Australian Dollar is leading commodity currencies broadly lower in Asian session today, as markets seem to be rushing to reverse April’s moves. Euro has somewhat taken the lead overnight, pulling Swiss Franc higher too, after initial reactions to non-eventful ECB. Yen is also trading generally lower in relatively quiet markets. With many countries on holidays today, volatility might jump in thin market conditions before weekend.

Technically, EUR/USD’s break strong rally overnight suggests that consolidation pattern from 1.0635 has finally started the third leg. Further rise should be seen through 1.0990 resistance towards 1.1147. Similarly, USD/CHF should be heading back to 0.9592 support and then 0.9502 as correction from 0.9901 extends. Both EUR/AUD and AUD/JPY show that Aussie is being rejected by key resistance levels. 0.6444 support in AUD/USD remains a level to watch. Break will solidify the case of short term topping in Aussie in general.

In Asia, Nikkei is currently down -2.29%. Japan 10-year JGB yield is up 0.0090 at -0.028. Hong Kong, China Singapore are on holiday. Overnight, DOW dropped -1.17%. S&P 500 dropped -0.92%. NASDAQ dropped -0.28%. 10-year yield dropped -0.005 to 0.622.

Japan Nishimura to avoid deflation return as Tokyo core CPI turned negative

Released from Japan, Tokyo all-items CPI slowed to 0.2% in April, down from 0.4% yoy. Core CPI (all items less fresh food) turned negative to -0.1% yoy, down from 0.4% yoy. Core-Core CPI (all items less fresh food and energy) dropped to 0.2% yoy, down from 0.7% yoy.

The capital city reported first decline in core CPI in three years. As an indicator of nationwide inflation trends, it raised concerns that Japan is returning into deflation. But that’s not totally unexpected as BoJ also forecast core inflation to turn negative to -0.7 to -0.3% this fiscal year.

Economy Minister Yasutoshi Nishimura pledged today that “the government will work with the central bank to ensure Japan absolutely does not slip back into deflation”.

Japan PMI manufacturing finalized at 41.9, suggests output dropped -15% annualized

Japan PMI Manufacturing was finalized at 41.9 in April, down from March’s 44.8, hitting an eleven-year low. Markit said plummeting demand led to further sharp production cutbacks. Supply chain disruptions intensified as coronavirus pandemic continued. Manufacturing employment fell at strongest rate since mid-2009.

Joe Hayes, Economist at IHS Markit, said: “Based on comparisons with official statistics, the latest survey data suggest manufacturing output declined by approximately 15% on an annual basis in April… The latest figures show that until we’re past the peak of the COVID-19 pandemic and export demand can begin its slow recovery, a sizeable chunk of Japan’s manufacturing economy is set to remain effectively shut down.”

BoJ minutes: Uncertain whether economy would recover strongly after coronavirus pandemic

In the minutes of BoJ’s March 16 meeting, members agreed there had been “significant uncertainties” over the coronavirus outbreak, “over the size and the persistence” of the economic impact. One member warned that the impact could be “significant and not just temporary”. One member said the downturn could be “serious and prolonged”., and it was “not easy to make up for the lost services consumption”.

Few members also said it’s “uncertain whether the economy would recover strongly after COVID-19 receded”, as economic activity had already shown some weakness due to sales tax hike and natural disasters.

Members “concurred” that downside risks to economic activity and prices “seemed to have been increasing”. They also concurred that outlook for prices was likely to be “somewhat weak for the time being”. But some members said there was a “greater possibility that the momentum toward achieving the price stability target would be lost.”

Australia AiG manufacturing dropped to 35.8 as unusual surge for manufactured food and groceries subsided

Australia AiG Performance of Manufacturing Index dropped sharply by -17.9 pts to 35.8 in April. That’s the largest monthly decline on record, and suggests that manufacturing contracted at its worst pace since April 2009. The sharp positive spike in March was more than reversed “as the unusual surge in demand for manufactured food and groceries subsided”.

Manufacturers cited a range of COVID-19 issues in April, with the most prevalent including: no new sales due to shutdowns; major customers cancelling orders; supply chain problems with inter-state freight movements, and delays; and increased prices for raw materials.

