Yen surges in Asian session as sentiments are knocked down hardly by US ban of European travellers. Global coronavirus cases jumped to 126,367 with 4633 deaths. Situation in Europe continue to worse, particular dire in Italy, cases in US also rose above 1,300. Nevertheless, new numbers in China, the origin of the global pandemic, are kept in low levels. Swiss Franc is currently the second strongest on risk aversion. Euro is following closely but it’s subject to risks from ECB’s coronavirus response package today. Australia Dollar is the weakest for today, followed by New Zealand. Canadian Dollar is just mixed. While oil price dip following US travel ban, it’s held well above 27.50 low for now.

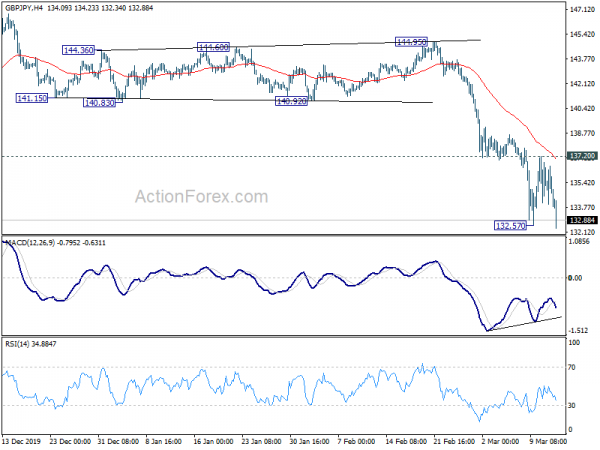

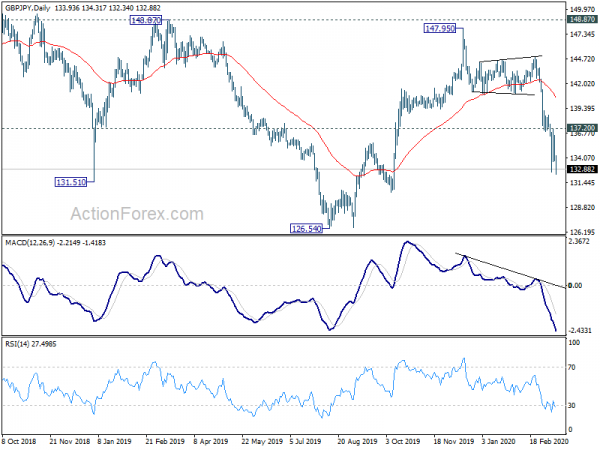

Technically, GBP/JPY’s break of 132.57 temporary low suggests fall resumption for retesting key level at 126.54. USD/JPY’s breach of 103.22 minor support argues that recovery from 101.18 temporary is completed, and this level would be retested soon. EUR/JPY is likely heading back to 115.86/116.12 key support zone with today’s steep decline. 0.6433 in AUD/USD remains a focus and break will confirm larger down trend resumption.

In Asia, currently, Nikkei is down -5.23%. Hong Kong HSI is down -3.61%. China Shanghai SSE is down -1.34%. Singapore Strait Times is down -3.72%. Japan 10-year JGB yield is up 0.0198 at -0.043. Overnight, DOW dropped -5.86%. S&P 500 dropped -4.89%. NASDAQ dropped -4.70%. 10-year yield, however, rose 0.072 to 0.820.

US bans travelers from Europe for 30 days, excluding goods

US President Donald Trump announced a ban on travelers to the US from Europe for 30 days, in a step to slow down the spread of coronavirus pandemic. The ban would apply to countries in the Schengen economic and travel zone, while UK and Ireland would be exempted. Also, goods are not included in the ban.

Trump said he would ask Congress for legislative action for measures to counter the economic impact of the coronavirus, including payroll tax relief. The Small Business Administration is also instructed to provide capital and liquidity to companies in need.

Separately, NBA said it will suspend its season after a played was tested positive for the coronavirus. Famous action Tom Hanks has been tested positive too while he’s in Australia. Total cases in the US surged to 1322, with 38 deaths, as of the time of writing.

