Global financial markets trade in mild risk averse mode today. European indices are dragged down by auto makers and oil producer stocks. Weaker than expected Eurozone PMIs also weigh. US futures also point to lower open. The forex markets are rather mixed with Aussie trading generally higher but Kiwi is the weakest one. Dollar and Euro are soft against most major currencies. Trader, nonetheless, are subdued as markets are eyeing the key events later in the week, including FOMC rate decision and GDP from US and UK.

Eurozone PMIs point to slightly slower growth.

Eurozone PMI manufacturing dropped to 56.8 in July, down from 57.4, missed expectation of 57.2. Eurozone PMI services was unchanged at 55.4, in line with expectation. The Eurozone PMI composite dropped to 55.8, hitting the lowest level since January. Germany PMI manufacturing dropped to 58.3, down from 59.6, missed expectation of 59.2. Germany PMI services dropped to 53.5, down from 54.0, missed expectation of 54.3. France PMI manufacturing rose to 55.4, up from 54.8, beat expectation of 54.6. France PMI services dropped to 55.9, down from 56.9, missed expectation of 56.7.

Markit noted that "the July fall in the PMI indicates that the Eurozone’s recent growth spurt lost momentum for a second successive month, but still remained impressive." And, "it’s too early to know for sure whether the economy has merely hit a speed bump or whether the upturn is already starting to fade. The evidence so far points to the former, with the economy hitting bottlenecks due to the speed of the recent upturn." Markit also noted that the data correspond to Q3 growth at 0.6%, slightly slowed than 0.7% expected for Q2.

Japan PMI manufacturing dropped slightly

Japan PMI manufacturing dropped slightly by 0.2 points to 52.2 in July, below expectation of 52.3. Markit noted that "the slowdown was driven by stagnation in export orders, amid reports of weaker demand from Southeast Asia markets." Nonetheless, "the sector continues to add jobs, with employment growth remaining among the best since the financial crisis, while optimism hit its highest level in five years of data collection."

Elsewhere, Canada whole sales rose 0.9% mom in May. China conference board leading index rose 1.6% in June.

IMF kept global forecast unchanged, downgraded US and UK

In the latest World Economic Outlook released over the weekend, IMF kept global growth forecast unchanged at 3.5% for 2017 and 3.6% for 2018. It saw risks "broadly balanced" for the short term but "skewed to the downside" for the medium term. It pointed out that "protracted policy uncertainty or other shocks could trigger a correction in rich market valuations, especially for equities, and an increase in volatility from current very low levels". And, "in turn, this could dent spending and confidence more generally, especially in countries with high financial vulnerabilities."

Growth forecasts for the US was lowered to 2.1% in 2017 and 2.1% in 2018, down from April projection of 2.3% and 2.5% respectively. IMF noted the "uncertainty" over US President Donald Trump’s policies as the main factor for the downward revision. IMF said that "the major factor behind the growth revision, especially for 2018, is the assumption that fiscal policy will be less expansionary than previously assumed, given the uncertainty about the timing and nature of U.S. fiscal policy changes."

IMF also downgraded UK growth forecast for 2017 to 1.7% , down from prior projection of 2.0%. For 2018, growth forecast was kept unchanged at 1.5%. It noted that the revision was based on "weaker-than-expected activity in the first quarter." Also, IMF warned that "the ultimate impact of Brexit on the United Kingdom remains unclear." The UK treasury responded by noting that "this forecast underscores exactly why our plans to increase productivity and ensure we get the very best deal with the EU, are vitally important."

China’s growth is projected to be at 6.7% in 2017 and 6.4% in 2018, revised up from prior projection of 6.6% and 6.2% respectively. Eurozone growth is forecast to be at 1.9% in 2017, 1.7% in 2018, upgraded from prior projection of 1.7% and 1.6% respectively. Japan growth is forecast to be at 1.3% in 2017, upgraded from prior 1.2%. For 2018, growth projection for Japan is kept unchanged at 0.6%.

USD/JPY Mid-Day Outlook

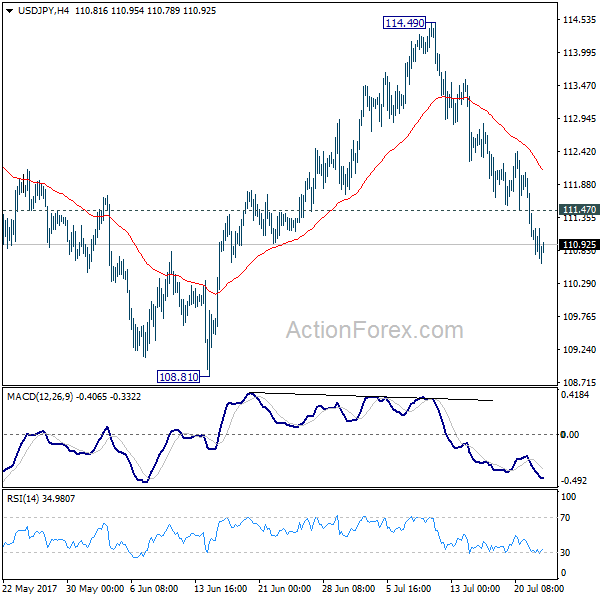

Daily Pivots: (S1) 110.73; (P) 111.40; (R1) 111.79; More…

Intraday bias in USD/JPY remains on the downside as fall from 114.49 is in progress for 108.81 support. Whole correction from 118.65 is possibly resuming. Break of 108.81 will confirm and target 61.8% retracement of 98.97 to 118.65 at 106.48. On the upside, break of 111.47 minor resistance will turn bias neutral and bring recovery before staging another decline.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, down side should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Jul P | 52.2 | 52.3 | 52.4 | |

| 07:00 | EUR | France Manufacturing PMI Jul P | 55.4 | 54.6 | 54.8 | |

| 07:00 | EUR | France Services PMI Jul P | 55.9 | 56.7 | 56.9 | |

| 07:30 | EUR | Germany Manufacturing PMI Jul P | 58.3 | 59.2 | 59.6 | |

| 07:30 | EUR | Germany Services PMI Jul P | 53.5 | 54.3 | 54 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jul P | 56.8 | 57.2 | 57.4 | |

| 08:00 | EUR | Eurozone Services PMI Jul P | 55.4 | 55.4 | 55.4 | |

| 12:30 | CAD | Wholesale Sales M/M May | 0.90% | 0.50% | 1.00% | 0.80% |

| 13:00 | CNY | Conference Board Leading Index Jun | 1.60% | 1.30% | 1.70% | |

| 13:45 | USD | Manufacturing PMI Jul P | 52.2 | 52 | ||

| 13:45 | USD | Services PMI Jul P | 54 | 54.2 | ||

| 14:00 | USD | Existing Home Sales Jun | 5.59M | 5.62M |