Global stock markets are mildly firmer in consolidative mode today, with slight gains in major European sessions. Poor US economic data triggered little reactions. Dollar’s rebound attempt is somewhat stuck below yesterday’s high for now, while Canadian Dollar is recovering. For now, New Zealand Dollar is the weakest one for today, followed by Sterling. Over the week, Yen is the strongest one, followed by the Pound. Kiwi is the weakest followed by Canadian.

Technically, EUR/CHF’s break of 1.0523 support today suggests resumption of larger down trend. Next downside target is 1.0394 projection level. EUR/JPY is still heading back towards 115.86 key support despite weak downside momentum. Break there will align the outlook with EUR/CHF for downtrend resumption. EUR/GBP turned into consolidation since Tuesday but there is effective no recovery. Further fall is expected towards 0.8276/8595 support zone as long as 0.8863 resistance holds. Overall, Euro looks rather vulnerable to another wave of selloff.

In Europe, currently, FTSE is up 0.56%. DAX is up 1.21%. CAC is up 0.68%. German 10-year yield is up 0.0113 at -0.452. Earlier in Asia, Nikkei dropped -1.33%. Hong Kong HSI dropped -0.58%. China Shanghai SSE rose 0.31%. Singapore Strait Times rose 0.26%. Japan 10-year JGB yield dropped -0.0157 to 0.005.

US initial jobless claims dropped to 5245k, continuing claims hit 11.98m

US initial jobless claims dropped -1370k to 5245k in the week ending April 11. Four-week moving average of initial claims rose 1241k to 5509k. Continuing claims rose 4.53m to 11.98m in the week ending April 4. Four-week moving average of continuing claims rose 2.57m to 6.07m.

Philly Fed manufacturing index dropped to -56.5, but future activity improved

Philadelphia Fed Manufacturing Business Outlook current activity index dropped to -56.5 in April, down from -12.7. That’s even below that nadir during the Great Recession, and was the lowest since July 1980. Looking at some details, new orders fell further into negative territory, from -15.5 to -70.9, record low. Current shipments dropped -74 pts to all-time low.

However, index for future general activity rose 8pts to 43.0. Over 53% of firms expected increases in activity over the next six months, while 10% expected declines. Future new orders held steady while futures rose 4 pts.

Also released, housing starts dropped to 1.22m in March versus expectation of 1.31m. Building permits dropped to 1.35m versus expectation of 1.30m. Canada manufacturing sales rose 0.5% mom in February versus expectation of 0.0% mom.

ECB Lagarde expects large contraction in Eurozone and rapidly deteriorating labor markets

ECB President Christine Lagarde told the International Monetary and Financial Committee, “in the euro area, incoming economic data, particularly recent survey results, have started to show unprecedented falls, pointing to a large contraction in output in the euro area, as well as to rapidly deteriorating labour markets.”

She added that the central bank is fully prepared to increase the size of its asset purchase programmes and adjust their composition, “by as much as necessary and for as long as needed. It will explore all options and all contingencies to support the economy through this shock” of coronavirus pandemic.

Separately, Executive Board member Isabel Schnabel said the central bank should do more to avoid financial fragmentation in the zone. And ECB “stands ready to adjust all of its instruments as needed … to avoid fragmentation that may hamper the smooth transition of our monetary policy,”

Governing Council member Gabriel Makhlouf said, “from the ECB’s perspective, as our actions have shown, we stand ready to support the citizens and economies of Europe if events show that we need to do more”. “Our focus has to be on supporting the public health response. But we also need to think about how we recover from the economic shock, and how the financial system supports the recovery, when it comes,” he added.

Eurozone industrial production dropped -0.1% in Feb, EU flat

Eurozone industrial production dropped -0.1% mom in February, the month before coronavirus pandemic measures began. Production of durable consumer goods fell by -2.0% mom and capital goods by -1.5% mom, while production of both intermediate goods and non-durable consumer goods rose by 0.4% mom and energy by 0.7% mom.

EU industrial productions was unchanged over the month. Among Member States for which data are available, the largest decreases in industrial production were registered in Greece (-3.7%), Portugal (-2.8%) and Malta (-2.6%). The highest increases were observed in Estonia (+8.7%), Denmark (+3.7%) and Latvia (+3.1%).

Also released, Germany CPI was finalized at 0.1% mom, 1.4% yoy in March. Swiss PPI came in at -0.3% mom, -2.7% yoy in March.

IMF Georgieva urges UK to extend Brexit transition

IMF Managing Director Kristalina Georgieva urged UK to seek longer Brexit transition. She told BBC radio that “it is tough as it is” with coronavirus pandemic. “Let’s not make it any tougher”. She added, “my advice would be to seek ways in which this element of uncertainty is reduced in the interests of everybody, of the UK, of the EU, the whole world.”

