The currency markets are relatively quiet today, with major pairs bounded inside yesterday’s range. Dollar weakens after poor durable goods orders data, but New Zealand Dollar is even weaker. Euro recovers after yesterday’s selloff, followed by Canadian Dollar ans Swiss Franc. For the week, Aussie is the strongest one, followed by Dollar. Sterling leads European majors as the weakest.

In Europe, currently, FTSE is down -0.65%, DAX is down -0.60%. CAC is down -0.45%. German 10-year yield is down -0.0335 at -0.457. Earlier in Asia, Nikkei dropped -0.86%. Hong Kong HSI dropped -0.61%. China Shanghai SSE dropped -1.06%. Singapore Strait Times dropped -0.95%. Japan 10-year JGB yield dropped -0.0142 to -0.022.

US durable goods orders dropped -14.4%, ex-transport orders dropped -0.2%

US durable goods orders dropped -14.4% mom in March, to USD 213.2B, worse than expectation of -12.0% mom. Ex-transport orders dropped -0.2%, better than expectation of -6.1%. Excluding defense, new orders decreased 15.8%. Transportation equipment, down two of the last three months, led the decrease, USD 35.6B or 41.0% to USD 51.2B.

German Ifo business climate dropped to 74.3, coronavirus crisis striking economy with full fury

Germany Ifo Business Climates dropped to 74.3 in April, down from 85.9, missed expectation of 79.8. That’s the lowest level on record, and the steepest monthly decline. Current Assessment index dropped to 79.5, down form 92.9, missed expectation of 81.0. Expectations index dropped to 69.4, down form 79.5, missed expectation of 75.0.

Manufacturing dropped from -18.7 to -44.4, lowest since March 2009. Services dropped from -7.6 to -34.2, a record low. Trade dropped from -21.0 to -48. Construction dropped from 5.0 to -17.6.

Clemens Fuest, President of the ifo Institute, said, “companies have never been so pessimistic about the coming months. The coronavirus crisis is striking the German economy with full fury.”

EU Barnier: UK cannot impose a short negotiation calendar, but not move

EU chief Brexit negotiator Michel Barnier complained that “the United Kingdom cannot impose this very short calendar for negotiations and at the same time not move, not progress on certain subjects that are important for the European Union.”

At the same time, “we cannot accept selective progress on a limited set of issues only. We need to find solutions on the most difficult topics,” he added. “The UK cannot refuse to extend the transition period and at the same time slow down discussions on important areas.” To be more specific, he said the UK “failed to engage substantially” on issues such as a future trade deal and that “we made no progress on fisheries”.

There will be two more rounds of talks in the week of May 11 and June 1, before a high-level meeting in June to review the negotiation progress. Barnier warned, “we must use these rounds to make real, tangible progress across all areas.”

UK retail sales dropped -5.1% in March, record contraction

In quantity term, UK retail sales dropped sharply by -5.1% mom in March, a record contraction since the series began. Ex-fuel sales dropped -3.7% mom. Over the year, total sales dropped -5.8% yoy while ex-fuel sales dropped -4.1% yoy. In the three months to March, retail sales volume dropped -1.6% 3mo3m. Sales at food stores rose in March, with slight increase in non-store retailing. But non-food stores sales, and fuels recorded steep decline.

UK Gfk consumer confidence unchanged at -34, no guarantee the fall has ended

UK Gfk Consumer Confidence was unchanged at -34 in April, hovering just 5 pts above historical low of -39 seen in July 2008.

Joe Staton, Client Strategy Director says: “Consumer Confidence has stayed steady at the minus -34 points recorded in our first COVID-19 flash of April 6th. It is too early to say whether this has now stabilised after weeks of adjustment to the reality of lockdown life, or whether further falls are to come…

“Overall, there is no guarantee yet that the fall in consumer confidence has ended, and we are only five points away from the record -39 low seen in July 2008.”

Japan CPI core slowed to 0.4%, more downward pressure ahead

Japan’s all-item CPI was unchanged at 0.4% yoy in March, matched expectations. CPI core (ex-fresh food), slowed to 0.4% yoy, down from 0.6% yoy, matched expectations. CPI core-core (ex-fresh food & energy) was unchanged at 0.6% yoy, also matched expectations. Corporate service price slowed to 1.6% yoy, down from 2.1% yoy, missed expectation of 1.7% yoy.

