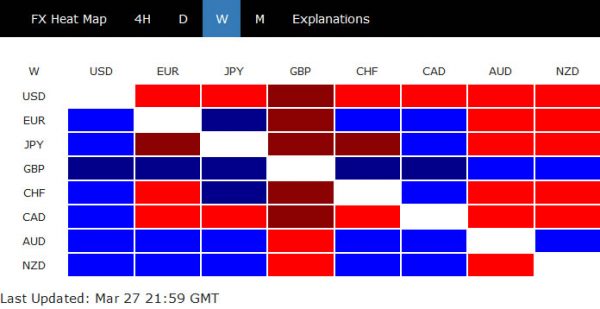

While the coronavirus pandemic continued to worsen globally, investor sentiment somewhat stabilized after governments and central banks rushed to push out tighter lockdown measures, fiscal stimulus and monetary easing. Dollar suffered massive selling on easing risk aversion, improving funding conditions, as well as Fed’s QE infinity. Canadian Dollar ended as the second weakest after BoC’s rate cut and QE, then Yen. Sterling was surprisingly the strongest one, followed by Australian and then New Zealand Dollar.

Nevertheless, it should be noted that recovery in US stocks have already been losing momentum since Thursday. We might see a come back in risk aversion if there is no slowdown of the coronavirus spread. In particular, some Asian countries like Singapore, Malaysia, Thailand, and even Japan, are vulnerable to second wave of attack by the coronavirus. Dollar, which is now close to key support zone, could strike back. The coming week could be crucial to the greenback’s fortune for Q2.

Dollar index eyes 97.83 fibonacci support after steep pull back

Dollar index suffered a huge setback last week after Fed’s QE infinity announcement. Break of 55 day EMA (98.72) is a sign of disruption of the up trend. While further decline might be seen initial this week, we’d tend to look for strong support from 61.8% retracement of 94.65 to 102.99 at 97.83 to bring rebound. But even so, there is little prospect of up trend resumption for the near term as consolidation form 102.99 should extend for a while.

However, sustained break of 97.83 will put focus back to 94.65 key support level. Sustained break of 94.65 will argue that whole up rise form 88.25 has already completed after rejection by 103.82 key resistance. The corrective pattern from 103.82, in this case, is going to extend with another falling leg back towards 88.25 key support before completion.

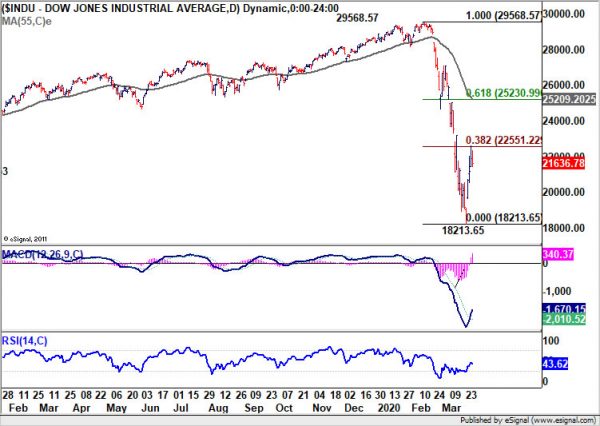

DOW’s corrective recovery might have already completed…

DOW edged lower to 18213.65 last week but turned into corrective recovery since then. However, it has apparently lost some upside momentum after reaching 22595.06, after hitting 38.2% retracement of 29568.57 to 18213.65. There’s a chance that the short lived recovery has already completed. Focus will immediately be on 55 hour EMA (now at 21225.02) this week. Firm break there will at least have an attempt to retest 18213.65 low. Comeback of risk aversion could have give Dollar Index some support for the rebound mentioned above. Nevertheless, break of 22595.06 will extend the rebound towards 55 day EMA (now at 25209.20).

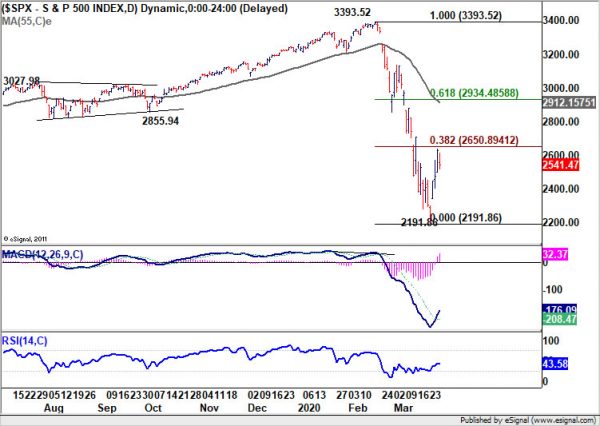

Similar picture seen in S&P 500

The picture in S&P 500 is similar, as recovery from 2191.86 also lost momentum just ahead of 38.2% retracement of 3393.52 to 2191.86 at 2650.89. Sustained break of 55 hour EMA (now at 2496.77) will indicate completion of the recovery, and would bring retest of 2191.86 low. Firm break of 2650.89 fibonacci level will bring stronger rebound towards 55 day EMA (now a 2912.15).

