Risk aversion stays in the markets today as WTI crude oil May future is back in negative territory above a brief stay above zero. Investors also turned cautious on news about critical health condition of North Korean leader Kim Jong-un. Yen and Dollar continue to trade as the strongest ones for today while Euro and Swiss Franc are displaying much resilience. Canadian Dollar is just mixed despite the wild ride in oil price. Instead, Kiwi, Aussie and Sterling are the worst performing ones.

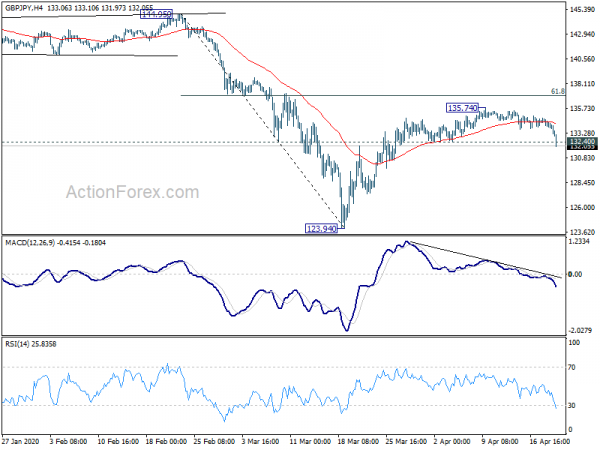

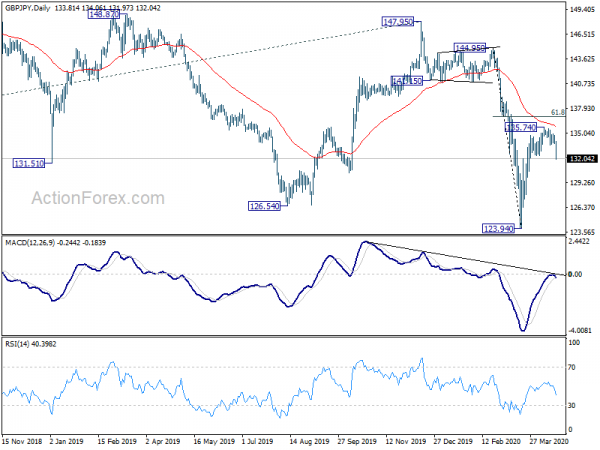

Technically, USD/CAD’s break of 1.4182 minor resistance solidify the case that correction from 1.4667 has completed at 1.3855. Focus is now on 1.4349 resistance and break will pave the way back to 1.4667. 0.6213 support in AUD/USD is a level to watch today and break will indicate completion of whole rebound from 0.5506. That might be another evidence of full return to risk off. GBP/JPY’s break of 132.40 support suggest completion of corrective rebound from 123.94. 0.8863 resistance in EUR/GBP and 1.2164 support GBP/USD are also worth some attentions. Break of these levels will mark the end of Sterling’s rebound.

In Europe, currently, FTSE is down -2.19%. DAX is down -3.27%. CAC is down -3.03%. German 10-year yield is down -0.0537 at -0.504. Earlier in Asia, Nikkei dropped -1.97%. Hong Kong HSI dropped -2.20%. China Shanghai SSE dropped -0.90%. Singapore Strait Times dropped -1.77%. Japan 10-year JGB yield rose 0.0045 to 0.018.

Canada retail sales rose 0.3% in February

Canada retail sales rose 0.3% mom to USD 52.2B in February, above expectation of 0.0% mom. That’s the first time sales grew for four months in a row since October 2018. Ex-auto sales was flat, also above expectation of -0.1% mom. Sales were up in 6 of 11 subsectors.

EU Breton: A package of EUR 1.6 trillion needed to support post pandemic recovery

European Commissioner for Internal Market and Services Thierry Breton said a package of EUR 1.6 trillion could be needed to help Europe’s economy recover from impact of coronavirus. That would represent some 10% of EU GDP. His top priority is to help small-and-medium businesses while a “Marshall plan” is required to help the tourism industry.

EU leaders are expected to meet on Thursday, by video conference. But it’s doubtful is there would be any conclusion on the way to finance the economic rescue package. It’s reported that the Commission prefers to finance the recovery fund via increased joint budget for 2021-27. Germany is said to support the financing through a larger EU budget and issuance of joint debt. But many details are still missing.

