Yen, Dollar, and Swiss Franc are set to close as the strongest ones for the week. Global stock market crash continues with US stocks suffering the worst decline since Black Monday overnight. Asian markets gap lower and are staying in deep red. For now, Australian Dollar is the worst performer of the week. Sterling follows as second weakest, partly due to the selloff against Euro. The markets will likely calm down a bit, with some profit taking trades, before the weekend.

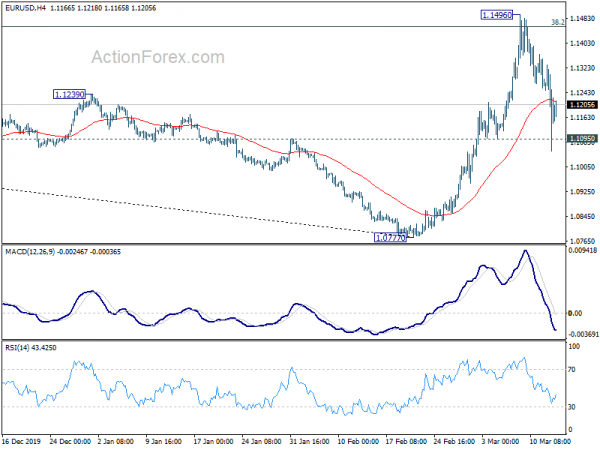

Technically, EUR/USD breached 1.1095 minor support as retreat from 1.1496 extends, but quickly recovered. As long as 1.1095 holds, rise from 1.0777 is still in favor to resume through 1.1496 at a later stage. However, firm break of 1.1095 will suggest rejection by 1.1496 long term fibonacci level and bring retest of 1.0777 low instead. Gold is another one that’s worth watching as it’s now pressing 1.557.04 resistance turned support level. Firm break there will confirm medium term topping at 1703.28 and bring deeper correction to 1495.81 fibonacci level at least.

In Asia, currently, Nikkei is down -8.27%. Hong Kong HSI is down -5.74%. China Shanghai SSE is down -3.32%. Singapore Strait Times is down -4.93%. Japan 10-year JGB yield is up 0.058 at -0.011. Overnight, DOW closed down -2352.60 pts, or -9.99%. S&P 500 dropped -9.51% while NASDAQ dropped -9.43%. 10-year yield, however, rose 0.0239 to 0.849, extending the recovery from 0.398 made earlier this week.

G7 pledges international cooperation as coronavirus cases break 130,000

US Treasury held a video conference with Canada, the European Commission, France, Germany, Italy, Japan and the United Kingdom. A short statement was issued noting, “The G7 is in regular contact and committed to continued international cooperation to address the global health and economic impacts of COVID-19.”

The coronavirus pandemic continues with total cases surged pass 130,000 level to 134,684. Death toll reached 4,973 and is set to break 5,000 soon. Italy’s cases rose to 15,113, with deaths at 1,016. Iran’s cases hit 10,075, with 429 deaths. The virus is still spreading quickly in Europe as Spain added 869 cases to 3,146. France added 595 cases to ,2876. Germany added 779 cases to 2,745. US also reported 429 new cases to 1,730.

China, the origin of this global pandemic, reported just 4 new cases a 1 new death. Accumulated total case hit 80,797, with 3,170 deaths.

Fed to inject $1.5T to address coronavirus disruptions in treasury markets

Fed announced massive liquidity injection to ease market strains due to coronavirus outbreak. Up to USD 1.5T will be pumped into the financial system. New York Fed said that the fund will be made available in three tranches of USD 500B, starting with purchases of a broader range of treasury securities.

New York Fed said, “these changes are being made to address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak..

Some analysts noted that the move was basically restarting QE, or at least, a point towards restarting QE. More measures could be announced with the rate decision on March 18 next week. Currently, fed fund futures are pricing in 94.5% of -100 bps rate cut to 0.00-0.25%.

