Asian markets are rather quiet finally as the weekend is coming. Currencies are digesting this week’s sharp moves for now, with mild recovery seen in commodity currencies and Sterling. Dollar and Yen turn slightly softer. But for the week, the greenback remains strongest, followed by Yen and Swiss Franc. Sterling is the weakest, followed by New Zealand Dollar and then Australian.

Coronavirus pandemic reached another check point with death toll in Italy surpassing China’s. Total deaths also break 10k level, with confirmed cases quickly approaching 250k. Situation in Iran seems to have plateaued but there is no sign of slowing in Italy yet. Spain and Germany are catching up even though the death toll of the latter at 44 remains low. Cases in US is also surging towards 15k level, with over 200 deaths. The pandemic, which originated from China, will remain the main theme of the markets.

In Asia, Japan is on holiday. Hong Kong HSI is up 2.98%. China Shanghai SSE is up 0.47%. Singapore Strait Times is up 1.07%. Gold is staying in range at around 1480. WTI crude oil is back testing prior support of 27.50. Overnight, DOW rose 0.95%. S&P 500 rose 0.47%. NASDAQ rose 2.30%. 10-year yield dropped -0.147 to 1.119.

BoE cuts rate to 0.10%, expands asset purchase by GBP 200B

After a special meeting overnight, BoE announces to cut Bank rate by -15bps to 0.10%. Also, Asset purchase target is raised by GBP 200B to GBP 645B. BoE will also enlarge the TFSME schedule financed by the issuance of central bank reserves.

BoE said in the statement: “Over recent days, and in common with a number of other advanced economy bond markets, conditions in the UK gilt market have deteriorated as investors have sought shorter-dated instruments that are closer substitutes for highly liquid central bank reserves. As a consequence, UK and global financial conditions have tightened.”

Fed Daly: Our tools are starting to work in the market

San Francisco Fed President Mary Daly said in an interview that it’s “absolutely appropriate” to have Fed working with fiscal agents to help small businesses and households to “weather this near term shutdown” due to coronavirus. The fiscal stimulus from Congress and the response moves by Fed this week are “exactly what we need to do to offset some of the near-term disruption”.

She noted that Fed’s tools are “starting the work in the market we care about”. “It’s encouraging to see that there’s more borrowing at the discount window; it’s encouraging to see that some of the volatility in markets has settled down,” Daly said.

RBNZ announces measures for to support financial system functioning

RBNZ announces a package of measures to support financial system functioning during the coronavirus pandemic. A Term Auction Facility is set up to give banks access to term funding, with collateralized loans available out to a term of 12 months. That should alleviate pressures in the funding markets. Other measures include funding in the fx swap markets, re-establishment of a USD swap line, supporting liquidity in the government market, and measures to have a greater control over short-term interest rates.

“The measures we are implementing today provide additional support to domestic financial markets. We will ensure our operations make financial markets operate smoothly,” Assistant Governor Christian Hawkesby said. “We are working in tandem with the banks, the wider financial market community, and the Government.”

On the data front

Germany will release PPI in European session while Eurozone will release current account. UK will release public sector net borrowing. Later in the day, Canada retail sales and US existing home sales will be featured.

USD/CAD Daily Outlook

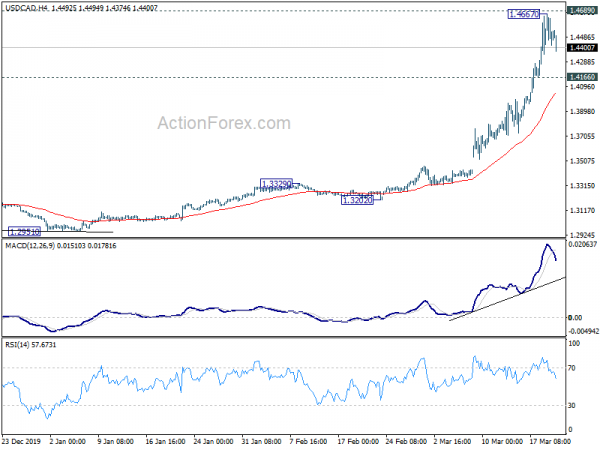

Daily Pivots: (S1) 1.4384; (P) 1.4527; (R1) 1.4632; More….

A temporary top is formed at 1.4667 in USD/CAD, ahead of 1.4689 key resistance, with the current retreat. Intraday bias is turned neutral first. Further rise is expected as long as 1.4166 support holds. Break of 1.4689 will confirm resumption of larger up trend. Nevertheless, break of 1.4166 will indicate short term topping and turn outlook neutral for lengthier consolidations.

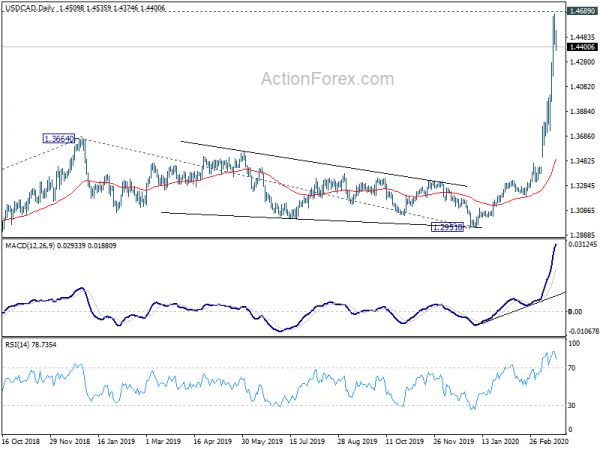

In the bigger picture, rise from 1.2061 is likely resuming whole up trend from 0.9056 (2007 low). Decisive break of 1.4689 will confirm. Next medium term target is 161.8% projection of 1.2061 to 1.3664 from 1.2951 at 1.5545. Rejection form 1.4689 will bring some consolidations first. But outlook will remain bullish as long as 1.3664 resistance turned support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 07:00 | EUR | Germany PPI M/M Feb | -0.10% | 0.80% | ||

| 07:00 | EUR | Germany PPI Y/Y Feb | 0.20% | 0.20% | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Jan | 30.3B | 32.6B | ||

| 09:30 | GBP | Consumer Inflation Expectations | 3.10% | |||

| 09:30 | GBP | Public Sector Net Borrowing (GBP) Feb | 0.9B | -10.5B | ||

| 12:30 | CAD | Retail Sales M/M Jan | 0.00% | |||

| 12:30 | CAD | Retail Sales ex Autos M/M Jan | 0.50% | |||

| 14:00 | USD | Existing Home Sales Feb | 5.52M | 5.46M |