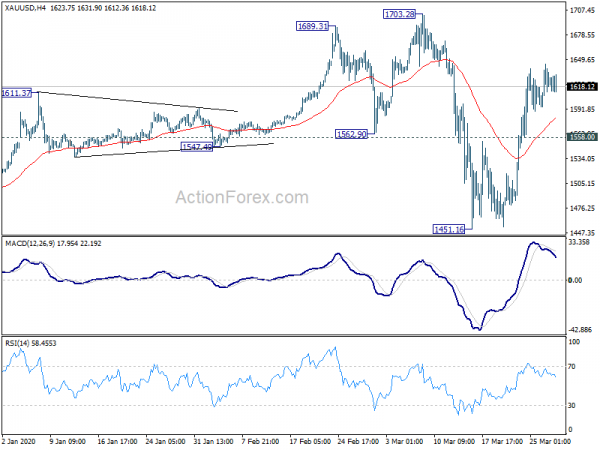

Gold’s rebound losing momentum

Development in Gold could be used as a test on whether Dollar is staging a genuine rebound. Gold’s rise from 1451.16 is seen as the second leg of the consolidation pattern from 1703.28. It has already be losing upside momentum as seen in 4 hour MACD. Break of 1556.00 support will argue that the third leg of the consolidation has already started, back towards 1451.16 support. Ideally, should Dollar be rebounding, we should see a corresponding break of 1556.00 support in Gold.

However, another rally will put 1703.28 back into focus. Decisive break there will indicate larger up trend resumption. That could correspond to a break of above mentioned 94.65 key support in Dollar index, which suggests bearish reversal.

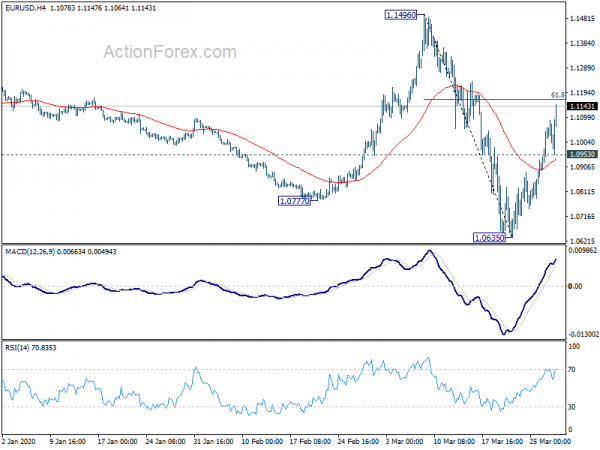

EUR/USD Weekly Outlook

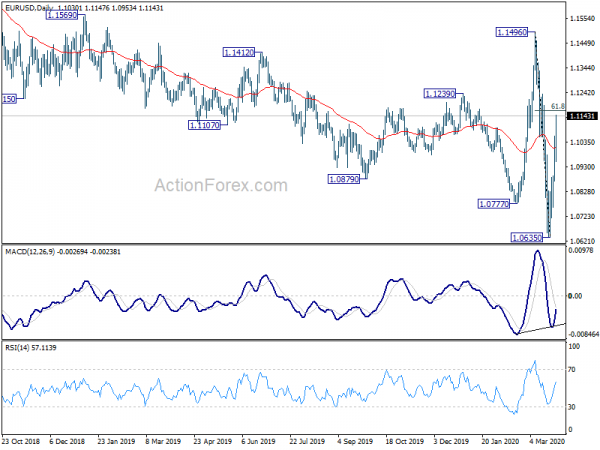

EUR/USD staged a strong rebound last week and hit as high as 1.1147. Initial bias stays on the upside this week with focus on 61.8% retracement of 1.1496 to 1.0635 at 1.1167. Sustained break there will raise the chance of larger trend reversal and turn focus to 1.1496 key resistance. On the downside,break of 1.0953 minor support will turn bias back to the downside for retesting 1.0635 low instead.

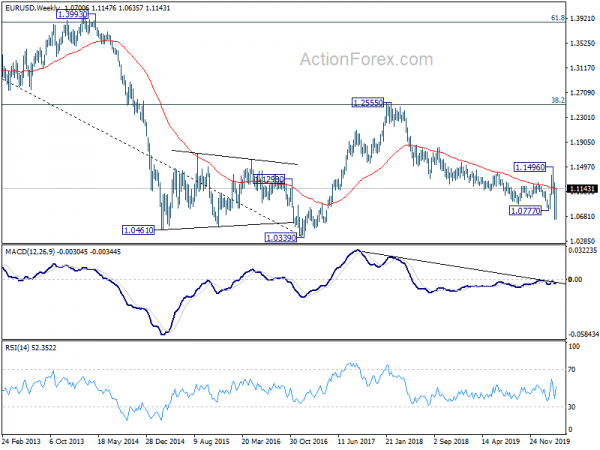

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

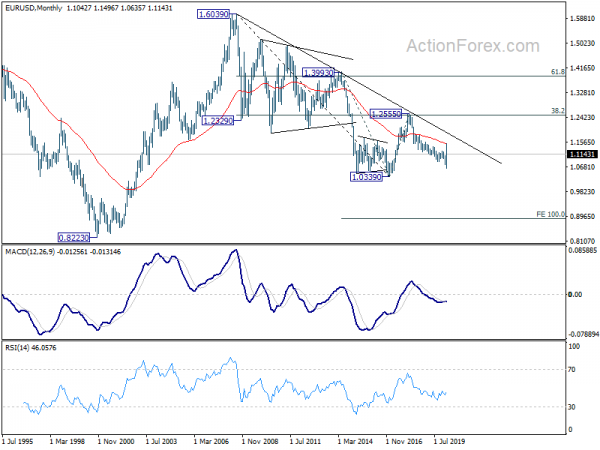

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. On break of 1.0339, next target will be 100% projection of 1.3993 to 1.0339 from 1.2555 at 0.8901.