Also from Australia, PPI came in at 0.2% qoq, 1.3% yoy in Q1.

Looking ahead

UK will release PMI manufacturing final, M4 money supply and mortgage approvals. Canada will release PMI manufacturing. Main focus will be on US ISM manufacturing while construction spending will also be released.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6477; (P) 0.6523; (R1) 0.6556; More…

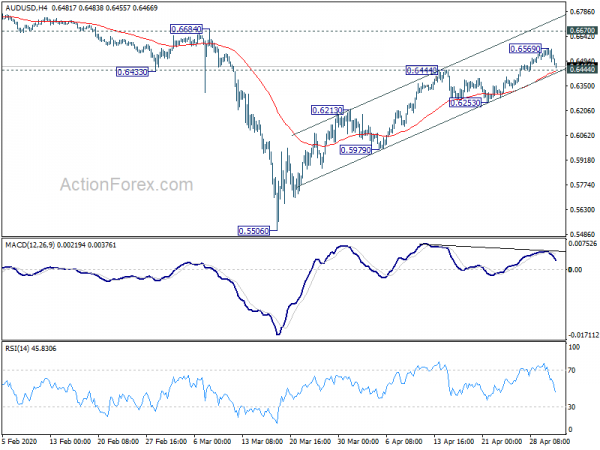

AUD/USD’s retreat from 0.6569 continues today and focus is now on 0.6444 resistance turned support. Sustained break there should confirm short term topping, on bearish divergence in 4 hour MACD. Intraday bias will be turned back to the downside for 0.6253 support first. Further break there will indicate completion of whole rebound from 0.5506 and turn outlook bearish. Though, above 0.6569 will extend the rebound to 0.6670 key resistance.

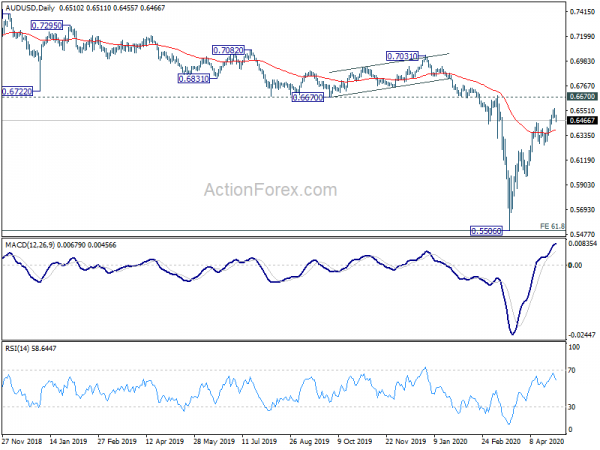

In the bigger picture, there is no clear sign of trend reversal yet. The larger down trend from 1.1079 (2011 high) is still in favor to extend. 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507 is already met. Sustained break there will pave the way to 0.4773 (2001 low). On the upside, however, sustained break of 0.6607 will suggest medium term bottoming and turn focus to 0.7031 resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tokyo CPI Core Y/Y Apr | -0.10% | 0.10% | 0.40% | |

| 00:30 | JPY | Jibun Bank Manufacturing PMI Apr F | 41.9 | 43.7 | 43.7 | |

| 01:30 | AUD | PPI Q/Q Q1 | 0.20% | 0.30% | ||

| 01:30 | AUD | PPI Y/Y Q1 | 1.30% | 1.40% | ||

| 06:30 | AUD | RBA Commodity Index SDR Y/Y Apr | -10.20% | |||

| 08:30 | GBP | Manufacturing PMI Apr F | 32.8 | 32.9 | ||

| 08:30 | GBP | Mortgage Approvals Mar | 59K | 74K | ||

| 08:30 | GBP | M4 Money Supply M/M Mar | 0.20% | 0.30% | ||

| 13:30 | CAD | Manufacturing PMI Apr | 46.1 | |||

| 13:45 | USD | Manufacturing PMI Apr F | 36.9 | 36.9 | ||

| 14:00 | USD | ISM Manufacturing PMI Apr | 36.7 | 49.1 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 30.7 | 37.4 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 43.8 | |||

| 14:00 | USD | Construction Spending M/M Mar | -3.90% | -1.30% |