Markets continue to staying in tight range today as consolidations continue. There is still no end in sight regarding the coronavirus pandemic, with confirmed cases breaking 800k handle, and deaths above 39k. Movements in the major stock indexes are mild based on recent standard. WTI crude oil is back above 22 handle after earlier dip this week. In the currency markets, Dollar is currently the strongest one, followed by Sterling and then Yen. New Zealand Dollar is the weakest followed by Australian.

Technically, Dollar is starting to display signs that recent pull back has completed. EUR/USD breaches 1.0953 minor support while USD/CHF breaches 0.9655 resistance. Next focus will be 1.4275 minor resistance in USD/CAD while AUD/USD is still far away from 0.5870 minor support. These levels will continue to be watched, together with 1558 support in gold.

In Europe, currently, FTSE is up 0.11%. DAX is down -0.54%. CAC is down -0.80%. German 10-year yield is up 0.0093 at -0.486. Earlier in Asia, Nikkei dropped -0.88%. Hong Kong HSI rose 1.85%. China Shanghai SSE rose 0.11%. Singapore Strait Times rose 2.69%. Japan 10-year JGB yield rose 0.0248 to 0.020.

Canada GDP grew 0.1% in Jan, coronavirus to have significant effect in Mar onward

Canada GDP grew 0.1% mom in January, below expectation of 0.2% mom. Growth was recorded in agriculture and forestry, construction, manufacturing, wholesale, finance and insurance, and public sector. Other sectors contracted including mining and oil and gas extraction, utilities, retail, and transportation and warehousing.

Statistics Canada said also noted: “The pandemic will significantly affect economic activity in March and subsequent months. Since the beginning of March, flight suspensions and travel advisories have been announced and various public events have been cancelled or postponed. Crude oil prices have declined amid lower demand due to a slowdown in global economic activity and travel. Additionally, tensions between oil-producing nations are expected to lead to an increase in supply.

Because of these factors, as well as supply chain disruptions for many types of goods, temporary closures of non-essential stores and service providers and the recent lowering of interest rates, the economic effects of the coronavirus outbreak will be deeply felt in subsequent months.”

Eurozone CPI slowed to 0.7%, energy dropped -4.3%

Eurozone CPI slowed to 0.7% yoy in March, down from 1.2% yoy, below expectation of 0.8% yoy. CPI core slowed to 1.0% yoy, down from 1.2% yoy, below expectation of 1.1% yoy. Looking at the main components, food, alcohol & tobacco rose 2.4% yoy, services rose 1.3% yoy, non-energy industrial goods rose 0.5% yoy. Energy dropped -4.3% yoy.

From Germany, unemployment rose 1k in March versus expectation of 28k. Unemployment rate was unchanged at 5.0%. Import price dropped -0.9% mom in February versus expectation of-0.3% mom.

France consumption dropped -0.1% in Feb, CPI slowed to 0.6% in Mar

France household consumption expenditure on goods dropped -0.1% mom in February. Energy expenditure fell again (0.9%), manufactured good consumption rebounded (0.2%), driven by durable good purchases (1.4%) and food consumption was stable (0.0%).

All item CPI slowed to 0.6% yoy in March, down from 1.4%. HICP slowed to 0.7% yoy, down from 1.6% yoy. The sharp drop in inflation should result from a strong downturn in the prices of energy (-3.9% yoy) and manufactured products (-0.5% yoy) and a slowdown in services (1.0% yoy) and tobacco prices (13.8% yoy).

UK Q4 GDP finalized at 0%, production dropped -0.7%

UK Q4 GDP was finalized at 0.0% qoq, 1.1% yoy. Service output rose 0.2% qoq, production output dropped -0.7% qoq, construction output dropped -0.1% qoq. Over the year, US economy grew 1.4% in 2020, up slightly from1.3% in 2018. Both were slowest since financial crisis of 2008 and 2009.

Current account deficit narrowed to GBP -5.6B in Q4 versus expectation of CAD -7.0B. Gfk consumer confidence dropped to -9 in March.

Japan released pre-pandemic data.

A batch of February economic data was released today, but the pre-pandemic data carry little significance for now. Industrial production rose 0.4% mom, down from January’s 1.0% mom. Retail sales jumped 1.7% yoy, versus January’s -0.4% yoy. Unemployment rate was steady at 2.4%. Jobs-to-applicants ratio dropped slightly from 1.49 to 1.45. Housing starts dropped -12.3% yoy.

New Zealand ANZ business confidence dropped to -63.5, severe recession is guaranteed

New Zealand ANZ Business Confidence tumbled to -63.5 in March, down from -19.4, close to a record low. All sectors are in deep negative: Agriculture (-79.4), Construction (-67.6), Services (-66.5), Retail (-65.4), Manufacturing (-46.2). Activity Outlook also dropped from 12.0 to -26.7: Retail (-40.7), Services (-26.8), Agriculture (-26.5), Construction (-23.7), Manufacturing (-21.0).

ANZ said: “Times are grim. We’ve never seen such a broad economic shock strike with such ferocity. Firms are right to be alarmed. Both fiscal and policy are leaping into action but a severe recession is guaranteed… It’s going to get worse before it gets better, and firms know that. Rock-bottom confidence is the symptom, not the cause, of the woes in the New Zealand (and global) economy.”

China PMIs back in expansion, but observations needed to confirm return to normal

China’s official NBS PMI Manufacturing rose to 52.0 in March, up from 35.7. NBS PMI Non-Manufacturing also rebounded to 52.3, up from 29.6. Both PMIs are back in expansion region. “As of March 25, the resumption rate of large and medium-sized enterprises was 96.6 per cent, an increase of 17.7 per cent from the survey results on February 25,” an NBS statement said. “We cannot say China’s economy has fully returned to normal levels based on a single month. We need to continue observing changes in the following months.”

