response to coronavirus

Fed Chair Jerome Powell will testify to the Congress on coronavirus and CARES act today. In pre-released opening remarks, He reiterated that Fed is “committed to using our full range of tools to support the economy”. Fed’s actions are ” only a part of a broader public-sector response”.

After lowering interest rate to near zero in March, the board expects to ” maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.”

Looking ahead

Fed Chair Jerome Powell’s Q&A in the testimony is the major focus of the day. But he’s unlikely to reveal anything groundbreaking. Germany will release ZEW economic sentiment. US will release housing starts and building permits.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2058; (P) 1.2148; (R1) 1.2194; More….

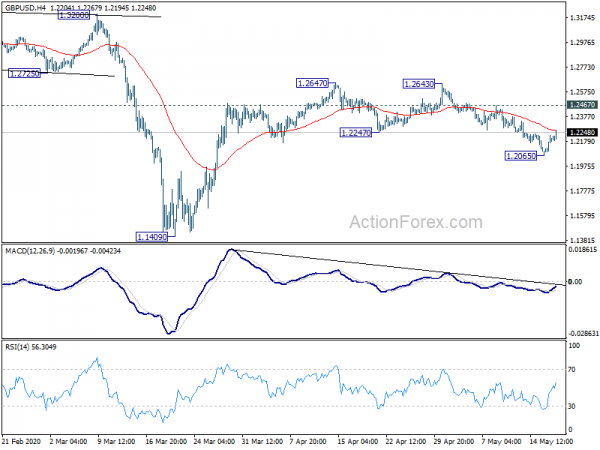

GBP/USD’s recovery from 1.2065 continues today and is now pressing 4 hour 55 EMA . Though, as it’s staying below 1.2467 minor resistance, intraday bias remains neutral first. We’ll holding on to the view that corrective rise from 1.1409 should have completed. On the downside, below 1.2065 will target a test on 1.1409 low. However, on the upside, break of 1.2467 will turn bias to the upside for 1.2647 resistance.

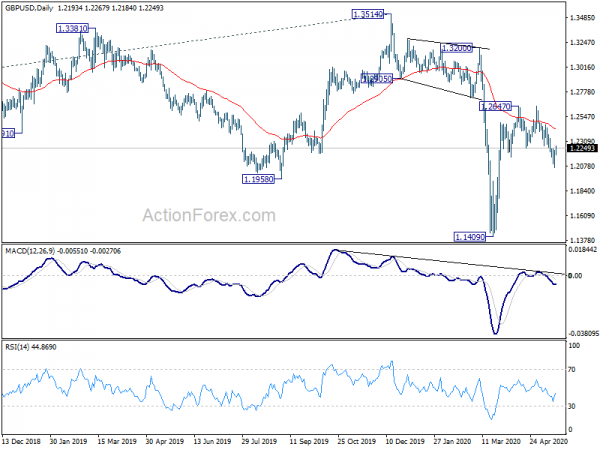

In the bigger picture, while the rebound from 1.1409 is strong, there is no indication of trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. Next medium term target will be 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273. In any case, outlook will remain bearish as long as 1.3514 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q1 | -0.30% | 0.10% | 0.30% | |

| 22:45 | NZD | PPI Output Q/Q Q1 | 0.10% | 0.40% | ||

| 1:30 | AUD | RBA Minutes | ||||

| 4:30 | JPY | Industrial Production M/M Mar F | -3.70% | -3.70% | -3.70% | |

| 6:00 | GBP | ILO Unemployment Rate 3M Mar | 3.90% | 4.40% | 4.00% | |

| 6:00 | GBP | Average Earnings Including Bonus 3M/Y Mar | 2.40% | 2.70% | 2.80% | |

| 6:00 | GBP | Average Earnings Excluding Bonus 3M/Y Mar | 2.70% | 2.70% | 2.90% | |

| 6:00 | GBP | Claimant Count Change Apr | 856.5K | 12.1K | ||

| 6:00 | GBP | Claimant Count Rate Apr | 3.50% | |||

| 9:00 | EUR | Germany ZEW Economic Sentiment May | 33.5 | 28.2 | ||

| 9:00 | EUR | Germany ZEW Current Situation May | -87.8 | -91.5 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment May | 27.4 | 25.2 | ||

| 12:30 | USD | Building Permits Apr | 1.00M | 1.35M | ||

| 12:30 | USD | Housing Starts Apr | 0.95M | 1.22M | ||

| 14:00 | USD | Fed’s Chair Powell testifies |