ECB Panetta: Absent of common coronavirus action would dilute public support for EU

ECB Executive Board member Fabio Panetta criticized that Eurozone’s fiscal response to the coronavirus pandemic has been insufficient. He emphasized, “only if all economies act with the necessary force to contain the recession will the loss in output for the entire eurozone be minimized.”

He warned, “any perception that common action is absent in times of desperate crisis would dilute public support for the European Union — an effect that is already visible in countries on the frontline of the health crisis.” And, “the threat to the single market is clear: uneven fiscal support implies that a firm’s location, rather than its business model, will be the decisive factor in determining whether it survives this crisis.”

German ZEW sentiment jumps as current situation deteriorates

German ZEW Economic Sentiment jumped sharply by 77.7 pts to 28.2 in April. However, Current Situation index dived by -48.4 pts to -91.5. Eurozone ZEW Economic Sentiment rose 74.78 pts to 25.2. Eurozone Current Situation gauge dropped -45.4 pts to -93.9.

ZEW President Achim Wambach said: “The financial market experts are beginning to see a light at the end of the very long tunnel. The results of the special questions on the coronavirus crisis included in the survey show that the experts do not expect to see positive economic growth until the third quarter of 2020. Economic output is not expected to return to pre-corona levels before 2022.”

UK employment rate hit record high before coronavirus pandemic

UK unemployment rate rose 0.1% to 4.0% in the three month to February, slightly above expectation of 3.9%. Employment rate rose 0.2% to a record high of 76.6% during the period. Wage growth slowed notably with average earnings including bonus decelerated to 2.8% 3moym down from 3.1%. Average earnings excluding bonus slowed to 2.9% 3moy down from 3.1%. The set of pre-coronavirus pandemic data is somewhat irrelevant to the markets.

RBA Lowe: Health and economic emergencies will cast a shadow over our economy

RBA Governor Philip Lowe said today that the economy will likely contract by around -10% in the first half. Most of the decline would take place in Q2 due to the coronavirus pandemic. At the same time, unemployment rate could jump from March’s 5.2% to around 10% by June.

He also sounded cautious regarding the post pandemic recovery. “Whatever the timing of the recovery, when it does come, we should not be expecting that we will return quickly to business as usual,” he said. “Rather, the twin health and economic emergencies that we are experiencing now will cast a shadow over our economy for some time to come.”

GBP/JPY Mid-Day Outlook

Daily Pivots: (S1) 133.50; (P) 134.12; (R1) 134.42; More…

GBP/JPY’s break of 132.40 support suggests that corrective rebound from 135.47 has completed. Intraday bias is turned back to the downside for retesting 123.94 low. Decisive break of 122.75/123.94 support zone will resume larger down trend. On the upside, in case of another rise, upside should be limited by 61.8% retracement of 144.95 to 123.94 at 136.92 to bring near term reversal.

In the bigger picture, price actions from 122.75 (2016 low) are merely a sideway consolidation pattern, which has completed at 147.96. Larger down trend from 195.86 (2015 high) as well as that from 251.09 (2007 high) are possibly resuming. Break of 122.75 should target 61.8% projection of 195.86 to 122.75 from 147.95 at 102.76 next. In any case, outlook will remain bearish as long as 147.95 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Mar | 4.02B | 3.23B | 3.57B | |

| 06:00 | GBP | ILO Unemployment Rate (3M) Feb | 4.00% | 3.90% | 3.90% | |

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Feb | 2.80% | 3.00% | 3.10% | |

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Feb | 2.90% | 3.20% | 3.10% | |

| 06:00 | GBP | Claimant Count Change Mar | 12.1K | 17.3K | 6.0K | |

| 06:00 | GBP | Claimant Count Rate Mar | 3.50% | 3.50% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | 28.2 | -43 | -49.5 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | 25.2 | -38.2 | -49.5 | |

| 09:00 | EUR | Germany ZEW Current Situation Apr | -91.5 | -30 | -43.1 | |

| 12:30 | CAD | Retail Sales M/M Feb | 0.30% | 0.00% | 0.40% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | 0.00% | -0.10% | -0.10% | |

| 14:00 | USD | Existing Home Sales Mar | 5.40M | 5.77M |