Euro trades mildly highly on cautious but optimistic comments from ECB President Mario Draghi after the central left monetary policy unchanged. But it’s staying in range against Dollar, Yen and even the weak Sterling. EUR/USD dipped to 1.1478 earlier today but is now back at 1.1550. Though, it’s held below temporary top at 1.1582. EUR/JPY and EUR/GBP are trading in recent range below 130.76 and 0.8948 respectively. Sterling remains the weakest major currency for the week as weighed down by weaker than expected inflation data even though retail sales surprised on the upside today. Dollar regains some ground today but follows Pound as the second weakest major currency.

ECB Draghi cautious, but still confident and optimistic

ECB kept key interest rate at 0.00% and deposit rate at -0.4% as widely expected. There was also no change in the quantitative easing program as the central bank will continue to buy EUR 60b of assets per month till the end of the year. In the post meeting press conference, ECB president Mario Draghi sounded cautious and said that "while the ongoing economic expansion provides confidence that inflation will gradually glide toward levels in line with the inflation aim, it has yet to translate into stronger inflation dynamics." And he maintained that "a very substantial degree of monetary accommodation is still needed for underlying inflation pressures to gradually build up."

Draghi emphasized that policy makers "need to be persistent and patient and prudent". He explained that while there were continued improves in growth momentum, the "inflation rate is still subdued". Overall, to us, Draghi sounds confident and optimistic even though he’s still cautious. And as he said, ECB is just "not there yet". Focus will turn to September meeting for more solid stance on tapering next year.

Brexit negotiations concluded with clarifications needed

Staying in Europe, at this end of the second week of Brexit negotiations, EU’s chief negotiator Michel Barnier said that "we require this clarification on the financial settlement, on citizens’ rights, on Ireland – with the two key points of the common travel area and the Good Friday Agreement – and the other separation issues where this week’s experience has quite simply shown we make better progress where our respective positions are clear." And Barnier emphasized that citizen rights should be backed by the Court of Justice of the EU. And he added that there was also disagreement over "the rights of future family members, or the exports of certain social benefits".

On the other hand, UK’s Brexit Secretary David Davis said that "we both recognise the importance of sorting out the obligations we have to one another, both legally and in a spirit of mutual cooperation." And, "we have had robust but constructive talks this week. Clearly there’s a lot left to talk about and further work before we can resolve this. Ultimately, getting to a solution will require flexibility from both sides."

BoJ pushed back the projected timing for achieving the inflation target

BoJ left its monetary stance unchanged in July. The central bank voted 7-2 to keep its target for 10-year JGBs at around 0% and its short-term deposit rate at -0.1% as expected. It also maintained the measure to buy government bonds at an annual rate of 80 trillion yen. What is more dovish is that the central bank now forecasts it would take longer than previously anticipated for the economy to achieve the 2% inflation target. It is the 6th time that the central bank pushed back the projected timing for achieving the inflation target.

The latest economic projections by BOJ unveiled that the timing for achieving its 2% inflation target has been delayed to sometime during fiscal 2019, from fiscal 2018 previously. Note that BOJ has turned more confident over the GDP growth outlook. At the accompanying statement, BOJ noted that the economy is ‘expanding moderately’, compared with June’s reference that economy was ‘turning toward a moderate expansion’. More in BOJ Left Rates and Asset Purchases Unchanged. Pushed Back Timing to Reach +2% Inflation

In the post meeting press conference, BoJ Governor Haruhiko Kuroda said that "European and U.S. central banks have also repeatedly delayed the projected timing for hitting their price targets. Part of the reason was the sharp decline in oil prices, along with other factors beyond the central banks’ control. It’s unfortunate that we had to push back the timing many times, but our forecasts must be an appropriate one that reflects economic and price developments at the time."

But he sounded confidence that "the momentum for hitting our price target remains intact and can be sustained under the current policy framework." He also emphasized that "the current policy framework is a very flexible one that can respond to economic, price and financial developments at the time. It’s also a highly sustainable framework. Once inflation expectations heighten, real interest rates fall further and the stimulus effect of our policy heightens."

Aussie enjoyed brief lift by solid job data

Aussie is lifted earlier today by solid job data but is seen losing momentum. Headline job data showed 14k growth in June, slightly below expectation of 15k. Prior month’s figure was revised down from 42k to 38k. Unemployment rate was unchanged at 5.6%. Looking at the details, full-time jobs rose 62k while partly offset by -48k fall in part-time jobs. Australia NAB business confidence was unchanged at 7 in Q2.

Aussie jumped sharply this week as RBA noted that the neutral nominal rate is now at 3.5%. But with reduction in risk aversion and/or increase in trend growth rate, the neutral real interest rate could rise back from current 1.0% to 1.5%. And that indirectly implies that the neutral nominal rate could also follow and rise. Australia Prime Minister Malcolm Turnbull tried to calm the market and said that RBA is only "sending a signal, which is probably prudent, which is to say … rates are more likely to go up than go down."