She also hailed the measures taken by the UK government on countering the economic impact of the pandemic. She said, “that very strong package of measures is helping the UK, but given the UK’s sizeable role in the world economy, it’s actually helping everyone.”

The Brexit transition period is set to end on December 31, with a new trade agreement in place. The time frame to reach a deal between UK and EU was already seen by unachieveable by some. But Prime Minister Boris Johnson has repeatedly said before he won’t seek another delay in Brexit.

Australia employment grew in March, coronavirus impact to be evident in April

Australia employment unexpected grew 5.9k in March, versus expectation of -40.0k contraction. Full-time employment dropped just 400 to 8.88m. Part-time employment rose 6.4k to 4.14m. Unemployment rate rose just 1% from 5.1% to 5.2%, much better than expectation of 5.5%. Participation rate was steady at 66.0%.

Chief Economist at the ABS, Bruce Hockman, said: “Today’s data shows some small early impact from COVID-19 on the Australian labour market in early March, but any impact from the major COVID-19 related actions will be evident in the April data.”

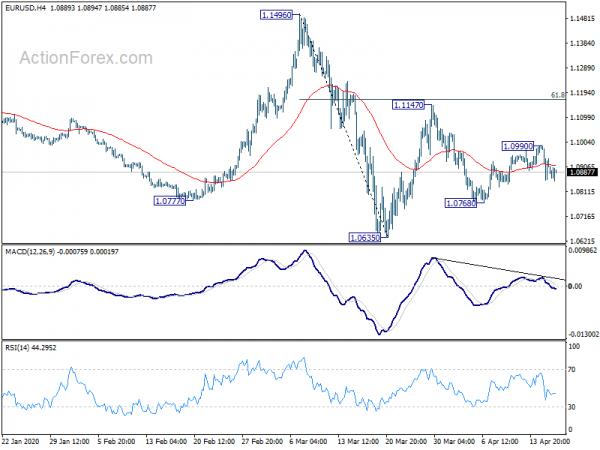

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0848; (P) 1.0920; (R1) 1.0983; More…

Intraday bias in EUR/USD stays on the downside for 1.0768 support. Break there will extend the decline from 1.1147 to retest 1.0635 low. On the upside, break of 1.0990 will target 1.1147 resistance. Overall, price actions from 1.0635 are seen as a consolidation pattern which might extend further. But upside should be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167.

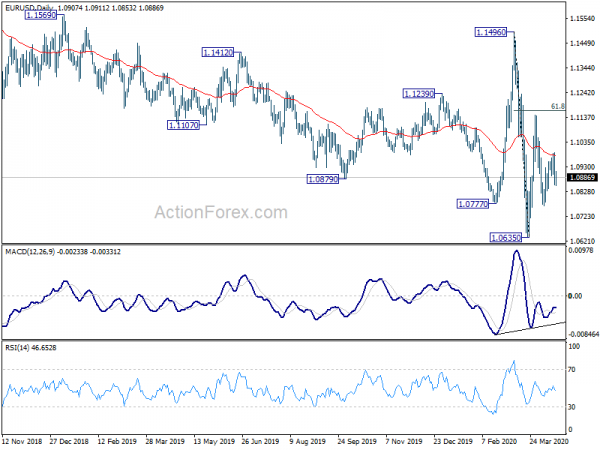

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | Consumer Inflation Expectations Apr | 4.60% | 4.00% | ||

| 01:30 | AUD | Employment Change Mar | 5.9K | -40.0K | 26.7K | 25.6K |

| 01:30 | AUD | Unemployment Rate Mar | 5.20% | 5.50% | 5.10% | |

| 06:00 | EUR | Germany CPI M/M Mar F | 0.10% | 0.10% | 0.10% | |

| 06:00 | EUR | Germany CPI Y/Y Mar F | 1.40% | 1.40% | 1.40% | |

| 06:30 | CHF | Producer and Import Prices M/M Mar | -0.30% | -1.20% | -0.90% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Mar | -2.70% | -2.10% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Feb | -0.10% | -0.70% | 2.30% | |

| 12:30 | CAD | Manufacturing Sales M/M Feb | 0.50% | 0.00% | -0.20% | |

| 12:30 | USD | Housing Starts Mar | 1.22M | 1.31M | 1.60M | 1.56M |

| 12:30 | USD | Building Permits Mar | 1.35M | 1.30M | 1.45M | |

| 12:30 | USD | Initial Jobless Claims (Apr 10) | 5245K | 6606K | 6615K | |

| 12:30 | USD | Philadelphia Fed Manufacturing Apr | -56.6 | -30 | -12.7 | |

| 14:30 | USD | Natural Gas Storage | 63B | 38B |