US stocks ignored policy uncertainty surrounding President Donal Trump and surged to record highs overnight. S&P 500 jumped to record high at 2477.13, up 0.29%, on strong earnings. NASDAQ also rose 0.02% to record at 6412.17. DOW jumped 0.47% to close at 21613.43, just shy of record. Surging oil price, which saw WTI reaching as high as 48.66, is another factor boosting sentiments. Meanwhile, US yields also staged a strong comeback just ahead of FOMC rate decision. 10 year yield closed up 0.072 to 2.326, scoring the largest jump in nearly 4 months. In the currency markets, Canadian Dollar is trading as the strongest major currency for the week while Yen and Swiss Franc are the weakest. Dollar and Sterling are mixed as markets await FOMC meeting and UK Q2 GDP.

The jump in treasury yield on inflation expectations is worth a note. It started with record German Ifo business sentiment that pushed 10 year bund yields up to 0.566. On the background, there was the strong rally in oil and industrial metal like copper. TNX is having its focus back on 2.396. Break there will extend the rebound from 2.103 to 2.621 high. Such development will be Yen negative.

Markets await FOMC and UK GDP

FOMC policy decision and statement will be the main focus today. The Fed would leave the policy rate unchanged but the key is whether the Fed would turn more dovish on the inflation outlook which might affect the future normalization path. The market consensus remains that there would be one more rate hike in December, which was signalled in the June dot plot. However, more and more voices of doubt about the implementation due to recent disappointment on the data front. Another focus is whether the Fed would announce the kickoff period of the balance sheet reduction plan.

Meanwhile, earlier in the day, Swiss will release UBS consumption. UK will release Q2 GDP and BBA mortgage approvals. US will also release new home sales.

Oil surged on production cut

Oil prices rallied on hopes that output surplus would come under control. Saudi Arabia has planned to cut exports to 6.6M bpd, down 1M bpd from a year ago, in August. The pledge was followed by UAE with its energy minister Mohamed al-Mazrouei announcing that state-owned Abu Dhabi National Oil Company will cut its crude exports by about 10% in September. While Nigeria and Libya are still exempted from the output cut deal, the two countries promised to limit outputs after which have reached a certain level.

IMF urged ECB to maintain stimulus

IMF said in a report published yesterday that "monetary policy should remain firmly accommodative until there is a sustained rise in the inflation path toward the ECB’s price stability objective." And, it also emphasized that some countries in the region need to tolerate inflation above target for a "prolonged period" to life the average inflation among member states. The IMF acknowledged that recovery in Eurozone is "firming and becoming broad based". But it also warned that "the improving near-term outlook is clouded by significant downside risks, especially in the medium and long term, amidst thin policy buffers." Also, "some high-debt countries could experience rising borrowing costs in the face of tighter global financial conditions or reduced monetary accommodation."

BoJ Nakaso: Improving output gap will lift prices

BoJ Deputy Governor Hiroshi Nakaso said that he’s still confident that inflation will reach the 2% target around fiscal 2019. And, BoJ should stick with the current stimulus program. He noted that for now, companies have been trying to "absorb higher labour costs by revising their business processes". In such a way, higher labour costs are not being passed on to consumers. However, he emphasized that "the output gap is clearly improving, so companies will become more aggressive in setting wages and prices."

Aussie lower after CPI

Australian Dollar weakens mildly today after lower than expected inflation data. CPI rose 0.2% qoq in Q2, below consensus of 0.4% qoq. Annually, CPI slowed to 1.9% yoy, down from 2.1% yoy and missed expectation of 2.2% yoy. RBA trimmed mean CPI slowed to 1.8% yoy, down from 1.9% yoy. RBA weighted median CPI, however, rose to 1.8% yoy, up from 1.7% yoy. RBA Governor Philip Lowe said today that tightening in global central banks "has no automatic implications for monetary policy in Australia". And RBA "didn’t" and "don’t need to" move in "lockstep" with others.

