Dollar recovers mildly today as stock rebound somewhat lost momentum. In particular, DOW closed lower after gaining nearly 1000 pts overnight. Asian markets turned mixed despite rally in Nikkei. Investors could be awaiting the results of OPEC++ decision on production cuts before taking another move. Yen is following Dollar is the second strongest for today. Australian Dollar is leading commodity currencies mildly lower.

Technically, intraday bias in Dollar turns neutral after today’s recovery. As long as these levels holds, more downside will remain mildly in favor in the greenback, for extending near term correction. The levels include 1.0768 support in EUR/USD, 0.5979 support in AUD/USD, 0.9797 resistance in USD/CHF and 1.4349 resistance in USD/CAD.

In Asia, Nikkei closed up 2.13%. Hong Kong HSI is down -1.39%. China Shanghai SSE is down -0.46%. Singapore Strait Times is down -2.06%. Japan 10-year JGB yield is up 0.0016 at 0.009. Overnight, DOWN dropped -0.12%. S&P 500 dropped -0.16%. NASDAQ dropped -0.33%. 10-year yield rose 0.060 to 0.736.

US to give small businesses another $250B critical lifeline

US Treasury Secretary Steven Mnuchin said he’s asking the Congress to “secure an additional $250 billion for the PPPLoan program to make sure small businesses get the money the need.” The funding would be on top of the USD 349B in forgivable loans to small businesses enacted on March 27.

Mnuchin also told bank CEOs that “we want to make sure that every single small business can participate. We want to assure the workers that if you don’t get the loan this week, there will be plenty of money for you next week,”

Separately, Senate Majority Leader Mitch McConnell said “It is quickly becoming clear that Congress will need to provide more funding or this crucial program may run dry.” He’s targeting to get Senate to vote on the measure on Thursday.

Senate Small Business Committee Chairman Marco Rubio said, “there is a critical need to supplement the (loan) fund to ensure America’s more than 30 million small businesses will be able to access this critical lifeline.”

S&P downgrade Australia’s rating outlook as recession will deteriorate fiscal headroom

Rating agency S&P kept Australia’s sovereign rating unchanged at AAA, but downgraded the outlook from “stable” to “negative”. The outlook was upgraded from “negative” to “stable” less than two years ago in September 2018, when the budget came close to balance.

“The COVID-19 outbreak has dealt Australia a severe economic and fiscal shock” S&P said. “We expect the Australian economy to plunge into recession for the first time in almost 30 years, causing a substantial deterioration of the government’s fiscal headroom at the ‘AAA’ rating level.”

Nevertheless, “while fiscal stimulus measures will soften the blow presented by the COVID-19 outbreak and weigh heavily on public finances in the immediate future, they won’t structurally weaken Australia’s fiscal position,” S&P said.

Treasurer Josh Frydenberg said the outlook downgrade was “a reminder of the importance of maintaining our commitment to medium term fiscal sustainability.”

New Zealand ANZ business confidence dropped to -73.1, times don’t get much tougher than this

New Zealand ANZ business confidence dropped to -73.1 in the April’s preliminary reading, down from March’s -63.5. Own activity outlook dropped sharply from -26.7 to -61.2. Export intentions dropped from -25.8 to -43.6. Investment intentions dropped from -14.4 to -50.2. Employment intention dropped from -22.5 to -53.8.

ANZ said, “firms are reeling from the abruptness and ferocity of the storm that has enveloped them, and with uncertainty extreme, planning a way out is very difficult. The quick-fire fiscal and monetary response will have helped, but times just don’t get much tougher than this.”

South Korea pledges new measures to help exporters and boost domestic demand

South Korean President Moon Jae-in announced additional support to the economy as businesses and domestic demand devastated by the coronavirus pandemic. 36 trillion won of cheap loans will be available to exporters. Measures of 17.7 trillion won will be rolled out to boost consumption and domestic demands. The new measures are on top of the planned economic package of 100 trillion won announced in late March.

