Asian markets are trading up mildly as the week starts, after coronavirus deaths in New York State fell for the first time. Italy also reported the fewest deaths in more than two weeks. However, investors remain cautious as it’s still almost impossible to forecast the full impact of the pandemic. In the currency markets, Yen and Swiss Franc are the weaker ones. They’re joined by Sterling on news that Prime Minister Boris Johnson was hospitalized after suffering persistent coronavirus symptoms for 10 days. Australian Dollar is leading other commodity currencies higher.

Technically, Yen’s rally attempt lost momentum since late last week. Focus will be on 109.70 minor resistance in USD/JPY, and break will put 111.71/122.22 resistance zone back into focus. 118.87 minor resistance in EUR/JPY will also be watched and break will suggest that 115.86/116.12 support zone was defended, and bring stronger rebound to 121.14 resistance. Meanwhile the persistence in Sterling’s weakness will also be noted too. Break of 1.2144 minor support in GBP/USD and 0.8987 minor resistance in EUR/GBP will open up more downside for the Pound.

In Asia, currently, Nikkei is up 2.19%. Hong Kong HSI is up 1.11%. Singapore Strait Times is up 2.47%. China is on holiday. Japan 10-year JGB yield is up 0.0129 at 0.004.

Consumer confidence in UK had record drop after coronavirus lockdown

In an interim COVID-19 flash report, Gfk said UK consumer confidence index has dropped sharply by -25pts to -34, between March 16 and 27. That’s the biggest fall since record began in January 1974.

Joe Staton, GfK’s Client Strategy Director, says: “Our COVID-19 ‘flash report’ shows a dramatic result with consumer confidence falling off the cliff in the last two weeks of March. The last time we saw such a decline was during the 2008 economic downturn. Our falling confidence in our personal financial situation and the wider economy reflects the new concern for many across the UK. Despite record grocery sales, and recent peaks for purchases of freezers, TVs and home office equipment as people prepared for a long period in the home, the Major Purchase Index is down 50 points – a stark picture for some parts of the retail industry in the short to medium term.”

Spain PM Sanchez: Virus doesn’t respect borders, nor should financing mechanisms

Spanish Prime Minister Pedro Sanchez urged Europe to “build a wartime economy and promote European resistance, reconstruction and recovery” as the country became the most coronavirus infected country in the continent. Total confirmed cases surged pass 131k, taking over Italy’s near 129k. There were 12,641 deaths recorded, comparing with Italy’s 15,887.

In a piece in Guardian, Sanchez said Europe “must start doing so as soon as possible with measures to support the public debt that many states, including Spain, are taking on. And it must continue to do so when this health emergency is over, to rebuild the continent’s economies by mobilising significant resources through a plan we are calling the new Marshall plan and which will require the backing of all of the EU’s common institutions.”

“In the coming months, the EU member states will inevitably take on greater volumes of debt to deal with the consequences of what is not just a health crisis, but an economic and social crisis,” he added. “That is why the response cannot be the same as that envisaged for asymmetric economic shocks, such as a financial or banking crisis in a single state or group of states. If the virus does not respect borders, then nor should financing mechanisms.”

RBNZ Orr will keep monetary support going for as long as necessary

RBNZ Governor Adrian Orr said in a article said the central bank recognized the “threat of COVID-19 to our collective well-being “. It will “keep monetary support going for as long as necessary through QE and other tools.”

He also noted that there are “some very hard yards ahead” while “some businesses will fail, unemployment will rise”. But “many firms will make it through this period through working with their bankers and their own team, and understanding and utilising the Government’s significant and expanding support packages”

He urged New Zealanders to “support each other, think beyond just the next six months or more, and visualise the role you can and will play in the vibrant, refreshed, sustainable, inclusive New Zealand economy.

OPEC meeting as the main risks for the week. RBA decision, FOMC and ECB minutes featured too

OPEC meeting, tentatively scheduled for April 8, will be the main risk of the week. It remains uncertain whether Saudi Arabia and Russia could agree on cutting production to stop price war. In particular, US is now dragged into the negotiations as it refuses to lower production of shale oil.

