Asian markets soften generally, having no follow through actions the strong but limited rebound in the US overnight. On the one hand, investors are disappointed by the lack of concrete announcement from US on coronavirus relief. On the other hand, the coronavirus outbreak continues to accelerate globally. Number of cases in Italy broke 10k level to 10149 while Iran jumped to 8042. Europe continues to be a big risk with France (1784 cases), Spain (1695), Germany (1565). USA also breaks 1k to 1010 cases.

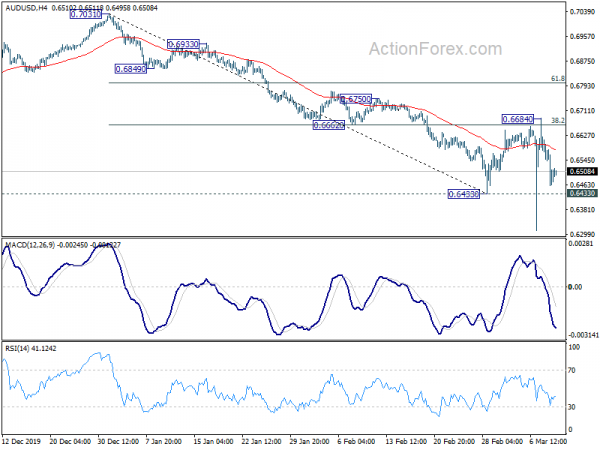

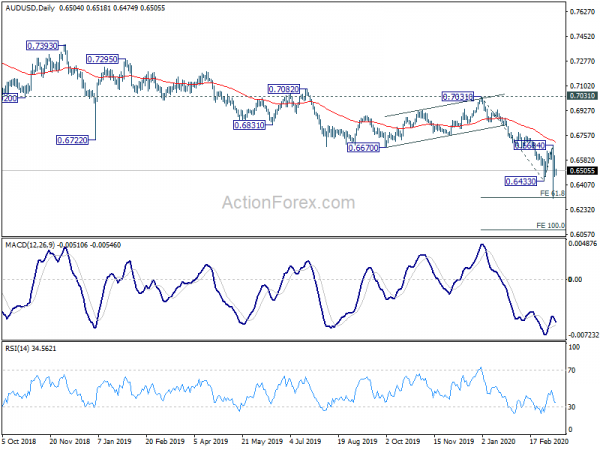

In the currency markets, commodity currencies remain the weakest ones this week, as now led by Canadian. Yen and Swiss are strong on risk aversion, with Euro in between as the new safe haven. Dollar is mixed together with Sterling. Technically, AUD/USD and NZD/USD are worth a watch today as focus turns to February lows at 0.6433 and 0.6191 respectively (this week’s spikes are disregarded). Break of these levels should finally confirm down trend resumption. EUR/GBP is still indecisive ahead of 0.8786 resistance. Today’s data might provide a push for make or break.

In Asia, Nikkei closed down -2.27%. Hong Kong HSI is down -0.52%. China Shanghai SSE is down -0.54%. Singapore Strait Times is down -1.16%. Japan 10-year JGB yield is down -0.0258 at -0.067. Overnight, DOW rose 4.89%. S&P 500 rose 4.94%. NASDAQ rose 4.95%. 10-year yield rose 0.249 to 0.748.

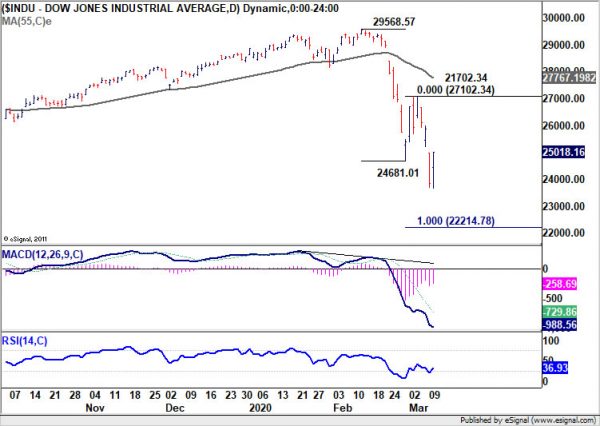

DOW had limited rebound as US still some way from coronavirus relief package

US stocks rebounded notably overnight but DOW’s 1167pts rise was way short of Monday’s -2000 pts loss. President Donald Trump disappointed the markets as he failed to deliver the coronavirus response measures he mentioned on Monday. There was no resolution at his meeting with Republicans. Trump just said after the meeting, “Be calm. It’s really working out. A lot of good things are going to happen.” It’s reported that Republicans are skeptical on the payroll tax cut pushed by economic adviser Peter Navarro.

Also, after the meeting, Trump sent Treasury Secretary Steven Mnuchin to meet House Speaker Nancy Pelosi to kick start a congressional response. After meeting with Pelosi, Mnuchin just said it’s too early to call the talks “negotiations”. Arguably, the US is still some way from concluding a certain relief package.

