The markets trade in mild risk aversion today and the sentiments sent Yen broadly higher. Meanwhile, Dollar regains some ground from Friday’s profit taking pull back. The greenback stays supported by firm expectation of a March Fed hike. Nonetheless, the moves in the forex markets are relatively limited. Politics has been a stronger drive in the forex markets, as well as others since late last year. This view is shared by the BIS too as seen in it’s quarterly report. For the moment, US fiscal policies, French elections, Brexit negotiations, as well as some geopolitical development like North Korea’s firing of missiles will stay as important market drivers. Dollar will look into Friday’s job report for sealing the case for a Fed hike.

BIS: Politics tightened its grip over financial markets

The Bank for International Settlements said in its quarterly report published today that "politics tightened its grip over financial markets in the past quarter, reasserting its supremacy over economics." The report touched on the political uncertainties in Europe with elections in France, Germany and the Netherlands. Meanwhile, it also pointed out reflation trades triggered by US president Donald Trump. Emerging markets are see as " caught between a rock and a hard place, the rock being the prospect of a tightening of U.S. monetary policy (even if gradual), an appreciating dollar and their FX currency debt, and the hard place the threat of rising protectionism."

UK treasury Hammond to deliver tax hike

In UK, Chancellor of the Exchequer Philip Hammond will deliver his first budget statement to Parliament on Wednesday. Hammond said during the weekend that UK has "got enough in the tank" so buffer the impact of Brexit. But he still emphasized the need to keep a tight rein on public finance. There are talks that Hammon would announce tax hike to counter the need to additional borrowing. Meanwhile, he talked hard regarding the negotiation with EU on Brexit terms. He vowed to "fight back" if UK and EU "don’t continue to work closely together". And UK will "forge new trade deals around the world".

Eurozone Sentix investor confidence hit near 10 year high

Eurozone Sentix investor confidence rose to 20.7 in March, up from 17.4 and beat expectation of 18.5. That’s also the highest level in more than 10 years, since August 2007. Sentix noted that "all the expectation components for the global economic regions rose and cast the decline of last month in a new light". And, "therefore the potential threat of a sudden halt to the economic recovery is off the table." Also, "in addition to the main regions, the positive economic momentum for emerging markets is retained." Also from Eurozone, retail PMI dropped to 49.9 in February.

EU to increase defense cooperation

European Union defense ministers are meeting in Brussels today for setting up a centralized command structure for certain military operations. That is seen by analysts as a response to doubtful commitment from US on NATO. EU foreign policy chief Federica Mogherini said the plan is a "major step forwards" that enables "more unified, more rational, more efficient approach to existing training missions." On the other hand, the exiting member UK’s defense secretary Michael Fallon urged EU to "cooperate more closely with NATO, to avoid unnecessary duplication and structures and to work together on new threats."

Yen jumps as North Korea fires ballistic missiles

The Japanese Yen jumps broadly in Asian session today on risk aversion as North Korea fired four ballistic missiles into nearby waters. Some analysts pointed out that the missile tests reminded the markets of the unpredictably of Kim Jong Un leadership. Japan prime minister Shinzo Abe warned that the missile launches "clearly show that this is a new level of threat" from North Korea".

China to target 6.5% growth this year

In China, Premier Li Keqiang suggested at the National People’s Congress that the government’s GDP growth target for this year is "around 6.5%, or higher if possible", down from 2016’s 6.5-7.0%. Inflation target stays at around 3% and a fiscal deficit at around 3% of GDP. The growth target of money supply M2 has been lowered, by -1 percentage point, to 12%. As suggested in the Work Report, the RMB exchange rate will "be further liberalized, and the currency’s stable position in the global monetary system will be maintained". A number of Chinese macroeconomic data would be released including trade balance and inflation.

RBA to stand pat

Australia TD securities inflation dropped -0.3% mom in February. Australia retail sales rose 0.4% mom in January, in line with consensus. RBA will announce rate decision tomorrow and it’s widely expected to stand pat.

USD/JPY Mid-Day Outlook

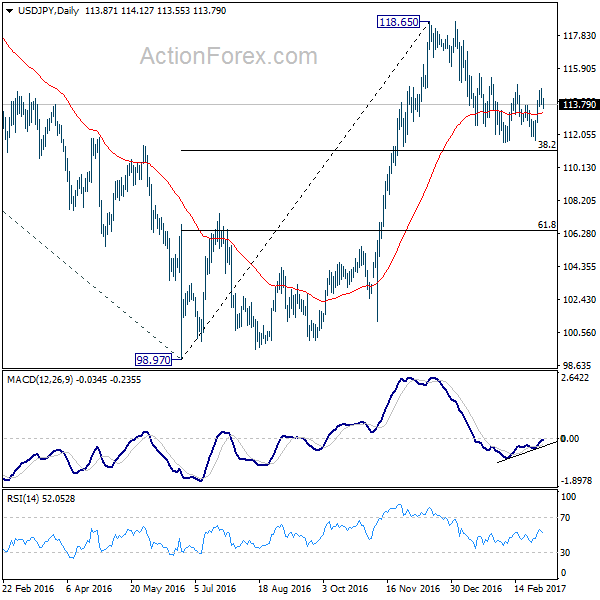

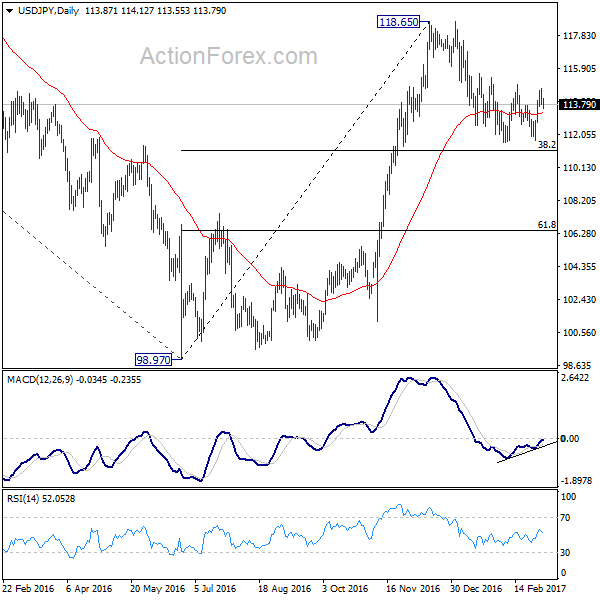

Daily Pivots: (S1) 113.61; (P) 114.18; (R1) 114.56; More…

USD/JPY weakens today but loss is limited so far. It’s holding above 55 hour EMA and stays well in range of 111.58/114.94. Intraday bias remains neutral first. The corrective fall from 118.65 might not be completed yet. But still, in case of another fall, we’d still expect strong support from 38.2% retracement of 98.97 to 118.65 at 111.13 to contain downside and bring rebound. On the upside, decisive break of 114.94 will indicate that it’s completed with a double bottom pattern (111.58, 111.68). In such case, intraday bias will be turned to the upside for retesting 118.65.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | TD Securities Inflation M/M Feb | -0.30% | 0.60% | ||

| 0:30 | AUD | Retail Sales M/M Jan | 0.40% | 0.40% | -0.10% | |

| 9:10 | EUR | Eurozone Retail PMI Feb | 49.9 | 50.1 | ||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Mar | 20.7 | 18.5 | 17.4 | |

| 15:00 | USD | Factory Orders Jan | 1.00% | 1.30% |