RBNZ McDermott stays dovish

RBNZ Assistant Governor John McDermott has spoken about the monetary policy outlook, with a dovish stance. He suggested that current estimates the neutral interest rate is around 3.5 % with potential output growth at 2.9% and core inflation at 1.4%. He added that the neutral rate has been slowly falling for some time, due to lower potential output growth. The impact on kiwi was rather muted. NZDUSD continued its sideways trading around a 10-month high. released from New Zealand, trade surplus widened to NZD 242m in June.

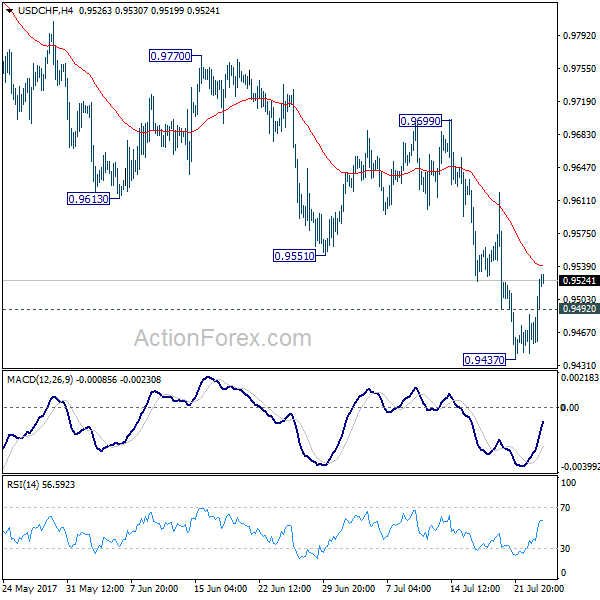

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9475; (P) 0.9500; (R1) 0.9549; More…

USD/CHF’s rebound indicates temporary bottoming at 0.9437 and intraday bias is turned neutral first. We remain cautious on strong support from 0.9443 key support to bring reversal. But break of 0.9699 is needed to confirm Otherwise, another fall will be in favor. Sustained trading below 0.9443 will extend the down trend from 1.0342 to 161.8% projection of 1.0342 to 0.9860 from 1.0099 at 0.9319.

In the bigger picture, focus is now back 0.9443 key support level. Sustained break there indicate underlying bearish momentum and would target 0.9 handle and possibly below. Meanwhile, strong rebound from current level and break 0.9699 resistance will extend long term range trading between 0.9443/1.0342.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jun | 242M | 100M | 103M | 130M |

| 23:50 | JPY | Corporate Service Price Y/Y Jun | 0.80% | 0.80% | 0.70% | |

| 1:30 | AUD | CPI Q/Q Q2 | 0.20% | 0.40% | 0.50% | |

| 1:30 | AUD | CPI Y/Y Q2 | 1.90% | 2.20% | 2.10% | |

| 1:30 | AUD | CPI RBA Trimmed Mean Q/Q Q2 | 0.50% | 0.50% | 0.50% | |

| 1:30 | AUD | CPI RBA Trimmed Mean Y/Y Q2 | 1.80% | 1.80% | 1.90% | |

| 1:30 | AUD | CPI RBA Weighted Median Q/Q Q2 | 0.50% | 0.50% | 0.40% | |

| 1:30 | AUD | CPI RBA Weighted Median Y/Y Q2 | 1.80% | 1.70% | 1.70% | |

| 6:00 | CHF | UBS Consumption Indicator Jun | 1.39 | |||

| 8:30 | GBP | BBA Mortgage Approvals Jun | 39.9K | 40.3K | ||

| 8:30 | GBP | GDP Q/Q Q2 A | 0.30% | 0.20% | ||

| 8:30 | GBP | Index of Services 3M/3M May | 0.40% | 0.20% | ||

| 14:00 | USD | New Home Sales Jun | 615K | 610K | ||

| 14:30 | USD | Crude Oil Inventories | -4.7M | |||

| 18:00 | USD | FOMC Rate Decision | 1.25% | 1.25% |