Dollar is staying under pressure as traders are back from holidays. Risk sentiment is relatively steady with new global coronavirus cases and deaths starting to trend down. The improvements are particularly evident in Spain and Italy since the start of April. There is also hope that the worst is over in the US and the UK as numbers could have peaked last week.

Following Dollar, Yen and Canadian are the next weakest. The OPEC+ agreement on production cut was far from being impressive to traders, as WTI crude oil is stuck in range below 30. On the other hand, Australian and New Zealand Dollar are the strongest ones despite poor economic data. Stabilization in sentiments also restore the inverse relationship between Gold and Dollar, as Gold jumped to new 7-year high on Dollar’s selloff.

In Asia, Nikkei is currently up 2.91%. Hong Kong HSI is up 0.65%. China Shanghai SSE is up 0.68%. Singapore Strait Times is up 2.46%. Japan 10-year JGB yield is up 0.005 at 0.014. Overnight, DOW dropped -1.39%. S&P 500 dropped -1.01%. NASDAQ rose 0.48%. 10-year year rose 0.020 to 0.749.

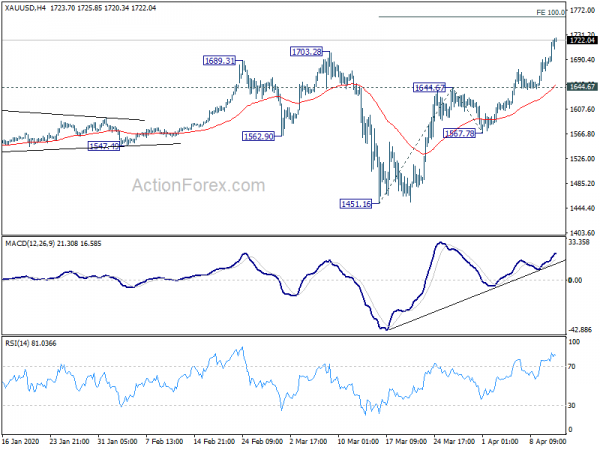

Gold hits new 7-year high as up trend resumes

Gold surged to new 7-year high as lifted by broad based weakness in Dollar. The correction from 1703.28 has completed early than expected at 1451.16. Break of this resistance confirms up trend resumption. Outlook will stay bullish as long as 1644.67 resistance turned support holds. Next upside target is 100% projection of 1451.16 to 1644.67 from 1567.78 at 1761.29.

In the bigger picture, the strong support from 55 week EMA displays clear medium term bullishness. A take on 1920.70 high would likely be seen next.

China returned to trade surplus, but exports plunged -13.3% this year

In March, in USD term, China’s exports dropped -6.6% yoy to USD 185.2B. Imports dropped -0.9% yoy to USD 165.3B. Trade surplus came in at USD 19.9B. From January to March accumulative, exports dropped -13.3% ytd/y to USD 478.2B. Imports dropped -2.9% ytd/y to 465.0B. Trade surplus came in at just USD 13.2B.

Also year-to-March, exports to EU dropped -16% ytd/y to USD 70.5B. Imports from EU dropped -7% ytd/y to USD 55.2B. Exports to US dropped -25.2% ytd/y to 68.3B. Imports from US dropped -3.7% ytd/y to USD 27.5B.

Australia NAB business confidence dropped to -66, recession of unprecedented speed and magnitude ahead

Australia NAB Business Confidence dropped to -66 in March, down from -2. That’s record low, even worse than the reading during 2008 global financial crisis and early 90s recession. Business Conditions dropped to -21, down from 0. While condition index was slightly worse than the reading at financial crisis, it sit well above the trough during 90s recessions.

NAB chief economist Alan Oster said “We expect a recession of unprecedented speed and magnitude for the Australian economy over the next three quarters. “This will see a sharp increase in unemployment.”

“Policy makers have made a huge response that we think will be unable to offset the negative prints we will see in economic data in the near term but we are optimistic these actions will support a solid recovery once the virus is contained,” Oster added.

New Zealand unemployment rate could peak at 26% without additional fiscal support

New Zealand Treasury published a report analyzing the economic impacts of the coronavirus pandemic. Assuming no additional fiscal measures beyond the announced NZD 20B direct support, contraction in GDP in the year to March 2021 could range from 13% (the least restrictive scenario), to closer to one-third (with tight restriction through the year).