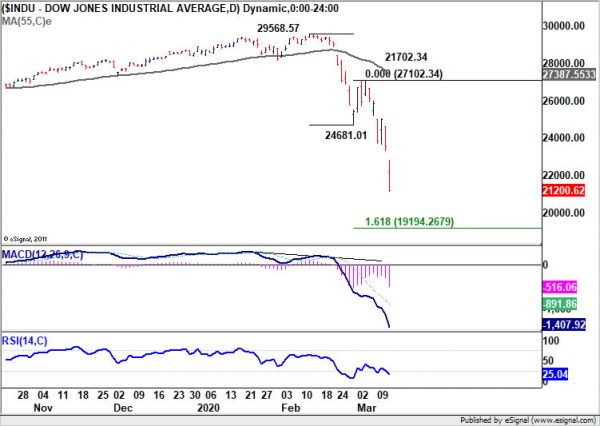

A bounce is due in DOW after worst day since Black Monday

After the massive selloff, DOW is now sitting inside an important long term support zone, between 55 month EMA and 38.2% retracement of 6469.95 to 29568.57 at 20744.89. It should be about the place to end the first leg of the correction for DOW to have a bounce.

Break of yesterday’s high of 23273.91, the lower end of the gap, would be the first sign of stabilization. The extent of the whole correction would very much depend on the strength and time of subsequent second leg consolidation.

However, firm break of 20744.89 will suggest something more serious is happening. In that case, the next near term target will be 161.8% projection of 29568.57 to 24681.01 from 21702.34 at 19194.26.

New Zealand manufacturing index rose to 53.2 before coronavirus impacts

New Zealand Business NZ Performance of Manufacturing Index rose 3.4 to 53.2 in February. Executive director for manufacturing Catherine Beard said, “while the sector has not been hit hard by Covid-19 as yet, offshore experiences show how rapidly the situation can change, especially for those manufacturers who source materials offshore and cater for particular markets”.

BNZ Senior Economist, Craig Ebert said that “The most encouraging aspect of the PMI – considering the global ructions beginning to emerge in February – was arguably its new orders. These gained to 55.3, from 50.9 in January. And with widespread reports of supply-chain disruptions around the world, it was also interesting to see the PMI’s Deliveries of Raw Materials index had picked up to 53.1, from 47.7”.

Looking ahead

Germany CPI and France CPI final will be featured in European session. US will release import price index and Michigan consumer sentiment.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1043; (P) 1.1188; (R1) 1.1321; More…

EUR/USD dropped to as low as 1.1055 and breached 1.1095 support, but quickly recovered. Intraday bias remains neutral first. On the downside, firm break of 1.1096 will argue that whole rebound form 1.0777 has completed, after rejection by 1.1496 fibonacci resistance. Intraday bias will be turned to the downside for retesting 1.0777 low. Though, rebound from current level will retain near term bullishness and bring another rally through 1.1496 at a later stage.

In the bigger picture, a medium term bottom should have formed at 1.0777 after drawing support from 78.6% retracement of 1.0339 (2017 low) to 1.2555 at 1.0813. Sustained break of 38.2% retracement of 1.2555 to 1.0777 at 1.1456 will raise the chance of medium term bullish reversal and target 61.8% retracement at 1.1876. Rejection by 1.1456 will suggests that price actions from 1.0777 are merely a correction. Another fall below 1.0777 low would be seen at a later stage in this case.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ PMI Feb | 53.2 | 49.6 | 49.8 | |

| 21:45 | NZD | Food Price Index M/M Feb | 0.00% | 0.20% | 2.10% | |

| 4:30 | JPY | Tertiary Industry Index M/M Jan | 0.20% | -0.20% | ||

| 7:00 | EUR | GermanyCPI M/M Feb F | 0.40% | 0.40% | ||

| 7:00 | EUR | Germany CPI Y/Y Feb F | 1.70% | 1.70% | ||

| 7:45 | EUR | France CPI (EU norm) M/M Feb F | 0% | 0% | ||

| 7:45 | EUR | France CPI (EU norm) Y/Y Feb F | 1.60% | 1.60% | ||

| 12:30 | USD | Import Price Index M/M Feb | -1.00% | 0% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Mar P | 97 | 101 |