The set of data suggested that underlying inflation in Japan was weakened further by the coronavirus pandemic. More downward pressure would be seen in the trend ahead due to falling oil prices. BoJ is going to meet next week and the central bank would be forced to downgrade both economic and price assessments.

Separately, Finance Minister Taro Aso said today that the Ministry is not discussing to remove the cap on asset purchase with BoJ. They’ll closely coordinate with each other on monetary policy. Economy Minister Yasutoshi Nishimura said that, the government’s new coronavirus economic stimulus package could boost GDP by 4.4%. The measures included expanded cash payouts to citizen are worth up to JPY 1.1T.

EUR/USD Mid-Day Outlook

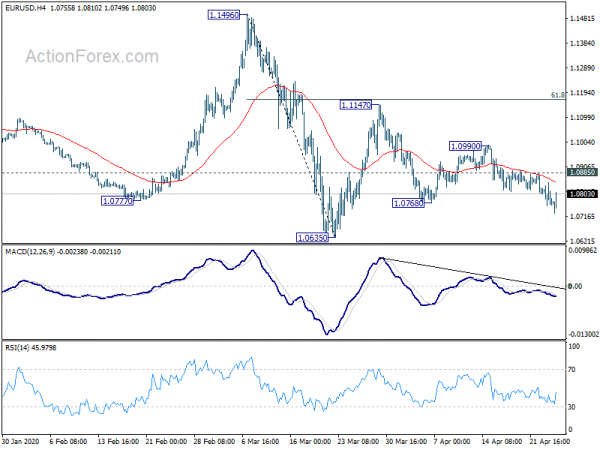

Daily Pivots: (S1) 1.0739; (P) 1.0793; (R1) 1.0829; More…

EUR/USD recovers mildly in early US session. But intraday bias stays on the downside with 1.0885 minor resistance intact. Current fall from 1.1147 would target a test on 1.0635 low next. On the upside, break of 1.0885 minor resistance could extend the consolidation from 1.0635 with another rise. But upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167.

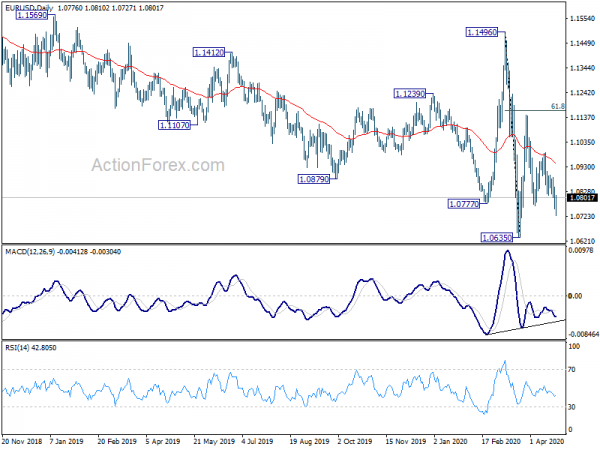

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Apr | -34 | -40 | -34 | |

| 23:30 | JPY | National CPI Core Y/Y Mar | 0.40% | 0.40% | 0.60% | |

| 23:50 | JPY | Corporate Service Price Index Y/Y Mar | 1.60% | 1.70% | 2.10% | |

| 04:30 | JPY | All Industry Activity Index M/M Feb | -0.60% | -0.40% | 0.80% | 0.60% |

| 06:00 | GBP | Retail Sales M/M Mar | -5.10% | -4.50% | -0.30% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Mar | -3.70% | -3.50% | -0.50% | |

| 08:00 | EUR | Germany IFO Business Climate Apr | 74.3 | 79.8 | 86.1 | 85.9 |

| 08:00 | EUR | Germany IFO Current Assessment Apr | 79.5 | 81 | 93 | 92.9 |

| 08:00 | EUR | Germany IFO Expectations Apr | 69.4 | 75 | 79.7 | 79.5 |

| 12:30 | USD | Durable Goods Orders Mar | -14.40% | -12.00% | 1.20% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Mar | -0.20% | -6.10% | -0.60% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Apr | 67.8 | 71 |