High volatility will very likely continue in the financial markets ahead. DOW might be able to close Monday’s gap should there be any positive news out of the White House in the coming days. But there is no sign of a major bottoming yet. Corrective from 29568.57 is expected to extend to 100% projection at 22214.78 ahead, sooner or later.

Australia consumer sentiment dropped 5-yr low, spectacular drop in economic expectations

Australia Westpac consumer sentiment dropped -3.8% to 91.9 in March, hitting the lowest level in five years. More importantly, it’s the second lowest level since the global financial crisis. Across the five component sub-indexes, biggest fall was around expectations for the economy, The “economy, next 12 months” sub-index recorded a spectacular -12.8% drop taking it to 77.9, a five year low.

Westpac said, “The Reserve Bank Board next meets on April 7. Given the clear risks being faced by the Australian economy over the next few months the Board is likely to lower the cash rate by a further 0.25%.”

And, cash rate will hit RBA’s lower bound of 0.25%, “the next policy approach is likely to involve a form of unconventional monetary policy where indications are that the Board favours the approach of setting a rate target further out the yield curve and signalling the commitment to defend that target”.

RBA Debelle: Too uncertain to assess coronavirus impacts beyond Q1

RBA Governor Guy Debelle said in a speech that because of the coronavirus, the global economy will be “materially weaker” in Q1 and in the period ahead. For Australia, RBA has estimated the impact of education and tourism sectors. These services exports, which account for 5% of GDP, would drop at least -10% in Q1. That translates into -0.5% subtraction of GDP just from these two sources. But that, he added, “it is just too uncertain to assess the impact of the virus beyond the March quarter.”

Debelle also said, the coronavirus is “a shock to both demand and supply”. Monetary policy “does not have an effect” on the supply side. But It can work to “ensure demand is stronger than it otherwise would be”. The government’s intention to support jobs, incomes, small business and investment will “provide welcome support” to the economy. “The combined effect of fiscal and monetary policy will help us navigate a difficult period for the Australian economy.”

Economists downgrade Singapore 2020 growth forecasts from 1.5% to 0.6%

According to a survey by Monetary Authority of Singapore, economists now expect the country’s economy to grow only 0.6% this year. That’s sharply lower than 1.5% growth as expected in the previous survey in December. That is within the government’s forecast range of -0.5% to 1.5%.

The respondents were also pessimistic across all key sectors. Manufacturing is expected to contract by -0.3% this year, versus prior forecast of 0.7% growth. Wholesale and retail are expected to contract by -0.7%, comparing to prior forecast of 0.4%. Accommodation of food services would contract -1.6%, versus prior forecast of 2.1%.

Finance and insurance are expected to growth 2.5%, lower than prior forecast of 3.5%. Construction is expected to grow 2.4%, just slightly revised down from 2.5%.

Looking ahead

UK GDP, productions and good trade balance will be the main feature in European session. But those are all January data, which might reflect post election bounce, but not coronavirus impacts. Later in the day, US will release CPI inflation while Canada will release capacity utilization.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6438; (P) 0.6525; (R1) 0.6588; More…

Focus is now back on 0.6433 support in AUD/USD after today’s decline. Firm break there will resume larger down trend and target 61.8% projection of 0.7031 to 0.6433 from 0.6684 at 0.6314 and then 100% projection at 0.6086. On the upside, break of 0.6684 will extend the correction form 0.6433. But upside should be limited by 61.8% retracement of 0.7031 to 0.6433 at 0.6803.

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Mar | -3.80% | 2.30% | ||

| 09:30 | GBP | GDP M/M Jan | 0.20% | 0.30% | ||

| 09:30 | GBP | Index of Services 3M/3M Jan | 0.00% | 0.10% | ||

| 09:30 | GBP | Industrial Production M/M Jan | 0.40% | 0.10% | ||

| 09:30 | GBP | Industrial Production Y/Y Jan | -2.30% | -1.80% | ||

| 09:30 | GBP | Manufacturing Production M/M Jan | 0.40% | 0.30% | ||

| 09:30 | GBP | Manufacturing Production Y/Y Jan | -3.30% | -2.50% | ||

| 09:30 | GBP | Goods Trade Balance (GBP) Jan | -7.5B | 0.8B | ||

| 12:30 | USD | CPI M/M Feb | 0.00% | 0.10% | ||

| 12:30 | USD | CPI Y/Y Feb | 2.30% | 2.50% | ||

| 12:30 | USD | CPI Core M/M Feb | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Feb | 2.30% | 2.30% | ||

| 12:30 | CAD | Capacity Utilization Q4 | 81.50% | 81.70% | ||

| 13:00 | GBP | NIESR GDP Estimate Feb | 0.00% | |||

| 14:30 | USD | Crude Oil Inventories | 2.0M | 0.8M |