World Bank: China’s growth could be just 0.1% as EAP suffers significant economic pain

In a report released today, the World Bank projected 2020 growth in developing East Asia and Pacific to slow to just 2.1% in the base line scenario, and -0.5% in the lower case scenario. That’s a sharp deterioration from 5.8% growth in 2019. For China, growth could be at 2.3% in the baseline and 0.1% in the lower case scenario, down from 2019’s 6.1%.

The report said the region is witnessing an “unusual combination of disruptive and mutually reinforcing events.” “Significant economic pain seems unavoidable in all countries.” “Containment of the pandemic would allow for a sustained recovery in the region, although risks to the outlook from financial market stress would remain high.”

EUR/USD Mid-Day Outlook

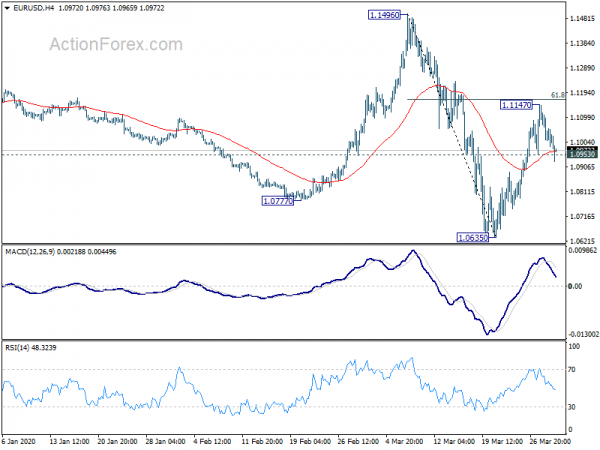

Daily Pivots: (S1) 1.0987; (P) 1.1065; (R1) 1.1121; More…

EUR/USD’s break of 1.0953 minor support suggests that corrective recovery from 1.0635 has completed. Intraday bias is turned back to the downside for retesting this low first. On the upside, however, decisive break of 61.8% retracement of 1.1496 to 1.0635 at 1.1167 will raise the chance of larger trend reversal and turn focus to 1.1496 key resistance.

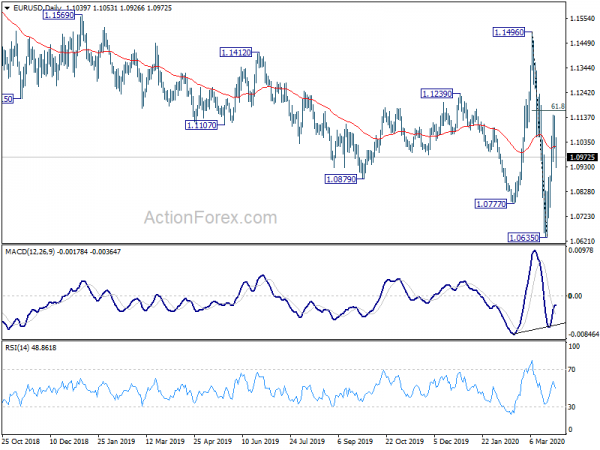

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Mar | -9 | -15 | -7 | |

| 23:50 | JPY | Industrial Production M/M Feb P | 0.40% | 0.10% | 1.00% | |

| 23:50 | JPY | Retail Trade Y/Y Feb | 1.70% | -1.20% | -0.40% | |

| 23:30 | JPY | Unemployment Rate Feb | 2.40% | 2.40% | 2.40% | |

| 00:00 | NZD | ANZ Business Confidence Mar | -63.5 | -19.4 | ||

| 00:30 | AUD | Private Sector Credit M/M Feb | 0.40% | 0.20% | 0.30% | 0.40% |

| 01:00 | CNY | NBS Manufacturing PMI Mar | 52 | 45 | 35.7 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Mar | 52.3 | 37.8 | 29.6 | |

| 05:00 | JPY | Housing Starts Y/Y Feb | -12.30% | -14.70% | -10.10% | |

| 06:00 | EUR | Germany Import Price Index M/M Feb | -0.90% | -0.30% | -0.40% | |

| 06:00 | GBP | GDP Q/Q Q4 | 0% | 0% | 0% | |

| 06:00 | GBP | Current Account (GBP) Q4 | -5.6B | -7.0B | -15.9B | |

| 06:30 | CHF | Real Retail Sales Y/Y Feb | 0.30% | -0.70% | -0.10% | 0.00% |

| 06:45 | EUR | France Consumer Spending M/M Feb | -0.10% | -0.70% | -1.10% | -1.20% |

| 07:55 | EUR | Germany Unemployment Change Mar | 1K | 28K | -10K | -8K |

| 07:55 | EUR | Germany Unemployment Rate Mar | 5.00% | 5.10% | 5.00% | |

| 09:00 | EUR | Eurozone CPI Y/Y Mar P | 0.70% | 0.80% | 1.20% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar P | 1.00% | 1.10% | 1.20% | |

| 12:30 | CAD | GDP M/M Jan | 0.10% | 0.20% | 0.30% | |

| 12:30 | CAD | Raw Material Price Index Feb | -4.70% | -0.80% | -2.20% | -2.30% |

| 12:30 | CAD | Industrial Product Price M/M Feb | -0.50% | 0.10% | -0.30% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jan | 3.10% | 3.20% | 2.90% | 2.80% |

| 13:45 | USD | Chicago PMI Mar | 40 | 49 | ||

| 14:00 | USD | Consumer Confidence Mar | 115.1 | 130.7 |