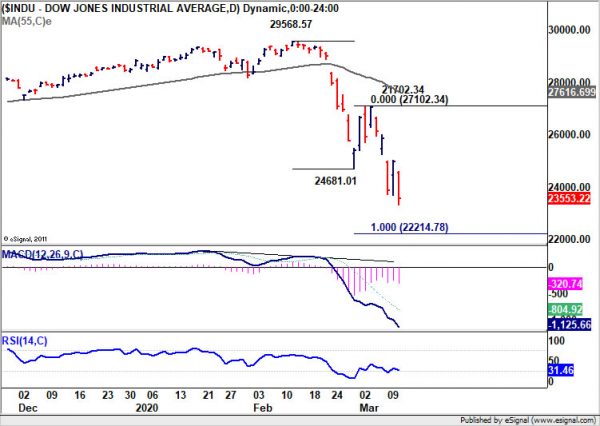

DOW dropped 5.8%, futures down another 1000pts after Trump’s Europe ban

DOW dropped -1464.94 pts or -5.86% overnight. DOW futures is down a further -1000 pts after Trump’s announcement. Technically, it’s still on track to 100% projection of 29568.57 to 24681.01 from 21702.34 at 22214.78. This level is inside an important support zone between 55 month EMA (now at 22627) and 38.2% retracement of 6469.96 to 29568.57 at 20744.89. Initial support is expected there to halt the selloff.

However, decisive break there will firstly hints on further downside acceleration. Also it would open up the case for decline to next key support level at 61.8% retracement at 15293.62.

ECB to deliver coronavirus response package and pandemic worsens

ECB rate decision is a major focus today and expectation is high for the central bank, to follow global peers, to deliver stimulus measures to ease coronavirus impact. Europe is in no doubt on fire now, with 12,462 coronavirus cases and 827 deaths in Italy. Prime Minister Giuseppe Conte tighten up country wide lockdown on Wednesday, closing all shops except supermarkets, food stores and chemists. He still sounded cautious as “we will only be able to see the effects of this great effort in a couple of weeks.”

Situation in other European countries are also worsening, with 2,821 cases and 48 deaths in France, 2,277 cases and 55 deaths in Spain, 1,966 cases and 3 deaths in Germany, 652 cases and 4 deaths in Switzerland, 629 cases in Norway, 514 cases in Denmark, 503 cases and 5 deaths in the Netherlands, 500 cases and 1 death in Sweden, 314 cases and 3 deaths in Belgium, 246 cases in Austria. The outbreak is already a serious blow to the domestic economy as well as a serious threat on production with supply chain disruptions. Also, tightening of financial conditions is worsening and broadening.

At this point, it’s unsure what more the ECB could do and how effect the new measures could be, given that interest rate already negative for long time and asset purchase restarted last year. ECB might opt for another -10bps cut in deposit rate and ramp up to QE to EUR 40B per month. There might also be targeted funding operations for banks.

Here are some suggested previews:

- Will the Fragmented ECB Disappoint Markets?

- ECB Preview Update: Scale-Up Of QE To Address The Credit Element

- ECB Expected to Announce Stimulus Package Including Deposit Rate Cut

On the data front

Japan PPI slowed to 0.8% yoy in February, down from 1.5% yoy, missed expectation of 1.0% yoy. Australia consumer inflation expectation was unchanged at 4.0% in March. UK RICS house price balance rose to 29 in February. Eurozone will release industrial production. US will release PPI and jobless claims.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 133.02; (P) 134.79; (R1) 135.77; More…

GBP/JPY’s break of 132.57 suggests resumption of whole decline from 147.95. Intraday bias is back on the downside. Current fall should target a test on 126.54 low next. On the upside, break of 137.20 resistance, however, will indicate short term bottoming, on bullish convergence condition in 4 hour MACD. Stronger rebound could then be seen to 55 day EMA (now at 140.52).

In the bigger picture, rejection by 148.87 resistance argues that rise from 126.54 is probably just third leg of the consolidation pattern from 122.75 (2016 low). Medium term outlook is turned neutral first. Break of 126.54 support would resume larger down trend from 195.86 (2015 high) through 122.75 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Feb | 0.80% | 1.00% | 1.70% | 1.50% |

| 0:00 | AUD | Consumer Inflation Expectations Mar | 4.00% | 4.00% | ||

| 0:01 | GBP | RICS Housing Price Balance Feb | 29% | 20% | 17% | 18% |

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | 1.20% | -2.10% | ||

| 12:30 | USD | PPI M/M Feb | -0.10% | 0.50% | ||

| 12:30 | USD | PPI Y/Y Feb | 1.90% | 2.10% | ||

| 12:30 | USD | PPI Core M/M Feb | 0.20% | 0.50% | ||

| 12:30 | USD | PPI Core Y/Y Feb | 1.70% | 1.70% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 6) | 215K | 216K | ||

| 12:45 | EUR | ECB Interest Rate Decision | 0% | 0% | ||

| 12:45 | EUR | ECB Deposit Rate Decision | -0.50% | -0.50% | ||

| 13:30 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | -109B |