Financial markets in Asian somewhat stabilized despite the massive crash in the US overnight. Investors are awaiting the next development in global coronavirus pandemic. Governments are all preparing fiscal support to their respective economies. US will announce “very dramatic” actions on Tuesday, which include payroll tax cut and “very substantial relief” for industries hit by the coronavirus outbreak. Meanwhile, WTI crude oil is also back above 30 handle after exhaustive selloff.

Technically, EUR/USD is still struggling to take out 1.1456 fibonacci resistance firmly. USD/CHF recovers after hitting 0.9185 projection level. USD/JPY is also recovering after above yesterday’s low at 101.18. There is prospect of a bit more upside in Dollar today. Meanwhile, Yen should be in pull back as seen in EUR/JPY and GBP/JPY. We might see Yen bulls taking profits first, before positioning for next trades.

In Asia, currently, Nikkei is down -0.14%. Hong Kong HSI is up 1.81%. China Shanghai SSE is up 0.62%. Singapore Strait Times is up 1.28%. Japan 10-year JGB yield is up 0.072 at -0.071. Overnight, DOW dropped -2013.76 pts or -7.79%. S&P 500 dropped -7.60%. NASDAQ dropped -7.29%. 10-year yield dropped to new record low at 0.398, then closed at 0.499, down -0.207.

Entire Italy in lockdown as coronavirus cases surged to 9172, 463 deaths

Coronavirus outbreak in Italy continued to worsen as total cases surged past South Korea to 9172, up 24% from a day ago. Total deaths increased by 97 to 463. Prime Minister Giuseppe Conte announced on Monday that the whole country will be placed under lockdown until next month. People could only travel for work, medical reasons or emergencies until April 3. All schools and universities are closed too. The numbers are showing that there has been a significant growth in infections, people in intensive care and deaths,” Conte said. “Our habits have to change right now. We must give things up for Italy.”

Situation in Europe in general remains worrying. There are 1412 cases and 30 deaths in France, 1231 cases and 30 deaths in Spain, 1224 cases and 2 deaths in Germany, 374 cases 2 deaths in Switzerland, 321 cases 5 deaths in the UK, 321 cases 4 deaths in the Netherlands, 261 cases in Sweden, 239 cases in Belgium, 227 cases in Norway, 131 cases in Austria.

China, the origin of the outbreak, continued to stabilize with 19 news cases to 80754, with 3136 deaths. Similarly, South Korea added 35 cases to 7513, with 54 deaths. Iran will likely surpass South Korea soon, with 7161 cases and 237 deaths. There are 708 cases reported in the US with 7 deaths, and 530 cases in Japan with 9 deaths.

Australia NAB business confidence dropped to -4, further deterioration likely

Australia NAB business confidence dropped from -1 to -4 in February. Business conditions dropped from 2 to 0. Looking at some details, trading conditions dropped from 5 to 4. Profitability conditions dropped from 1 to -5. Nevertheless, employment conditions ticked up from 1 to 2. Forward orders dropped sharply form -1 to -4. Stocks dropped from 0 to -6. Exports dropped from -1 to -2.

Alan Oster, NAB Group Chief Economist: “Both conditions and confidence fell in the month, but not by as much as we had feared. That said, both continue to track below average and with forward orders weakening its likely we could see further deterioration”.

“With leading indicators softer, it is unlikely we will see a material improvement in conditions in the near term. With conditions and confidence continuing to track below average – there are risks around future capex and employment growth.

From New Zealand, manufacturing sales rose 2.4% in Q4.

Australian PM Morrison: Coronavirus impact could be larger than global financial crisis

Australian Prime Minister Scott Morrison warned today that the coronavirus could have larger impact to Australian economy than the global financial finances in 2008. That’s because “the epicenter of this crisis as opposed to that one is much closer to home”, referring to the close tie with China.

Also, “there is the potential for heightened risk aversion to flow over into reduced business and consumer spending, reduced demand across our economy. These effects would be greater if coronavirus were to have a significant impact on the health of our workforce, which is what we need to plan for, and that’s something we’re working very hard to prevent at the moment.”

Morrison said the government will soon announce stimulus response to the coronavirus outbreak. It’s reported by the Australian newspaper that the measures could worth about AUD 10B.

BoJ Kuroda: Markets are making very unstable moves

BoJ Governor Haruhiko Kuroda told the parliament today, “there’s uncertainty on when the coronavirus will be contained, and markets are making very unstable moves”. BoJ will “continue to keep an eye out on how the spread of the virus could affect Japan’s economy and prices, particularly via domestic and overseas market developments, and act appropriately as needed without hesitation.”