Unemployment rate could peak at 13% in the least restrictive scenario, or 26% in the tight restriction scenario. However, with additional NZD 20B in fiscal spending directed to households and businesses, unemployment rate could be limited to less than 10% in the least restrictive scenario Inflation will remain below 2% midpoint of RBNZ’s target range.

Separately, Finance Minister Grant Robertson said that the government will announce further support for businesses this week and more in the Budget next month. He said, “the Budget is also another important part of the response, and it will include significant support to respond to and recover from Covid-19. As is usual with the Budget, there may well be pre-announcements, especially where they relate to urgent Covid-19 response activities.”

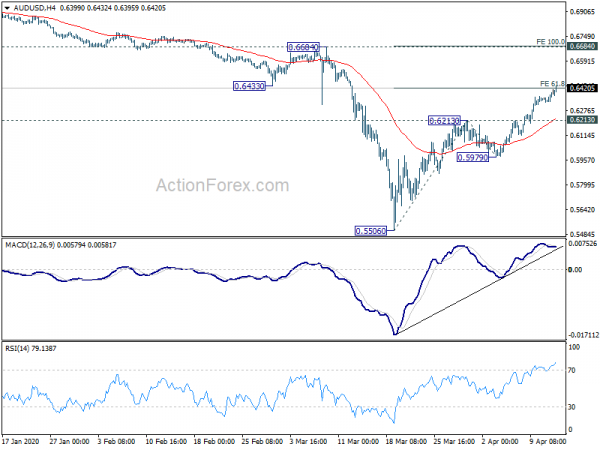

AUD/USD Daily Report

Daily Pivots: (S1) 0.6338; (P) 0.6373; (R1) 0.6420; More…

AUD/USD’s rebound from 0.5506 continues today and met 61.8% projection of 0.5506 to 0.6213 from 0.5979 at 0.6416. there is no sign of topping yet. Current rise could target 100% projection at 0.6686, which is close to 0.6684 key resistance. On the downside, though, break of 0.6213 resistance turned support will argue that such rebound has completed. Intraday bias will be turned back to the downside for 0.5979 support for confirmation.

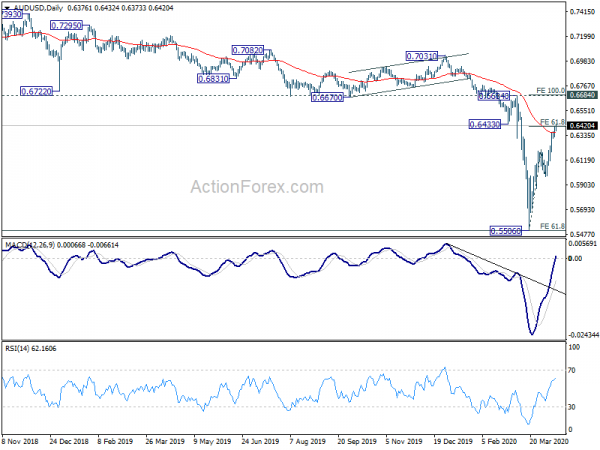

In the bigger picture, there is no clear sign of trend reversal yet. The larger down trend from 1.1079 (2011 high) is still in favor to extend. 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507 is already met. Sustained break there will pave the way to 0.4773 (2001 low). On the upside, break of 0.6670 support turned resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | NAB Business Confidence Mar | -66 | -4 | -2 | |

| 1:30 | AUD | NAB Business Conditions Mar | -21 | 0 | ||

| 2:00 | CNY | Trade Balance (CNY) Mar | 130B | 175B | -43B | |

| 2:00 | CNY | Exports (CNY) Y/Y Mar | -3.50% | -15.90% | ||

| 2:00 | CNY | Imports (CNY) Y/Y Mar | 2.40% | -2.40% | ||

| 3:50 | CNY | Trade Balance (USD) Mar | 19.9B | 19.7B | -7.1B | |

| 3:50 | CNY | Imports (USD) Y/Y Mar | -0.90% | -4.00% | ||

| 3:50 | CNY | Exports (USD) Y/Y Mar | -6.60% | -17.20% | ||

| 12:30 | USD | Import Price Index M/M Mar | -3.10% | -0.50% |