Dollar and yen are staying in the driving seats for the week so far, on risk aversion. After the historic horrors of the May WTI oil contract, the markets are now into June contract, which is down at around 10. Asian markets are trading generally down, following the US. In the currency markets, Dollar and Yen remain the strongest ones for the week, followed by the resilient Euro. Sterling is currently the worst performing one, followed by Canadian Dollar.

Technically, Euro continues to display much resilience in the markets. In particular, focus in on 0.8863 minor resistance in EUR/GBP. Break should confirm short term bottoming at 0.8681 and bring stronger rebound. EUR/AUD continues to trade in range above 1.7003 temporary low. Break of 1.7350 minor resistance will also suggest short term bottoming too. EUR/JPY is still defending 115.86/116.33 support zone. Break of 117.41 minor resistance will turn bias to the upside for stronger rebound too.

In Asia, currently, Nikkei is down -1.57%. Hong Kong HSI is down -0.56%. China Shanghai SSE is down -0.16%. Singapore Strait Times is down -1.50%. Overnight, DOW dropped -2.67%. S&P 500 dropped -3.07%. NASDAQ dropped -3.48%. 10-year yield dropped -0.055 to 0.571.

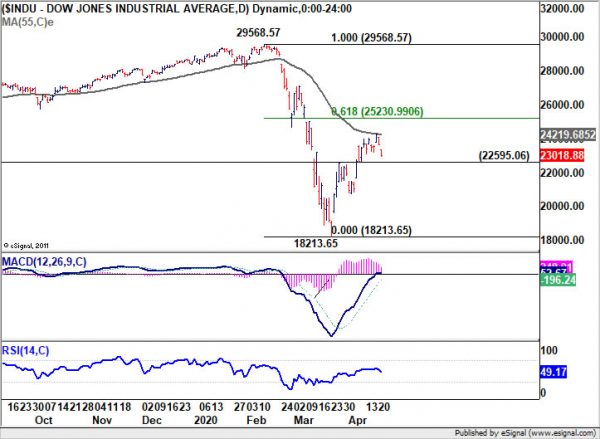

DOW could have finished corrective rebound after rejection by 55 day EMA

DOW gapped down yesterday and eventually closed down -631.56 pts, or -2.67%, at 23018.88. The development raises the chance that corrective rebound from 18213.65 has completed after rejection by 55 day EMA. Immediate focus is back on 22595.06 resistance turned support. Break will add more credence to this case and target next support level at 20735.02.

In case of another rise, it now looks like upside would be limited by 61.8% retracement of 29568.57 to 18213.65 at 25230.99.

BoE Bailey: Not enough finance has gone through to small firms

BoE Governor Andrew Bailey said in an interview with Daily Mail that there are a number of “bottleneck” in the system, so that not enough finance has gone through to small firms in the coronavirus crisis. Only around GBP 2B has been lent to companies under the Covid Business Interruption Loan scheme.

He noted it’s hard for banks to deal with a huge surge in loan demands, at a time when their staff are having health struggles. It’s also difficult to assess the risk with the loans to small firms. Bailey added, “this gums up the operational side. It is clearly not satisfactory and [the system] clearly needs to be un-gummed. I gee up the banks regularly. The Chancellor and I are both extremely keen that credit flows to firms.”

Regarding lockdown exit, “I think we have to be careful when thinking about human psychology,’ he said. ‘If we had a lifting and then [lockdown] came back again, I think that would damage people’s confidence very severely.”

Australia retail sales rose 8.2% on unprecedented demand

Preliminary readings showed Australia retail sales rose 8.2% in March. That’s the strongest seasonally adjusted rise ever published. ABS said the data indicated “unprecedented demand in March in the Food retailing industry, with strong sales across supermarkets, liquor retailing and other specialised food.”