Japan Finance Minister Taro Aso reiterated that the government will only tap the remainder of this fiscal’s budget to finance the coronavirus response package. “We need to ascertain the current situation first”, he said, “at this stage there’s no saying” whether the government needs an extra budget. He also noted, “financing will focus on small and tiny businesses who face the need of financing over the next two to three weeks.”

From Japan, M2 rose 3.0% yoy in February versus expectation of 2.8% yoy. From China, CPI slowed to 5.2% yoy in February. PPI dropped -0.4% yoy.

Looking ahead

Eurozone will release Q4 GDP revision and employment change. France will release nonfarm payrolls and industrial output. Italy will also release industrial output.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9174; (P) 0.9258; (R1) 0.9333; More…

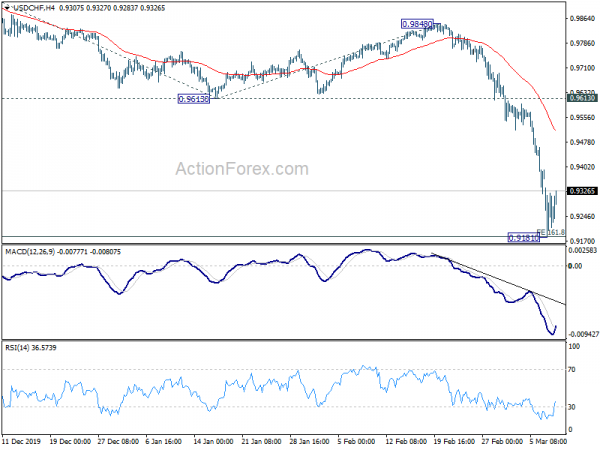

With 4 hour MACD crossed above signal line, a temporary low should be formed at 0.9181 in USD/CHF. Intraday bias is turned neutral for consolidations first. But upside of recovery should be limited well below 0.9613 support turned resistance to bring fall resumption. On the downside, break of 0.9181 will target 200% projection of 1.0023 to 0.9613 from 0.9848 at 0.9028 next.

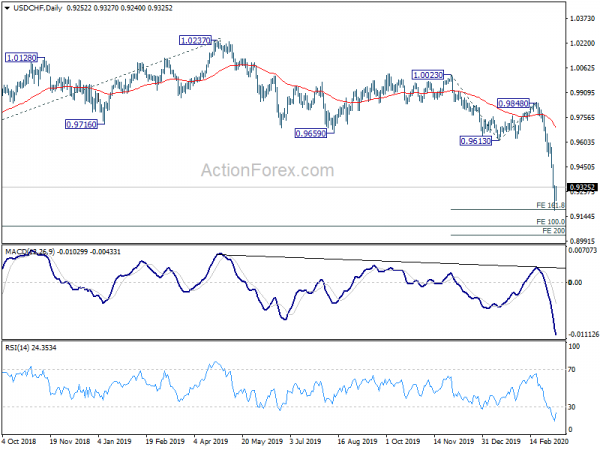

In the bigger picture, current development suggests that decline from 1.0237 is the third leg of the pattern from 1.0342 (2016 high). Focus will be on 100% projection 1.0342 to 0.9186 from 1.0237 at 0.9081. Sustained break there will argue that USD/CHF is in a long term down trend, which would target 138.2% projection at 0.8639 next. For now, outlook will remain bearish as long as 0.9613 support turned resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q4 | 2.40% | -0.30% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Feb | 3.00% | 2.80% | 2.80% | |

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Feb | -0.40% | -0.20% | 0.00% | |

| 00:30 | AUD | NAB Business Confidence Feb | -4 | -1 | ||

| 00:30 | AUD | NAB Business Conditions Feb | 0 | 3 | ||

| 01:30 | CNY | CPI Y/Y Feb | 5.20% | 4.90% | 5.40% | |

| 01:30 | CNY | PPI Y/Y Feb | -0.40% | 0.10% | 0.10% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Feb P | -35.60% | |||

| 06:30 | EUR | France Nonfarm Payrolls Q/Q Q4 F | 0.20% | 0.20% | ||

| 07:45 | EUR | France Industrial Output M/M Jan | 1.60% | -2.80% | ||

| 09:00 | EUR | Italy Industrial Output M/M Jan | -2.70% | |||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 | 0.10% | 0.10% | ||

| 10:00 | EUR | Eurozone Employment Change Q/Q Q4 F | 0.30% | 0.30% | ||

| 10:00 | USD | NFIB Business Optimism Index Feb | 104.5 | 104.3 |