RBA will meet this week and it’s widely expected to stand pat after delivering all the emergency measures in March already. Fed and ECB will release meeting minutes but are unlikely to reveal anything new. On the data front, Eurozone investor confidence, Canada employment and US jobless claims will catch most attention. Any other data for the period before the coronavirus will likely be shrugged off.

Here are some highlights for the week:

- Monday: Germany factory orders; Eurozone Sentix investor confidence; UK construction PMI; BoC business outlook survey.

- Tuesday: Japan average cash earnings, household spending, leading indicators; Australia trade balance, RBA rate decision; Germany industrial production; Canada Ivey PMI.

- Wednesday: Japan machine orders, current account; Swiss unemployment rate; Canada housing starts, building permits; FOMC minutes.

- Thursday: Japan consumer confidence; German trade balance; UK GDP, productions, trade balance; ECB minutes; Canada employment; US jobless claims, PPI, U of Michigan sentiments.

- Friday: Japan PPI; China CPI, PPI; US CPI.

GBP/USD Daily Outlook

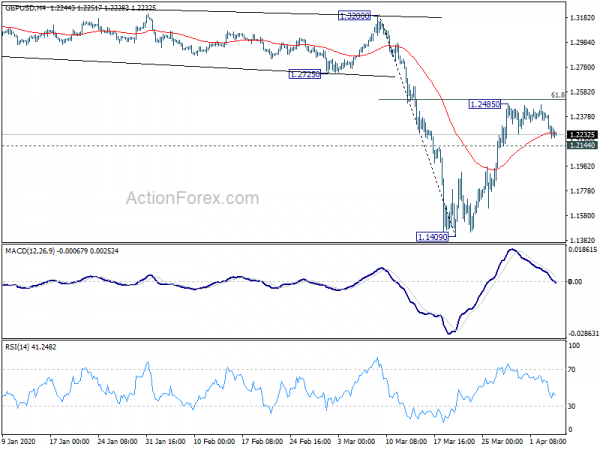

Daily Pivots: (S1) 1.2180; (P) 1.2295; (R1) 1.2384; More…

Intraday bias in GBP/USD remains neutral for the moment. On the downside, break of 1.2144 minor support will suggest completion of the rebound from 1.1409 and turn bias to the downside for retesting 1.1409 low. On the upside, sustained break of 61.8% retracement of 1.3200 to 1.1409 at 1.2516 will raise the chance of larger reversal and turn focus to 1.3200 resistance first.

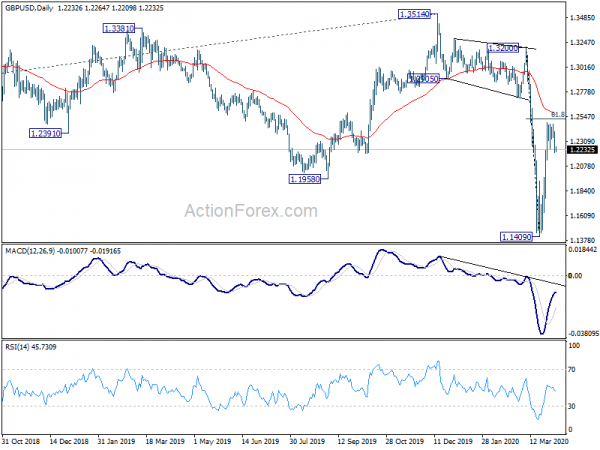

In the bigger picture, down trend from 2.1161 (2007 high) is still in progress. Next medium term target will be 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273. In any case, outlook will remain bearish as long as 1.3514 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | ANZ Commodity Price Mar | -2.10% | -2.10% | ||

| 01:00 | AUD | TD Securities Inflation M/M Mar | 0.20% | -0.10% | ||

| 06:00 | EUR | Germany Factory Orders M/M Feb | -1.90% | 5.50% | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Apr | -30.5 | -17.1 | ||

| 08:30 | GBP | Construction PMI Mar | 44 | 52.6 | ||

| 14:30 | CAD | BoC Business Outlook Survey |