On the data front

US initial jobless claims dropped 15k to 233k in the week ended July 15. That matched the lowest second lowest level since the global financial crisis and hovered near a 44 year low. Initial claims stayed below 300k handle for the 124 straight weeks, longest streak since early 1970s. Continuing claims rose 28k to 1.98m in the week ended July 8. And it stayed below 2m level for 15 straight week, best streak since 1973. Also from US, Philly Fed manufacturing index dropped to 19.5 in July, below expectation of 23.7. From Eurozone, current account surplus widened to EUR 30.1b in May. German PPI rose 0.0% mom, 2.4% yoy in June. UK retail sales rose 0.6% mom in June. Swiss Trade surplus narrowed to CHF 2.81b in June. Japan trade surplus narrowed to JPY 0.08T in June. All industry activity index dropped -0.9% mom in May.

EUR/USD Mid-Day Outlook

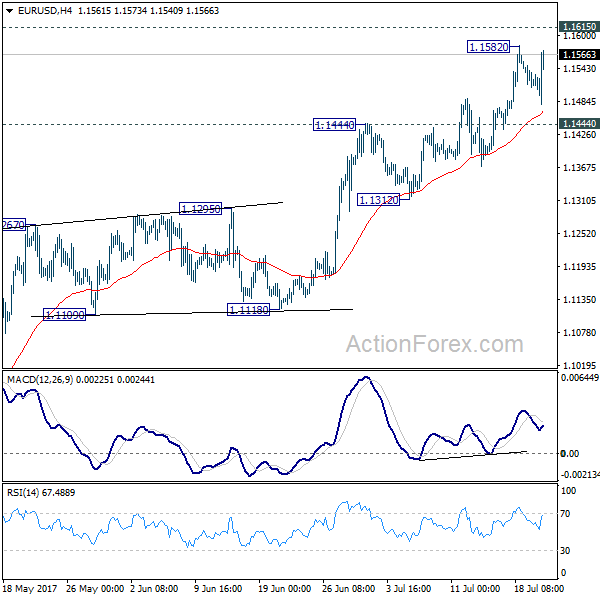

Daily Pivots: (S1) 1.1498; (P) 1.1526 (R1) 1.1544; More…

EUR/USD rebounds strongly in early US session but it’s kept below 1.1582 temporary top. Intraday bias remains neutral and the consolidation from 1.1582 could extend. In case of another fall, downside should be contained by 1.1444 resistance turned support to bring rise resumption. Above 1.1582 will target 1.1615 key resistance first. Decisive break there will pave the way to 1.2 handle next.

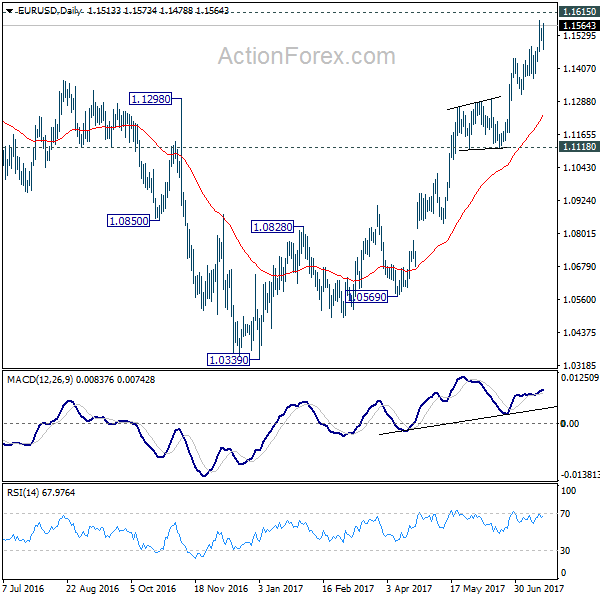

In the bigger picture, the firm break of 1.1298 resistance further affirm medium term reversal. That is, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Further rise would be seen to 55 month EMA (now at 1.1756). Sustained break there will pave the way to 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 next. This will now remain the favored case as long as 1.1118 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BOJ Monetary Policy Statement | |||||

| 23:50 | JPY | Trade Balance (JPY) Jun | 0.08T | 0.12T | 0.13T | 0.12T |

| 01:30 | AUD | NAB Business Confidence Q2 | 7 | 6 | 7 | |

| 01:30 | AUD | Employment Change Jun | 14.0k | 15.0k | 42.0k | 38.0k |

| 01:30 | AUD | Unemployment Rate Jun | 5.60% | 5.60% | 5.50% | 5.60% |

| 04:30 | JPY | All Industry Activity Index M/M May | -0.90% | -0.80% | 2.10% | 2.30% |

| 06:00 | CHF | Trade Balance (CHF) Jun | 2.81B | 2.89B | 3.40B | |

| 06:00 | EUR | German PPI M/M Jun | 0.00% | -0.10% | -0.20% | |

| 06:00 | EUR | German PPI Y/Y Jun | 2.40% | 2.30% | 2.80% | |

| 08:00 | EUR | Eurozone Current Account (EUR) May | 30.1B | 23.3B | 22.2B | 23.5B |

| 08:30 | GBP | Retail Sales M/M Jun | 0.60% | 0.30% | -1.20% | |

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (JUL 15) | 233K | 245K | 247K | 248K |

| 12:30 | USD | Philly Fed Manufacturing Jul | 19.5 | 23.7 | 27.6 | |

| 14:00 | EUR | Eurozone Consumer Confidence Jul A | -1.1 | -1.3 | ||

| 14:00 | USD | Leading Indicators Jun | 0.40% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 57B |