Separately reported by the central bank, Household loans rose a net 9.6 trillion won in March, highest jump since record began in 2004. That came after another record of 9.3 trillion won rise back in February. Mortgage lending rose a net 6.3 trillion won, slowed from February’s 7.8 trillion won.

On the data front

Japan current account surplus widened to JPY 2.38T in February. Machine orders grew 2.3% mom, much better than expectation of -2.7% mom.

Looking ahead, Swiss will release unemployment rate. Canada will release housing starts and building permits. US will release crude oil inventories and FOMC minutes.

AUD/USD Daily Report

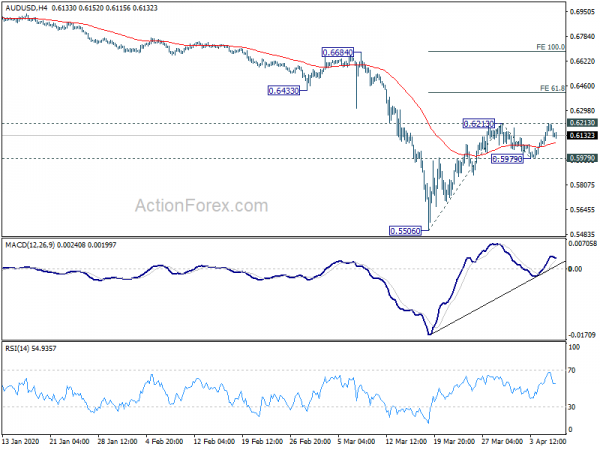

Daily Pivots: (S1) 0.6096; (P) 0.6152; (R1) 0.6228; More…

AUD/USD retreats mildly after failing 0.6213 resistance. But with 0.5979 support intact, further rise is mildly in favor. Break of 0.6213 will extend the corrective rise from 0.5506 to 61.8% projection of 0.5506 to 0.6213 from 0.5979 at 0.6416. On the downside, break of 0.5979 will now indicate completion of rise from 0.5506. Intraday bias will be turned back to the downside for retesting 0.5506.

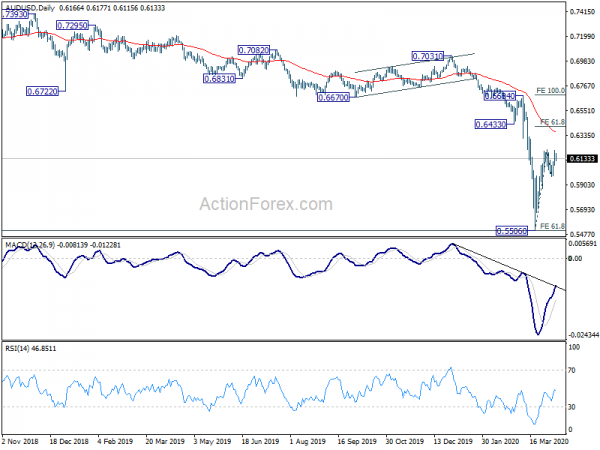

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507 is already met. Sustained break there will pave the way to 0.4773 (2001 low). On the upside, break of 0.6670 support turned resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Current Account (JPY) Feb | 2.38T | 2.02T | 1.63T | |

| 23:50 | JPY | Machinery Orders M/M Feb | 2.30% | -2.70% | 2.90% | |

| 5:00 | JPY | Eco Watchers Survey: Current Mar | 14.2 | 22.2 | 27.4 | |

| 5:45 | CHF | Unemployment Rate s.a M/M Mar | 2.80% | 2.30% | ||

| 12:15 | CAD | Housing Starts Mar | 205.0K | 210.1K | ||

| 12:30 | CAD | Building Permits M/M Feb | 4.00% | |||

| 14:30 | USD | Crude Oil Inventories | 13.8M | |||

| 18:00 | USD | FOMC Minutes |