US stocks suffered the worst start to a quarter in history overnight. But Asian markets are generally steady after initial weakness. Other markets are generally stuck in familiar range. Dollar and Yen remain the strongest one for the week but there is still no clear follow through buying. Oil price is also gyrating in a tight range despite the surge in inventories. Traders seem to be waiting for tomorrow’s non-farm payroll reports before taking the next move. Though, today’s jobless claims might trigger some more volatility too.

Technically, there is no breakthrough development so far. Dollar could have bottomed against both Euro and Swiss but the recoveries are weak. Gold’s reaction to 1558 support will continue to be seen as a test on the genuine strength in Dollar’s rebound. Also, 106.75 support in USD/JPY will eventually decide whether Dollar or Yen will take the lead for the next move.

In Asia, currently, Nikkei is down -0.67%. Hong Kong HSI is down -0.09%. China Shanghai SSE is up 0.33%. Singapore Strait Times is down -0.93%. Japan 10-year JGB yield is down -0.018 at -0.011. Overnight, DOW dropped -4.44%. S&P 500 dropped -4.41%. NASDAQ dropped -4.41%. 10-year yield dropped -0.063 to 0.635.

Trump warned of very painful weeks, Fauci said vaccine on track

US President Donald Trump warned of “very, very painful two weeks” ahead for Americans. “I want every American to be prepared for the hard days that lie ahead,” Trump said at the White House. “We’re going to go through a very tough two weeks. This is going to be a very painful, very, very painful two weeks.”

White House health advisor Dr. Anthony Fauci said that the first human trial testing a potential vaccine is “on track”. “It’ll take a few months to get the data to where we’ll feel confident to go to the phase two, and then a few months from now we’ll be in phase two and I think we’re right on target for the year to year and a half,” Fauci said.

Fed Rosengren: CARES Act a good start but we have to do more

Boston Fed President Eric Rosengren said yesterday that Fed has “acted quickly to address spillovers from the economic disruption” caused by coronavirus pandemic. But “we are probably going to have to do more than what was jut in the CARES Act, but I think it was a very good start in trying to mitigate some of the costs”. He referred to the recently passed USD 2T Coronavirus Aid, Relief and Economic Security (CARES) Act.

Rosengren also added “we’re witnessing the pandemic’s stark effects on public health. Meanwhile, the necessary response – social distancing – has stilled our strong economy, disrupting countless lives and livelihoods.” Social distancing practices are also “distorting the credit and liquidity flows that underpin our economy, threatening the greater pain of a full‐blown financial crisis.”

Australia NAB business confidence dropped to -11 in Q1

Australia NAB Business Confidence dropped from -2 to -11 in Q1. Current Business Conditions dropped from 6 to -3. Conditions for the next 3 months dropped from 8 to -4. Conditions for the next 12 months dropped from 16 to 7.

Alan Oster, NAB Group Chief Economist: “While the bulk of the survey was collected prior to the introduction of the more significant containment measures, the spread of the coronavirus and international developments has clearly impacted confidence. Business conditions were also weaker – and this was before activity saw a significant disruption”.

“Unsurprisingly, the forward indicators point to ongoing weakness in the business sector. While there was clearly a large amount of uncertainty at the time of the survey, it was clear that looming lockdowns and an escalation in social distancing measures would materially impact economic activity”.

Elsewhere

Japan monetary base rose 2.8% yoy in march, below expectation of 3.7% yoy. Swiss CPI and Eurozone PPI will be featured in European session. US might deliver another stunning jobless claims report today. Trade balance and factory orders will also be released. Canada will publish trade balance too.

USD/CAD Daily Outlook

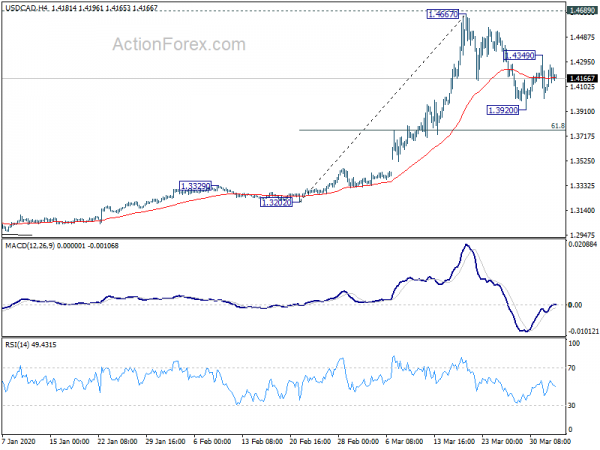

Daily Pivots: (S1) 1.4064; (P) 1.4168; (R1) 1.4273; More….

USD/CAD’s recovery from 1.3920 struggled to extend after hitting 1.4349 and intraday bias is turned neutral first. On the upside, break of 1.4349 will reaffirm that correction from 1.4667 has completed. Intraday bias will be turned to the upside for retesting 1.4667/89 resistance zone. On the downside, below 1.3920 will extend the correction. But downside should be contained by 61.8% retracement of 1.3202 to 1.4667 at 1.3762 to bring rebound.

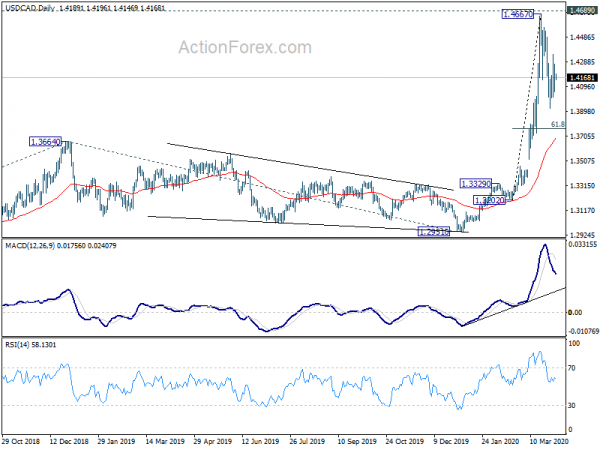

In the bigger picture, rise from 1.2061 is likely resuming whole up trend from 0.9056 (2007 low). Decisive break of 1.4689 will confirm this bullish case. Next medium term target is 161.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.5545. Rejection by 1.4689 will bring some consolidations first. But outlook will remain bullish as long as 1.3664 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Mar | 2.80% | 3.70% | 3.60% | |

| 6:30 | CHF | CPI M/M Mar | 0.10% | 0.10% | ||

| 6:30 | CHF | CPI Y/Y Mar | -0.50% | -0.10% | ||

| 9:00 | EUR | Eurozone PPI M/M Feb | -0.10% | 0.40% | ||

| 9:00 | EUR | Eurozone PPI Y/Y Feb | -0.60% | -0.50% | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Mar | -26.30% | |||

| 12:30 | USD | Initial Jobless Claims (Mar 27) | 3283K | |||

| 12:30 | USD | Trade Balance (USD) Feb | -43.6B | -45.3B | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Feb | -1.5B | |||

| 14:00 | USD | Factory Orders M/M Feb | -0.70% | -0.50% | ||

| 14:30 | USD | Natural Gas Storage | -29B |