The rise was “slightly offset by strong falls in industries including cafes, restaurants and takeaway food services, and clothing, footwear and personal accessory retailing, which were impacted by new social distancing regulations introduced in March. ”

Looking ahead

Inflation data are the major focuses today. UK will release CPI, CPI and PPI. Canada will release CPI and new housing price index. US will release house price index and crude oil inventories.

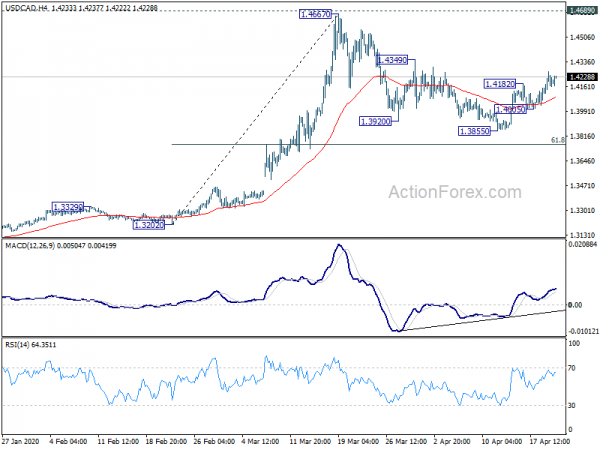

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4125; (P) 1.4195; (R1) 1.4276; More….

Intraday bias in USD/CAD remains on the upside at this point. Corrective decline from 1.4667 should have completed at 1.3855. Break of 1.4349 resistance will pave the way to 1.4667/4689 key resistance zone. On the downside, break of 1.4005 minor support will extend the correction with another fall. But downside should be contained by 61.8% retracement of 1.3202 to 1.4667 at 1.3762 to bring rebound.

In the bigger picture, rise from 1.2061 is likely resuming whole up trend from 0.9056 (2007 low). Decisive break of 1.4689 will confirm this bullish case. Next medium term target is 161.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.5545. Rejection by 1.4689 will bring some consolidations first. But outlook will remain bullish as long as 1.3664 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Westpac Leading Index M/M Mar | -0.80% | -0.40% | ||

| 6:00 | GBP | CPI M/M Mar | 0.40% | |||

| 6:00 | GBP | CPI Y/Y Mar | 1.50% | 1.70% | ||

| 6:00 | GBP | Core CPI Y/Y Mar | 1.60% | 1.70% | ||

| 6:00 | GBP | RPI M/M Mar | 0.50% | |||

| 6:00 | GBP | RPI Y/Y Mar | 2.30% | 2.50% | ||

| 6:00 | GBP | PPI Input M/M Mar | -2.00% | -1.20% | ||

| 6:00 | GBP | PPI Input Y/Y Mar | -0.90% | -0.50% | ||

| 6:00 | GBP | PPI Output M/M Mar | -0.40% | -0.30% | ||

| 6:00 | GBP | PPI Output Y/Y Mar | 0.90% | 0.40% | ||

| 6:00 | GBP | PPI Core Output M/M Mar | -0.10% | |||

| 6:00 | GBP | PPI Core Output Y/Y Mar | 0.50% | 0.40% | ||

| 8:30 | GBP | DCLG House Price Index Y/Y Feb | 1.50% | 1.30% | ||

| 12:30 | CAD | New Housing Price Index M/M Mar | 0.40% | |||

| 12:30 | CAD | CPI M/M Mar | 0.40% | |||

| 12:30 | CAD | CPI Y/Y Mar | 2.20% | |||

| 12:30 | CAD | CPI Common Y/Y Mar | 1.80% | |||

| 12:30 | CAD | CPI Median Y/Y Mar | 2.10% | |||

| 12:30 | CAD | CPI Trimmed Y/Y Mar | 2.00% | |||

| 13:00 | USD | Housing Price Index M/M Feb | 0.30% | 0.30% | ||

| 14:00 | EUR | Eurozone Consumer Confidence Apr P | -20 | -12 | ||

| 14:30 | USD | Crude Oil Inventories | 19.2M |